Malaysia’s economy showed resilience in December, with inflation easing to 1.8% and GDP growth projected to remain steady at 4.0%-5.0% in 2025. Strong exports and increased investments drove economic expansion, while Malaysia took a significant step in sustainable trade by exporting certified rubber to the EU. Strengthened economic ties with China saw bilateral trade reach nearly US$98 billion, reinforcing Malaysia’s position in global commerce. The stock market experienced a positive surge, with key indices posting notable gains. Meanwhile, Penang’s new tech park aims to boost its semiconductor and electronics industry, and Bursa Malaysia introduced sustainability reporting updates and a pioneering Waqf-featured ETF.

Malaysia economy update

- Malaysia’s annual inflation rate eased to 1.8% in November 2024, down from 1.9% in October and below market expectations of 2.1%. The slowdown was driven by moderating price increases for transport (0.4% vs 0.7%) and health (1.2% vs 1.4%), along with continued declines in costs for clothing (-0.3% vs -0.2%) and communication (-3.9% vs -1.7%).

- Malaysia’s GDP growth is projected to remain steady at 4.0%-5.0% in 2025, following a robust performance in the first three quarters of 2024, which saw an average growth of 5.2%. The economy expanded by 5.3% in Q3 2024, driven by stronger exports and increased public and private investments, surpassing 2023’s growth of 3.6%.

- Malaysia is set to export its first batch of 200 metric tons of sustainably certified rubber to the European Union, marking a significant step in aligning with the EU’s new anti-deforestation regulations. The move highlights Malaysia’s commitment to sustainable practices and compliance with the legislation, which prohibits the import of commodities associated with deforestation-linked supply chains.

- Malaysia and China have strengthened their economic ties, with bilateral trade reaching nearly US$98 billion (approximately RM440 billion) in the first 11 months of 2024, matching the total trade volume for 2023. This represents a 6.9% year-on-year growth, highlighting opportunities for further economic collaboration, according to Investment, Trade, and Industry Minister Tengku Zafrul Aziz.

Malaysia stock market update

December brought positive momentum to Malaysia’s key stock market indices. The FTSE Bursa Malaysia KLCI increased by 3.53%, closing at RM1,642.33. The FTSE Bursa Malaysia Mid 70 Index saw a strong gain of 5.47%, reaching RM18,836.87. The FTSE Bursa Malaysia Top 100 Index also performed well, rising by 3.70% to RM12,261.16. A month of solid growth and optimism for Malaysian markets.

- Penang, often referred to as Malaysia’s “investment sweet spot,” is set to bolster its status as a hub for technology and innovation with the opening of a new tech park. The development aims to attract global technology companies and further solidify Penang’s position as a key player in Malaysia’s semiconductor and electronics sectors.

- Eq8 Capital Sdn Bhd, a member of Kenanga Investors Group, has launched the world’s first Waqf-featured exchange-traded fund (ETF), the Eq8 FTSE Malaysia Enhanced Dividend Waqf ETF (EQ8WAQF), on the Main Market of Bursa Malaysia. The ETF aims to distribute income annually, with half allocated as Waqf assets for socio-economic impact initiatives and the remaining half distributed to unitholders.

- Bursa Malaysia has announced that Red Ideas Holdings Berhad has changed its name to Jagasolution Berhad. The company’s shares will be traded and quoted under the new name and stock short name, “JAGAAPP,” starting from 9:00 a.m. on Monday, 16 December 2024. The stock number will remain unchanged.

- Bursa Malaysia Securities Berhad has announced updates to sustainability reporting requirements for the Main Market and ACE Market Listing Requirements, aligning them with the National Sustainability Reporting Framework (NSRF). This move integrates the IFRS Sustainability Disclosure Standards into reporting, reflecting Malaysia’s push for robust and transparent sustainability practices.

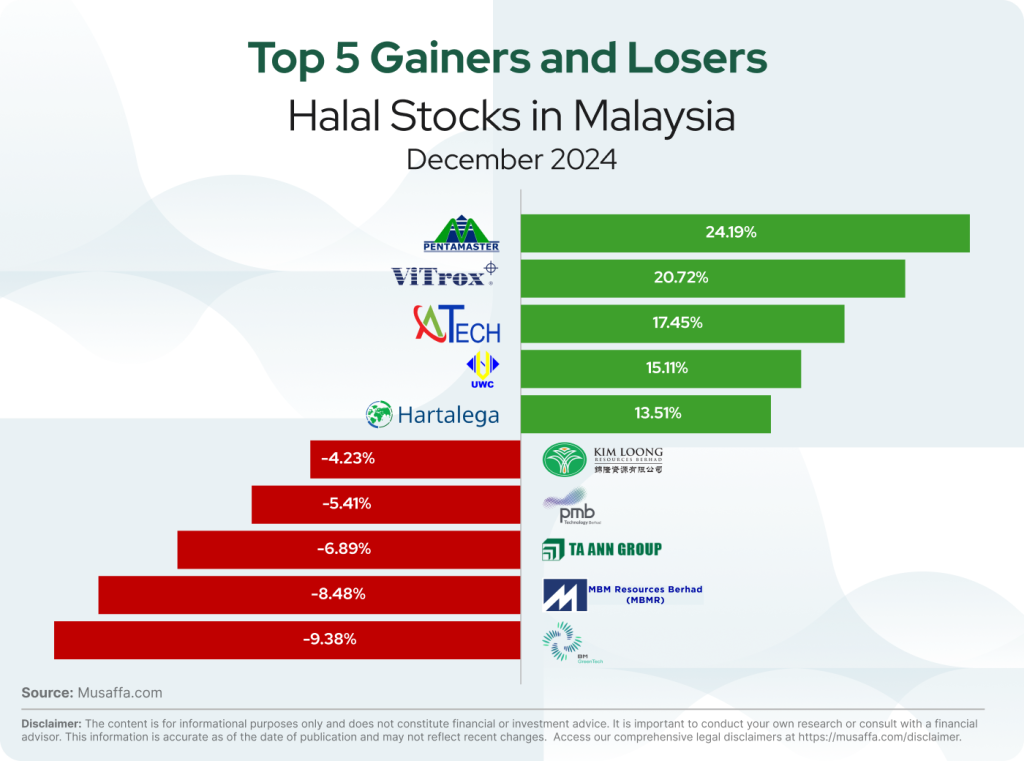

Malaysian top gainer and top loser stocks for December

Summary

Malaysia’s economy remained stable in December, with easing inflation, solid GDP growth projections, and expanding global trade, particularly with China and the EU. The stock market showed strong performance, while new sustainability initiatives and investment projects reinforced Malaysia’s economic prospects.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Go Premium

Go Premium