Canada’s economy faced key developments in December, with the Bank of Canada implementing a significant rate cut to support growth amid inflation concerns. Economic indicators showed mixed results, with a decline in wholesale trade and easing inflation nearing the central bank’s target. Meanwhile, trade tensions resurfaced as Canadian officials responded to renewed tariff threats from the U.S., prompting government investments in border infrastructure. In the stock market, indices struggled, but new initiatives in AI-driven green data centers and strategic corporate moves in key industries showcased efforts to drive long-term economic resilience.

Canada economy update

- The Bank of Canada’s decision to implement a jumbo rate cut on December 11 was a closely contested move, according to meeting minutes. Policymakers debated the risks of easing monetary policy too aggressively amid persistent inflationary pressures but ultimately prioritized supporting economic growth in the face of slowing demand.

- Canada’s wholesale trade likely declined by 0.7% in November, according to a flash estimate from Statistics Canada. The drop suggests continued softness in key sectors, reflecting weaker demand and broader economic challenges. This marks a potential slowdown after months of mixed performance in the wholesale trade industry.

- Canada’s inflation rate eased to 1.9% in November, marking a slight decline from previous months and moving closer to the Bank of Canada’s 2% target. The drop was driven by lower energy prices and a slowdown in food price increases, providing some relief to consumers. Analysts see the trend as a positive sign for economic stability, though underlying pressures remain in certain sectors.

- Canadian premiers have called for a robust response to President Donald Trump’s renewed tariff threats on Canadian exports, according to a federal minister. The premiers emphasized the need to protect key industries, including steel and aluminum, while urging the government to prepare countermeasures to safeguard the Canadian economy.

- The Canadian government has announced new funding to enhance border infrastructure and streamline trade in response to President Donald Trump’s recent tariff threats. The investment aims to bolster Canada’s ability to manage cross-border commerce efficiently while protecting key industries from potential economic disruptions.

Canada stock market update

December was a challenging month for Canadian markets. The S&P/TSX Composite Index saw a decrease of 3.59%, closing at CAD$ 24,727.94. The S&P/TSX Venture Composite Index also declined by 2.67%, ending the month at CAD$ 597.84. Despite some setbacks, Canadian markets faced headwinds as economic uncertainty impacted performance.

- Canada has proposed a $15 billion incentive program to encourage investment in AI-driven green data centers, according to a report by the Globe and Mail. The initiative aims to position Canada as a global leader in sustainable technology infrastructure while supporting the rapid growth of artificial intelligence.

- Unifor members have ratified a new agreement with Canadian National Railway, ensuring labor stability for one of Canada’s largest transportation networks. The deal includes wage increases and improved benefits, reflecting months of negotiations aimed at addressing worker concerns. This agreement is expected to support uninterrupted operations and bolster Canada’s supply chain.

- Argo Gold has acquired an additional uranium claim in Saskatchewan, expanding its footprint in one of the world’s most resource-rich regions for uranium. The new claim is expected to strengthen the company’s position in the growing nuclear energy sector as global demand for clean energy solutions rises.

- Scryb Inc. has announced the sale of its joint venture interest in Fionet Rapid Response Group for CAD$3.5 million, along with a royalty agreement. The transaction provides Scryb with immediate capital while maintaining a future revenue stream through royalties, aligning with its strategy to optimize financial resources and focus on core business areas.

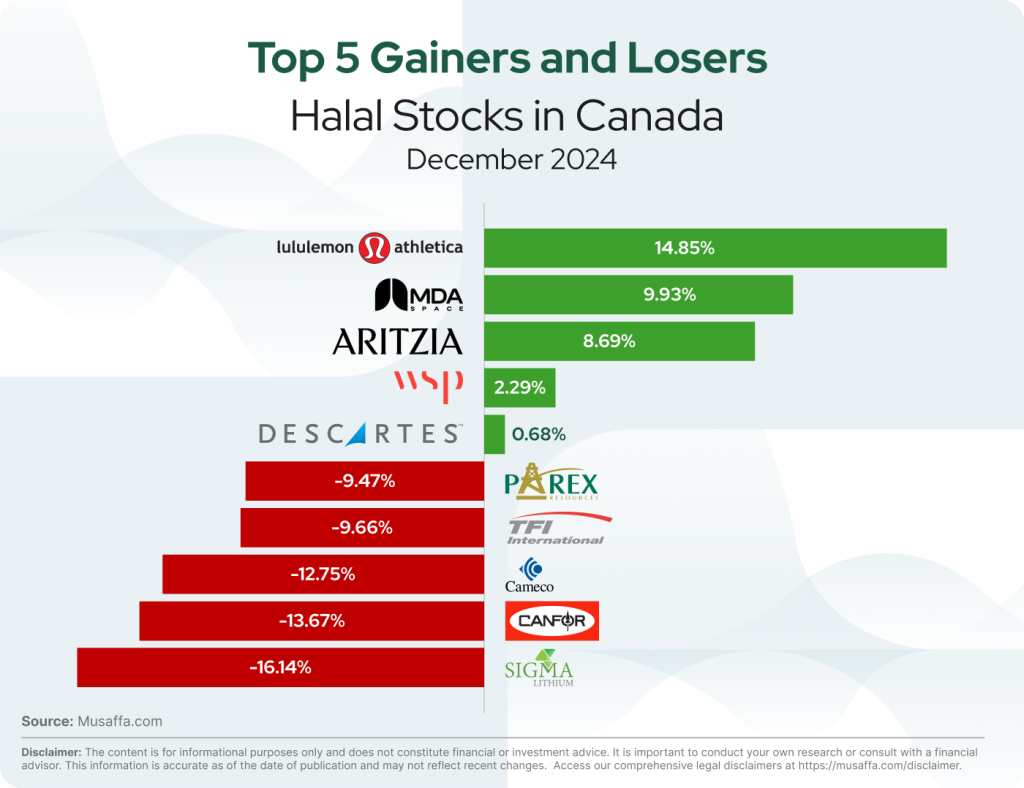

Canadian top gainer and top loser stocks for December

Summary

Canada’s economy navigated a complex landscape in December, balancing monetary easing with inflationary risks. A decline in wholesale trade highlighted economic weaknesses, while inflation trends provided a positive sign. Policymakers focused on trade stability, responding to U.S. tariff threats with infrastructure investments. Stock markets faced headwinds, but Canada pushed forward with strategic investments in AI, labor agreements, and energy sector expansions. These efforts reflect the country’s commitment to sustaining economic stability amid global uncertainties.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Go Premium

Go Premium