Saudi Arabia’s economy remained resilient in November, with non-oil exports rising by 15% year-over-year, reflecting the success of Vision 2030 diversification efforts. Job creation surged in key sectors like transport and logistics, with 122,000 new positions added. Despite a projected $27 billion budget deficit for FY 2025, the government remains committed to expansionary spending to drive economic growth. Saudi Arabia’s mega-projects, including NEOM and The Line, continue to attract significant foreign investment, reinforcing its economic transformation. S&P Global projects 4.7% GDP growth in 2025, underscoring confidence in the Kingdom’s long-term outlook.

Saudi Arabia economy update

- Saudi Arabia has continued its push toward job creation as part of Vision 2030, achieving significant growth in employment across various sectors. The transport and logistics sector alone added 122,000 jobs, reflecting a steady trajectory in reducing unemployment rates, with a goal to lower the rate to 5% by 2030.

- The Kingdom’s non-oil exports rose by 15% year-over-year to SAR 528 billion, driven by diversification initiatives in industrial and mining sectors. This underscores a shift away from petrochemical dependence toward broader economic resilience.

- Saudi Arabia approved its fiscal year 2025 budget, projecting a deficit of $27 billion. Despite the deficit, the budget emphasizes expansionary spending to boost economic growth, particularly through Vision 2030 projects. This strategy aims to drive diversification away from oil dependency.

- Despite a global economic slowdown, Saudi Arabia remains resilient due to diversification efforts and continued investments in mega-projects like NEOM and The Line. These initiatives are attracting international investors and boosting domestic economic activity.

- S&P Global has projected Saudi Arabia’s GDP growth to reach 4.7% in 2025, emphasizing the Kingdom’s economic resilience and diversification efforts. This forecast reflects confidence in Saudi Arabia’s Vision 2030 initiatives, particularly its focus on expanding non-oil sectors and increasing foreign investments.

Saudi Arabia stock market update

November was a challenging month for Saudi markets. The Tadawul All-Share Index decreased by 3.17%, closing at 11,641.31. However, the Parallel Market Capped Index saw a strong performance, rising 11.64% to reach 30,394.7. A month of contrasting movements in Saudi market indices.

- Diriyah Co. attracted significant interest from international investors, with ongoing discussions involving $500 million or larger investments. The company is positioning itself as a major player in Saudi Arabia’s Vision 2030 giga-projects, particularly in sustainable urban development.

- Almoosa Health, a leading healthcare provider in Saudi Arabia, has announced plans for an initial public offering (IPO) aimed at driving expansion and innovation within the Kingdom’s healthcare sector. According to the company’s CEO, the funds raised will support the development of advanced medical facilities, digital health solutions, and specialized care services.

- Saudi Aramco Base Oil Company has announced that it will maintain the prices for propane and butane for December 2024, signaling stability in the Kingdom’s liquefied petroleum gas (LPG) exports. The decision comes as part of the company’s strategy to remain competitive in the global energy market, despite fluctuations in global commodity prices.

- In November 2024, Saudi Arabia successfully raised $910 million through its latest sukuk offering, demonstrating strong investor confidence in the Kingdom’s financial stability and its ability to attract capital for development projects. The sukuk, which was oversubscribed, highlights the growing appeal of Islamic finance instruments and the country’s efforts to diversify its funding sources.

- Saudi Arabia’s hotel industry experienced a significant 11.4% surge in spending, according to data released by the Saudi Arabian Monetary Authority (SAMA) in November. This growth comes amid a broader trend of declining point-of-sale (POS) transactions in other sectors, highlighting the resilience and appeal of the tourism and hospitality industries in the Kingdom.

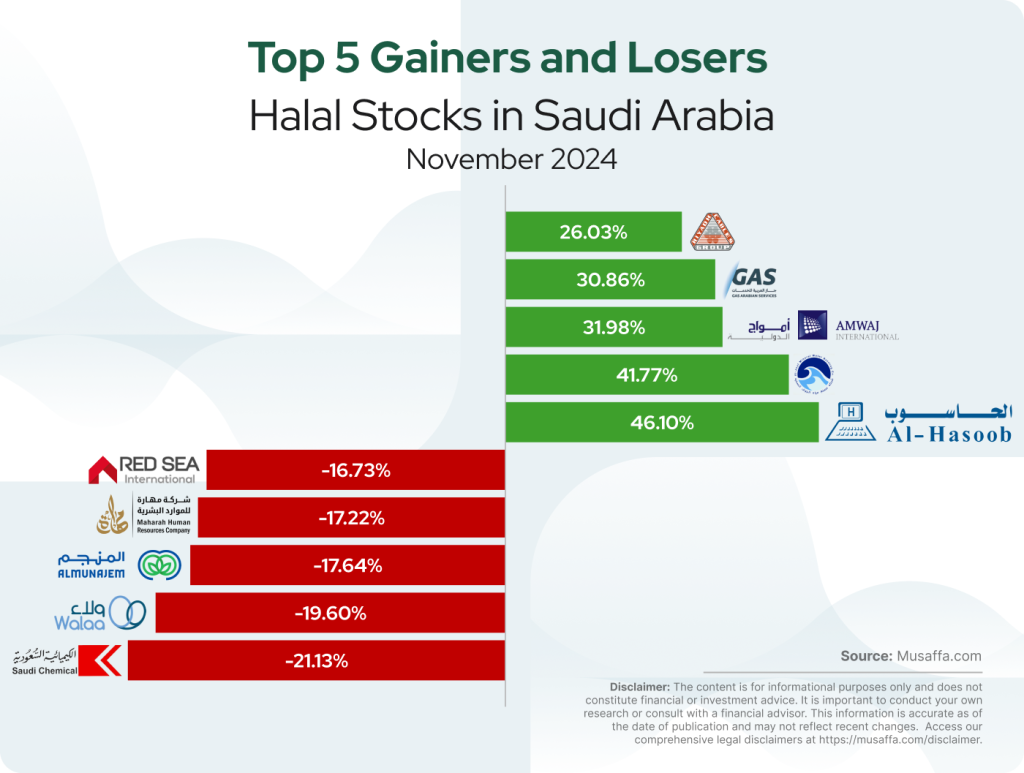

Saudi Arabian top gainer and top loser stocks for November

Summary

Saudi Arabia’s stock market saw mixed results in November, with the Tadawul All-Share Index declining by 3.17%, while the Parallel Market Capped Index surged by 11.64%. Major developments included Diriyah Co.’s international investment push, Almoosa Health’s IPO plans, and Saudi Aramco Base Oil Company’s price stability strategy. The Kingdom raised $910 million through an oversubscribed sukuk offering, reinforcing investor confidence. Meanwhile, Saudi Arabia’s hotel industry saw an 11.4% surge in spending, highlighting the tourism sector’s strong performance amid broader economic shifts.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Go Premium

Go Premium