India’s economy in January 2025 saw significant fiscal and inflationary developments. The federal government disbursed ₹1.73 trillion ($20.13 billion) to states for capital projects and welfare programs, while fiscal deficit projections improved to 4.7%-4.8% of GDP, lower than the estimated 4.9%. Retail inflation slowed to 5.22% in December, though wholesale inflation accelerated to 2.37%, driven by rising food prices. Stock markets faced pressure, with the BSE SENSEX and NIFTY 50 declining by 1.22% and 1.20%, respectively. Corporate movements included Adani Group’s planned 20% stake sale in Adani Wilmar, Bajaj Healthcare’s approval for manufacturing Pimavanserin, Whirlpool India’s stock drop following its parent’s divestment plans, and VA Tech Wabag’s 6% gain after securing a ₹121 crore wastewater treatment contract in Bahrain.

India economy update

- India’s federal government disbursed 1.73 trillion rupees ($20.13 billion) on January 10 to states as part of tax devolution, aiming to bolster capital spending and fund development and welfare initiatives.

- India is projected to record a fiscal deficit of 4.7%-4.8% of GDP for FY25, according to a report by Mint, which would be below the government’s initial estimate of 4.9%. This improvement is attributed to reduced spending on planned capital investments and higher-than-expected dividends from the Reserve Bank of India.

- India’s annual retail inflation slowed to 5.22% in December, down from 5.48% in November, as food price increases moderated, according to government data. The figure came slightly below the Reuters poll projection of 5.3%. Despite this decline, the inflation rate remains above the 5.0% mark, potentially impacting monetary policy decisions.

- India’s wholesale inflation rate accelerated to 2.37% year-on-year in December, up from 1.89% in November, aligning with market expectations, according to government data. Food prices continued to show strong inflationary pressure, rising 8.89% year-on-year, driven by a 28.65% increase in vegetable prices and a 6.82% rise in cereal prices, though both showed marginal variations compared to November.

India stock market update

January continued to pose challenges for India’s markets. The BSE SENSEX declined by 1.22%, closing at ₹77,186.74, while the NIFTY 50 dropped by 1.20%, ending at ₹23,361.05. Economic pressures persisted, impacting investor sentiment and leading to further losses across major indices.

- India’s Adani Group announced plans to sell up to a 20% stake in its joint venture with Wilmar International, Adani Wilmar, as part of efforts to comply with minimum public shareholding rules and to exit the consumer goods business. The stake sale, starting January 10, includes an offer of 13.5% with an option to sell an additional 6.5%. The floor price is set at ₹275 per share, approximately 15% lower than the prior closing price of ₹323.45 on the National Stock Exchange.

- Bajaj Healthcare‘s shares rose nearly 4% after receiving approval from the Drug Controller General of India (DCGI) to manufacture both the active pharmaceutical ingredient (API) and the drug formulation of Pimavanserin, a 34 mg capsule. Pimavanserin is an atypical antipsychotic used to treat hallucinations and delusions linked to Parkinson’s disease psychosis.

- Whirlpool India shares dropped 20% after its parent company, Whirlpool Corporation, announced plans to reduce its stake in the Indian unit to about 20% by mid to late 2025. Currently holding 51%, Whirlpool Corporation intends to sell down its stake through market sales. This announcement follows a previous sale of nearly 24% of Whirlpool India’s shares in 2024 for around $468 million.

- VA Tech Wabag shares rose nearly 6% on January 29 after the company secured a seven-year, Rs 121 crore contract to operate a wastewater treatment plant in Bahrain for BAPCO Refining. This contract adds to the company’s growing operations and maintenance portfolio in Bahrain, where it has managed a sewage treatment plant since 2018.

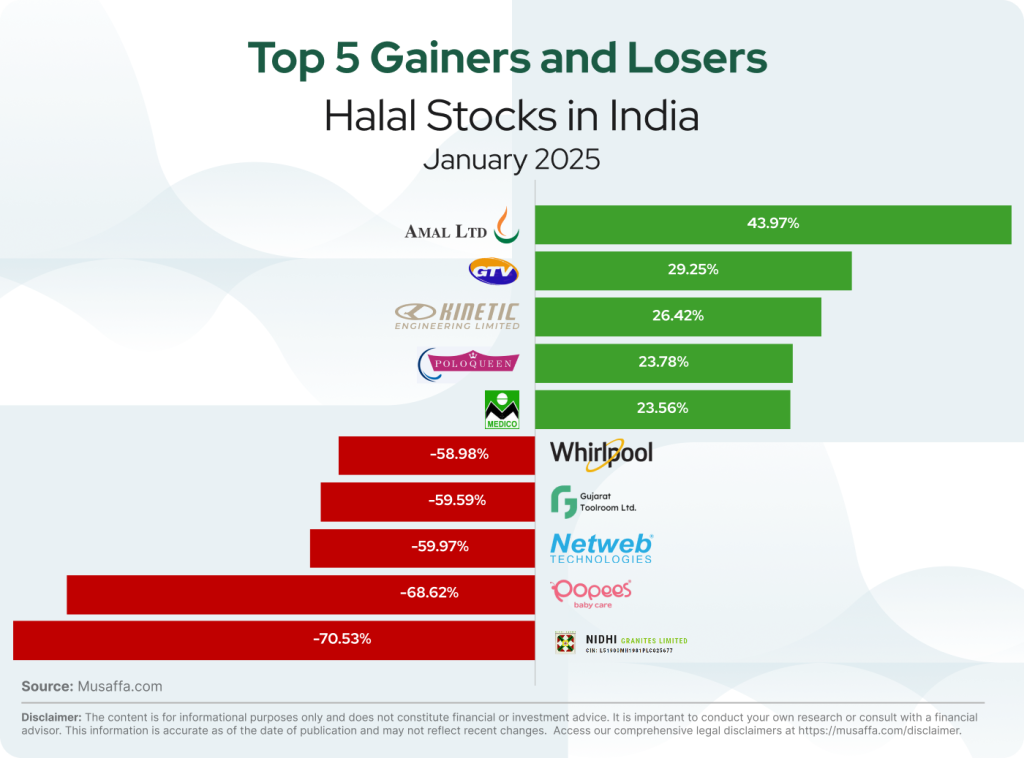

Indian top gainer and top loser stocks for January

Summary

India’s economy in January 2025 showed improved fiscal deficit projections and moderated retail inflation, though wholesale inflation rose due to food price pressures. The stock market faced declines, reflecting investor caution. Key corporate updates included Adani Wilmar’s stake sale, Bajaj Healthcare’s expansion into Parkinson’s treatment, Whirlpool India’s stock dip following its parent’s divestment, and VA Tech Wabag’s contract win in Bahrain.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Go Premium

Go Premium