Malaysia’s economy in January 2025 showed a continued decline in inflation, with the annual rate easing to 1.7% in December, its lowest level since January. Core inflation also slowed, reflecting moderated price pressures. The country set an ambitious target to attract 35.6 million tourists by 2026, aiming to boost economic growth. However, Q4 2024 GDP growth slowed to 4.8%, primarily due to contractions in agriculture and weaker manufacturing output. The stock market struggled, with key indices such as the FTSE Bursa Malaysia KLCI dropping by 5.20%. Corporate highlights included Chin Hin Group’s increased stake in Ajiya Bhd, HDC’s clarification on non-Bumiputera halal certifications, Salutica Bhd’s stock plunge after losing a legal battle against Apple, and NationGate Holdings’ decline following concerns over shifts in AI-driven demand.

Malaysia economy update

- Malaysia’s annual inflation rate eased to 1.7% in December 2024, marking the lowest level since January and falling slightly below November’s 1.8% and market expectations. The deceleration was driven by slower price increases in furnishing and household maintenance (0.4% vs 0.5%), health (1.1% vs 1.2%), recreation (1.7% vs 2.0%), and miscellaneous goods (3.2% vs 3.4%).

- Core inflation, excluding volatile fresh food and administered prices, rose 1.6% year-on-year in December, the slowest since January 2022. On a monthly basis, consumer prices inched up 0.1%, reversing the 0.1% decline recorded in November. For the full year, Malaysia’s inflation rate averaged 1.8%, continuing its downward trend for the second consecutive year.

- Malaysia is setting an ambitious target to attract 35.6 million foreign tourists in 2026, a significant 30% jump from its 2024 goal of 27.3 million visitors. The government anticipates the tourism sector will generate 147.1 billion ringgit ($25.4 billion) in revenue by 2026, reinforcing its importance as a key driver of Malaysia’s economy.

- Malaysia’s economy expanded by 4.8% year-on-year in Q4 2024, a slowdown from 5.3% in the previous quarter and the weakest growth since Q1 2024, according to flash data. The deceleration was largely attributed to a sharp contraction in agriculture (-0.6% vs. 3.9% in Q3), driven by lower oil palm production and reduced forestry and logging activities, and slower growth in manufacturing (4.3% vs. 5.6%).

Malaysia stock market update

January was a challenging month for Malaysia’s key stock market indices. The FTSE Bursa Malaysia KLCI fell by 5.20%, closing at RM1,556.92. The FTSE Bursa Malaysia Mid 70 Index saw a significant decline of 6.66%, ending at RM17,587.02, while the FTSE Bursa Malaysia Top 100 Index dropped by 5.63% to RM11,575.9. A tough start to the year for Malaysian markets.

- Chin Hin Group Bhd has proposed acquiring an additional 12.27% stake in Ajiya Bhd for RM54.2 million, raising its total ownership to 66.36%. The deal, priced at RM1.45 per share, was agreed on a willing-buyer willing-seller basis and represents a 9.9% discount to Ajiya’s last traded price of RM1.61.

- Halal Development Corporation Bhd (HDC) revealed that over 70% of halal certificate holders in Malaysia are non-Bumiputera companies, a fact that should not be viewed as problematic, according to its chairman Khairul Azwan Harun. He highlighted that these companies meet the Department of Islamic Development Malaysia (Jakim)’s rigorous standards. Non-Bumiputera firms have traditionally dominated the food manufacturing sector

- Shares of Salutica Bhd plunged as much as 45% to a two-year low of 23 sen after losing a patent infringement suit against Apple Malaysia in the Kuala Lumpur High Court. The court ordered Salutica’s subsidiary to pay Apple Malaysia RM1.2 million in a counterclaim. Following the ruling, Salutica plans to review the grounds of judgment within one to two weeks.

- Shares of NationGate Holdings Bhd hit a three-month low, dropping as much as 14.7% to RM1.86, as investors reacted to Chinese startup DeepSeek’s launch of a free open-source AI model. NationGate, a key assembler of Nvidia Corp’s graphic processing units in ASEAN, faced concerns over potential shifts in demand dynamics following the AI development.

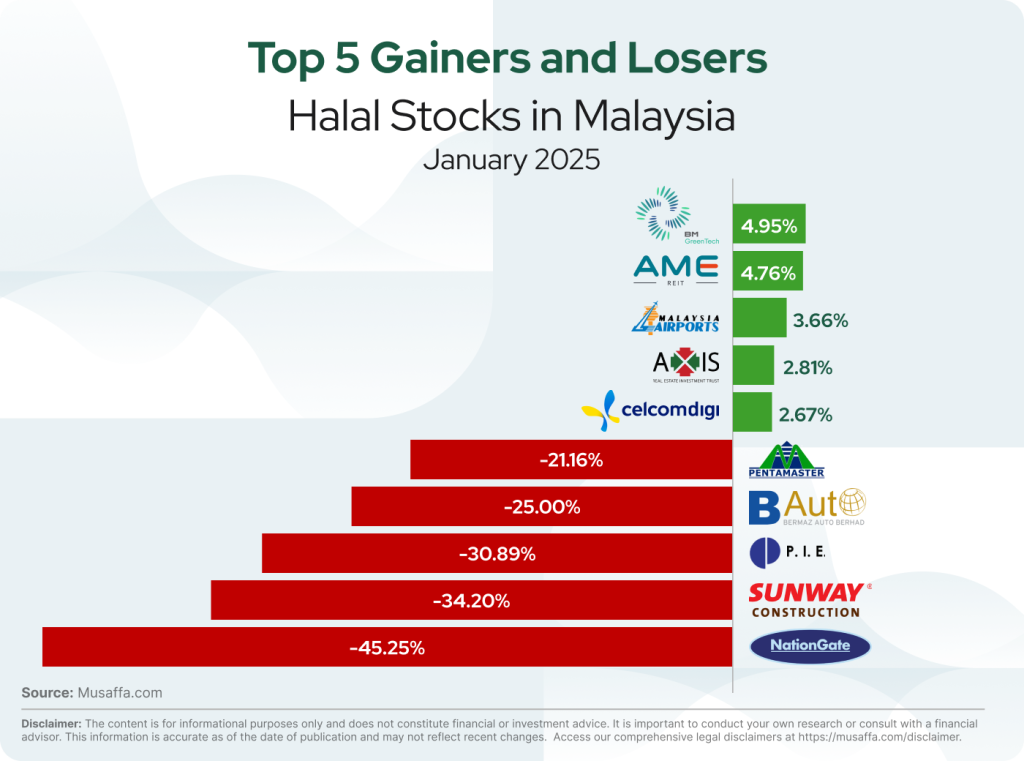

Malaysian top gainer and top loser stocks for January

Summary

Malaysia’s inflation rate eased to 1.7% in December, while Q4 GDP growth slowed to 4.8% due to weaker agricultural and manufacturing performance. The stock market faced challenges, with major indices seeing sharp declines. Key corporate updates included Chin Hin Group’s stake acquisition in Ajiya, HDC’s clarification on halal certifications, Salutica’s stock drop after a court loss to Apple, and NationGate’s decline amid AI market shifts.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Go Premium

Go Premium