The U.S. economy remained stable in January, with key policy and market developments shaping the landscape. President Donald Trump suspended offshore wind leasing for environmental and economic review, while the Biden administration secured most IRA clean energy grants from potential clawbacks. The Federal Reserve kept interest rates unchanged, emphasizing data-driven decisions amid policy uncertainties. Solar energy is projected to lead electricity generation growth, while existing home sales hit a 10-month high despite long-term market challenges. Stock markets posted solid gains, with the S&P 500 rising 2.93%. Major corporate moves included a $500 billion AI investment, Chevron’s natural gas power plans, and Gilead’s patent dispute settlement.

USA economy update

- President Donald Trump has suspended new federal offshore wind leasing pending an environmental and economic review, citing concerns about wind turbines’ impact on wildlife, aesthetics, and costs. He claimed, without evidence, that offshore wind projects contribute to whale deaths and called wind energy “the most expensive form of energy.

- The Biden administration has secured 84% of Inflation Reduction Act (IRA) clean energy grants, amounting to $96.7 billion, from potential clawbacks by future administrations. These funds have been “obligated” through signed contracts with agencies and recipients, ensuring continued progress in clean energy deployment.

- The Federal Reserve leaves rates unchanged on Wednesday, January 30, signaling a cautious approach to any future rate cuts. Fed Chair Jerome Powell emphasized that decisions would hinge on inflation and employment data. Despite a stable economic landscape with steady unemployment rates and recent positive inflation readings, Powell highlighted uncertainty stemming from upcoming policy decisions by President Trump’s administration, including changes in immigration, tariffs, and taxes.

- The U.S. Energy Information Agency (EIA) forecasts that solar energy will lead U.S. electricity generation growth over the next two years. Utilities and independent power producers are expected to add 26 gigawatts (GW) of solar capacity in 2025 and an additional 22 GW in 2026, building on a record 37 GW added in 2024.

- U.S. existing home sales surged to a 10-month high in December, rising 2.2% to an annual rate of 4.24 million units, according to the National Association of Realtors. Despite this boost, 2024 marked the lowest sales levels in three decades, with the median house price reaching a record $407,500. While housing supply has improved, elevated mortgage rates near 7% and subdued homebuying sentiment are expected to limit further gains.

USA stock market updates

January brought positive momentum to U.S. markets! The S&P 500 rose by 2.93%, closing at $6,040.53. The Dow Jones saw a strong gain of 4.70%, reaching $44,544.66. The Nasdaq climbed by 1.64% to $19,627.44, while the Russell 2000 increased by 2.58%, closing at $2,287.69. A month of steady gains across all major indices.

- Gilead Sciences and the U.S. government have settled a billion-dollar patent dispute over HIV prevention drugs Truvada and Descovy. The case, filed in Delaware federal court, followed Gilead’s 2023 jury trial victory against the government’s infringement claims. Gilead’s General Counsel, Deborah Telman, highlighted the settlement’s role in enabling the company to maintain its focus on developing innovative treatments for life-threatening diseases.

- President Donald Trump announced a $500 billion private-sector investment in AI infrastructure, led by OpenAI, SoftBank, and Oracle Corporation under a joint venture named Stargate. The initiative aims to establish 20 massive data centers across the U.S., starting with Texas, creating over 100,000 jobs. With $100 billion earmarked for immediate use, the project will focus on leveraging AI to enhance industries like healthcare, including the analysis of electronic health records.

- Chevron Corporation has announced plans to construct natural gas-based power plants near U.S. data centers in response to surging energy demand fueled by AI growth. Partnering with investment firm Engine No. 1 and GE Vernova, Chevron aims to deliver up to 4 gigawatts of power through natural gas turbines, enough to supply about 3 million homes.

- DeepSeek, a Chinese AI startup, triggered a massive sell-off on Wall Street as its disruptive, cost-effective AI model cast doubts on the billions spent by U.S. tech giants on artificial intelligence. Founded in 2023 by Liang Wenfeng, DeepSeek recently released its R1 reasoning model, which reportedly outperformed OpenAI’s latest in third-party tests.

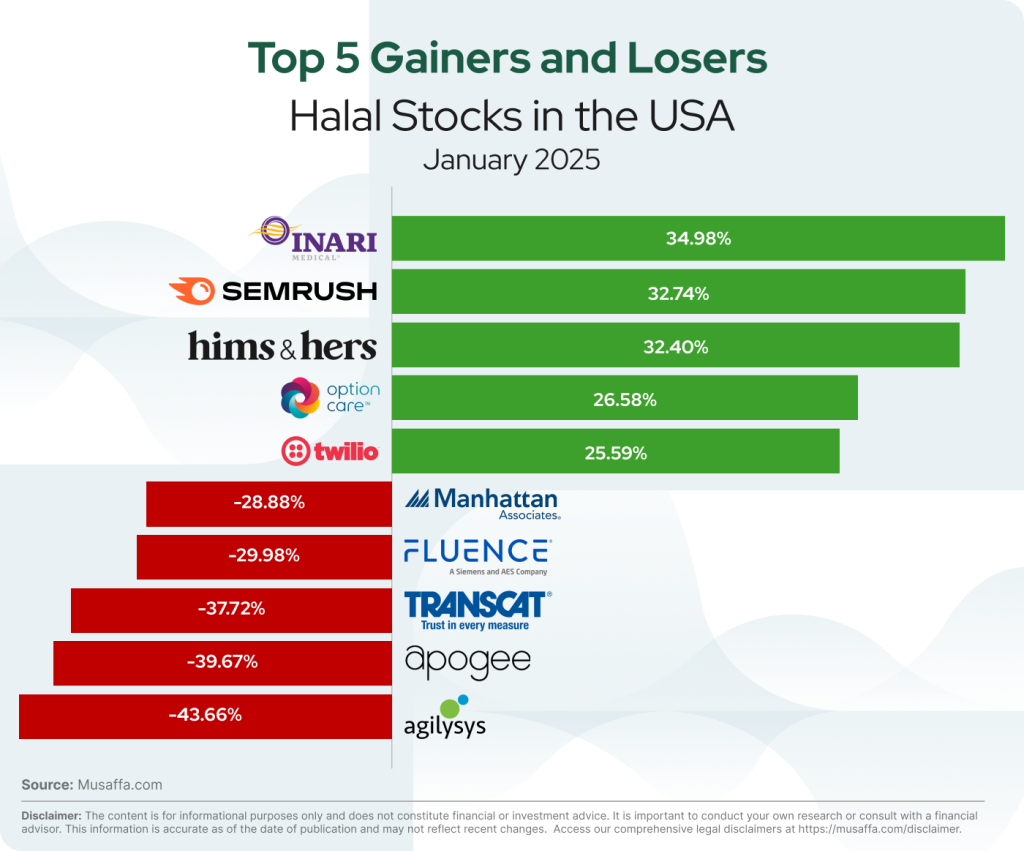

USA top gainer and top loser stocks for January

Summary

The U.S. economy showed resilience in January, with steady monetary policy, clean energy investments, and AI-driven growth initiatives. While Trump halted offshore wind leasing, the Biden administration safeguarded clean energy funds. The Fed maintained rates, housing showed mixed signals, and the stock market saw broad gains. Key corporate developments included major AI and energy projects, highlighting evolving economic priorities.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Go Premium

Go Premium