Indonesia implemented a 15% global minimum corporate tax from January 1, aligning with international tax reforms. Bank Indonesia unexpectedly cut its benchmark rate to 5.75% to support economic growth, while inflation remained stable at 1.57% in December. The country officially joined BRICS as its 11th full member, reinforcing its commitment to global economic collaboration. In the stock market, the IDX Composite and IDX LQ45 saw minor declines amid economic concerns. Major corporate movements included PT Sekar Laut’s buyback share sales, PT Puri Global Sukses’ land expansion, and PT Ingria Pratama Capitalindo’s aggressive housing sales targets. PT Saraswanti Anugerah Makmur surged post-stock split, and PT Remala Abadi saw a 59.09% jump following acquisition news.

Indonesia economy update

- Indonesia has introduced a 15% global minimum corporate tax effective January 1, aligning with the international effort to reduce tax competition among nations. This regulation, issued by the finance ministry, makes Indonesia part of the 140 countries that signed the 2021 global tax agreement.

- Bank Indonesia unexpectedly lowered its benchmark seven-day reverse repo rate by 25 basis points to 5.75% on January 15, marking the first rate cut since September 2024. The central bank cited the need to support economic growth while ensuring inflation remains under control as the key reason for the monetary policy adjustment.

- Indonesia officially joined BRICS as its 11th full member, with the announcement made on January 7 following Brazil’s confirmation a day earlier. The Indonesian government emphasized its commitment to using the membership to strengthen partnerships and amplify the voices of the Global South, reflecting its strategic aim to foster cooperation among emerging economies.

- Indonesia’s annual inflation rate remained stable at 1.57% in December 2024, slightly below market expectations of 1.6% but within Bank Indonesia’s target range of 1.5% to 3.5%. Food, health, accommodation, and education categories saw rising prices, while transport and communication costs declined.

Indonesia stock market update

January saw continued challenges for Indonesia’s markets. The IDX Composite fell slightly by 0.09%, closing at IDR 7,073.48, while the IDX LQ45 declined by 0.38%, ending at IDR 823.55. Economic concerns persisted, contributing to modest losses across both indices.

- PT Sekar Laut Tbk has transferred 12.64 million buyback shares as of December 31, 2024, generating IDR 4.58 billion from sales through PT BNI Sekuritas at an average price of IDR 171 per share. With 678.1 million buyback shares still remaining, SKLT plans to continue selling these to public investors.

- PT Puri Global Sukses Tbk has secured a 3,987 m² landbank in Bengkong, Batam, for IDR 7 billion to expand its successful Monde Signature housing project. The company anticipates generating up to IDR 13 billion in revenue from sales in Phase II. PURI reported IDR 101 billion in revenue from the project’s first phase and aims for IDR 514 billion from The Monde City apartment project in 2025.

- PT Ingria Pratama Capitalindo Tbk has set an ambitious target to sell 642 housing units in 2025, double its 2024 sales of 330 units, which marked a 30.4% year-on-year increase. The company currently has 418 ready-to-occupy units to meet rising market demand. Sales in 2024 were primarily driven by Kalimantan (70.6%) and West Java (29.4%).

- PT Saraswanti Anugerah Makmur Tbk shares surged 37.3% to IDR 1,030 following shareholder approval of a 1:2 stock split on January 16. This rally marks a recovery from last week’s decline to IDR 725. The stock split reduces the nominal value of shares from IDR 100 to IDR 50 and increases the authorized capital to IDR 1.74 trillion, divided into 34.8 billion shares.

- Shares of PT Remala Abadi Tbk soared by 59.09% to IDR 1,225 per share over the past five days, reaching a market valuation of IDR 1.58 trillion. This spike follows news of its planned acquisition by PT Iforte Solusi Infotek, a subsidiary of PT Sarana Menara Nusantara Tbk under the Djarum Group.

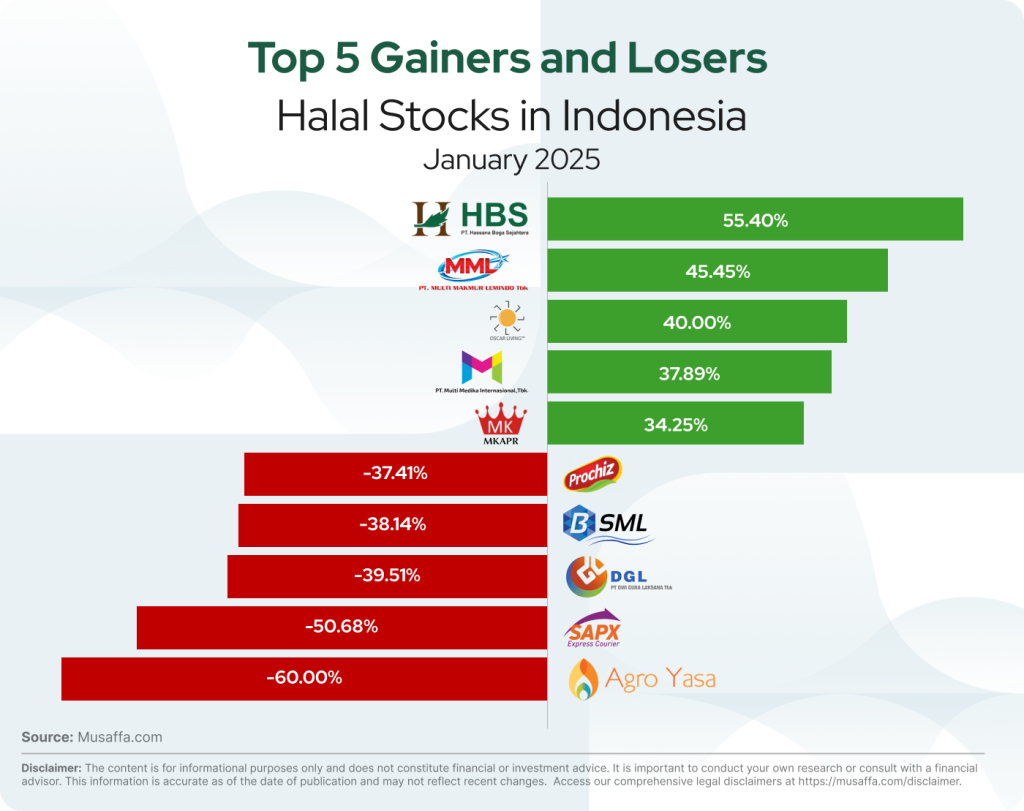

Indonesian top gainer and top loser stocks for January

Summary

Indonesia introduced a 15% global minimum tax, cut its benchmark interest rate to 5.75%, and joined BRICS as its 11th member, reflecting strategic economic moves. Inflation remained steady at 1.57%, within Bank Indonesia’s target. The IDX Composite and IDX LQ45 posted slight losses. Key market activities included PT Sekar Laut’s share sales, PT Puri Global Sukses’ land acquisition, and PT Ingria Pratama Capitalindo’s housing expansion. PT Saraswanti Anugerah Makmur rallied post-stock split, while PT Remala Abadi soared 59.09% on acquisition news.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Go Premium

Go Premium