The UK economy faced challenges in January, with a £49 billion public maintenance backlog, a National Insurance hike pressuring businesses, and a downward revision in GDP growth forecasts. Wind power surpassed gas as Britain’s top electricity source in 2024, marking a milestone in the country’s energy transition. The Bank of England expects 1.5% growth in 2025, but private analysts remain cautious.

UK economy update

- A National Audit Office (NAO) report reveals a staggering £49 billion ($60 billion) maintenance backlog across schools, hospitals, and prisons in the UK, underscoring the strain on public services caused by tight public finances. The report warns that delaying these essential repairs could result in even higher costs in the future.

- In 2024, wind power became Britain’s largest electricity source, surpassing gas-fired plants for the first time, according to the National Energy System Operator (NESO). Wind accounted for 30% of the electricity mix, followed by gas at 26.3%, imports at 14.1%, and nuclear at 14%. Britain, with nearly 15 GW of offshore wind capacity, aims to quadruple this to 60 GW by 2030 to decarbonize its power sector.

- A Bank of England survey revealed that many UK firms plan to raise prices and cut jobs due to a National Insurance hike taking effect in April. Among over 2,000 businesses surveyed, 61% expect reduced profits, 54% plan price increases, 53% anticipate lower employment, and 39% foresee smaller pay rises. This follows the £25 billion payroll tax increase announced by Finance Minister Rachel Reeves in October.

- Morgan Stanley has revised the UK’s 2025 GDP growth forecast down to 0.9% from an earlier estimate of 1.3%, aligning with cautious outlooks from Goldman Sachs and J.P. Morgan. The downgrade reflects a slowing economy and signs of a weakening labor market. While the Bank of England maintains a more optimistic 1.5% growth forecast, buoyed by temporary public spending boosts.

UK stock market update

January brought strong gains for UK markets! The FTSE 100 Index rose by 4.74%, closing at £8,560.31. The FTSE All-Share Index also saw a significant increase of 3.99%, ending the month at £4,645.99. A month of positive growth and renewed market optimism

- Trainline shares dropped nearly 7% following the UK government’s announcement of plans to create a government-backed online train ticket retailer under the Great British Railways (GBR). The initiative aims to simplify ticket purchases by integrating individual operators’ ticketing systems, part of the broader Rail Reform Bill.

- British homewares retailer Dunelm Group shares fell sharply due to experiencing a slowdown in sales growth during its second quarter, with sales rising just 1.6% compared to 3.5% in the first quarter. This reflects broader challenges in the UK retail sector, where rising employer taxes, increased minimum wages, and operational costs are weighing on businesses and consumer spending.

- Pets at Home maintained its full-year guidance despite a 0.2% dip in third-quarter revenue to £361.6m, driven by weaker retail sales amid challenging UK consumer conditions. While Vet Group revenue surged by 21.3%, with like-for-like growth of 19.9% supported by rising subscriptions and visits, retail revenue declined 2.4%, with a 2.8% drop in like-for-like sales.

- AstraZeneca and Daiichi Sankyo‘s Enhertu has received U.S. FDA approval for treating adults with HER2 breast cancer after progression on one or more hormone therapies. The decision was based on the DESTINY-Breast06 phase 3 trial, which demonstrated a 36% reduction in the risk of disease progression or death compared to chemotherapy.

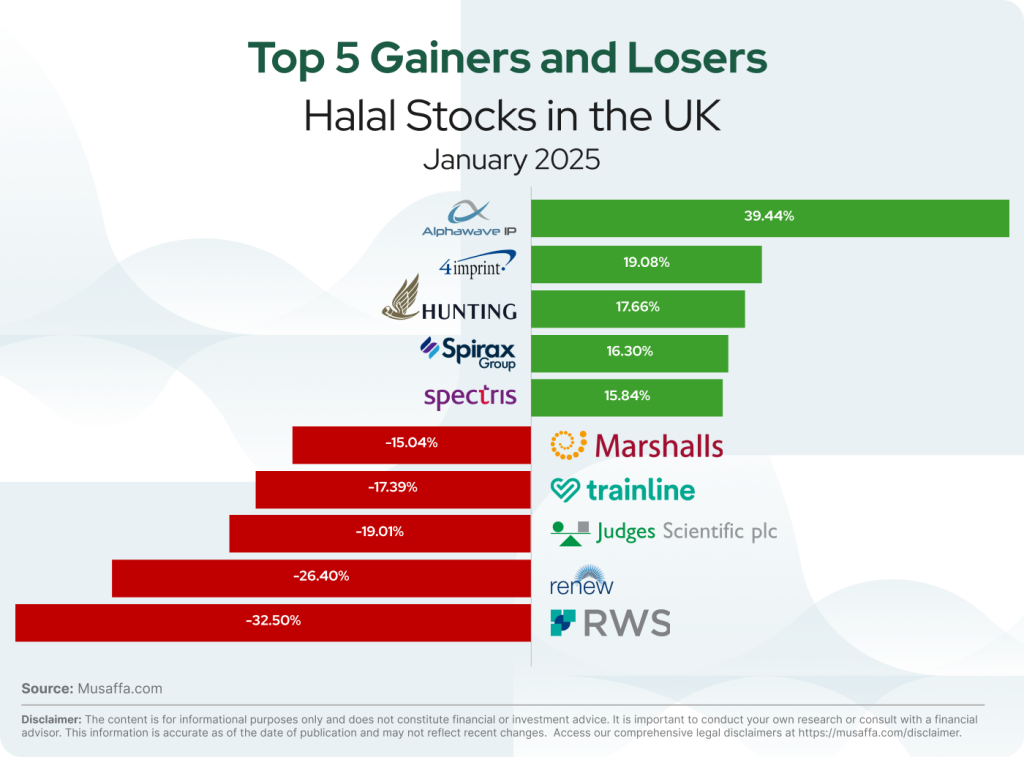

UK top gainer and top loser stocks for January

Summary

The UK economy grapples with infrastructure challenges, fiscal tightening, and slowing growth, while energy transition gains momentum. Markets rallied in January, though retail and travel stocks faced pressure. AstraZeneca’s latest FDA approval added a bright spot to the corporate landscape.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Go Premium

Go Premium