Saudi Arabia’s economy in January 2025 remained stable, with inflation at 1.7%, primarily driven by rising housing costs. The Kingdom’s crude oil production increased by 1.21% year-on-year, while natural gas production is projected to grow by 4% in 2025 with major projects like Jafurah and Tanajib. The Tadawul All-Share Index rose by 2.67%, while the Parallel Market Capped Index saw a slight decline. Key developments included the authorization of foreign investments in listed companies owning real estate in Makkah and Madinah, Walaa Cooperative Insurance’s retained “A-” rating, the Capital Market Authority’s $274 billion capital raising efforts, and a successful SR3.72 billion sukuk issuance as part of Saudi Arabia’s economic transformation under Vision 2030.

Saudi Arabia economy update

- The International Energy Agency (IEA) reported that the nuclear power industry needs to double its funding to $120 billion annually by 2030 to meet growing infrastructure demands. The report emphasized the importance of both public and private investments, highlighting that predictable future cash flows are essential for reducing financing costs and attracting private capital.

- Saudi Arabia’s inflation rate reached 1.7% in 2024, primarily driven by a 10.6% surge in house rents, according to data from the General Authority for Statistics. The housing, water, electricity, gas, and other fuels categories collectively saw an 8.8% price increase, intensifying household costs. Despite these pressures, the Kingdom’s inflation rate remained one of the lowest in the Middle East and globally.

- Saudi Arabia’s crude oil production rose by 1.21% year-on-year to 8.92 million barrels per day in November, according to the Joint Organizations Data Initiative. Despite this increase, crude exports dropped by 2.05% to 6.21 million bpd, although this marked the highest export level in eight months.

- Saudi Arabia’s natural gas production is expected to grow by 4% in 2025, fueled by the launch of major projects such as Jafurah Phase 1 and Tanajib, according to the International Energy Agency. Jafurah Phase 1 is set to add 2 billion cubic meters of natural gas annually, while the Tanajib project will contribute 27 billion cubic meters per year.

Saudi Arabia stock market update

January brought mixed results for Saudi markets. The Tadawul All-Share Index rose by 2.67%, closing at SAR 12,357.35, reflecting continued growth. However, the Parallel Market Capped Index saw a slight decline of 0.72%, ending the month at SAR 31,250.65. A month of contrasting performances for Saudi market indices.

- Saudi Arabia’s Capital Market Authority has authorized foreign investments in listed companies owning real estate in Makkah and Madinah, marking a significant policy shift. The decision, effective immediately, aims to enhance market competitiveness and support the Kingdom’s Vision 2030 diversification goals. While property ownership in these holy cities traditionally remains restricted to Saudi nationals, foreigners have been permitted to lease properties.

- Walaa Cooperative Insurance Co. in Saudi Arabia has retained its “A-” long-term financial strength rating from S&P Global, with a stable outlook. The agency also affirmed Walaa’s “gcAAA” Gulf Cooperation Council regional scale and “ksaAAA” Saudi national scale ratings, citing the company’s strong capital position and strategic business growth initiatives.

- Saudi Arabia’s capital markets have raised $274 billion over the past five years as part of efforts to finance the Kingdom’s Vision 2030 economic transformation agenda. The Capital Market Authority’s 2024-2026 strategy focuses on boosting investments, attracting global interest, and supporting economic diversification.

- Saudi Arabia’s National Debt Management Center has successfully raised SR3.72 billion ($990 million) through its riyal-denominated sukuk issuance for January. This follows sukuk issuances of SR11.59 billion in December 2024, SR3.41 billion in November, and SR7.83 billion in October.

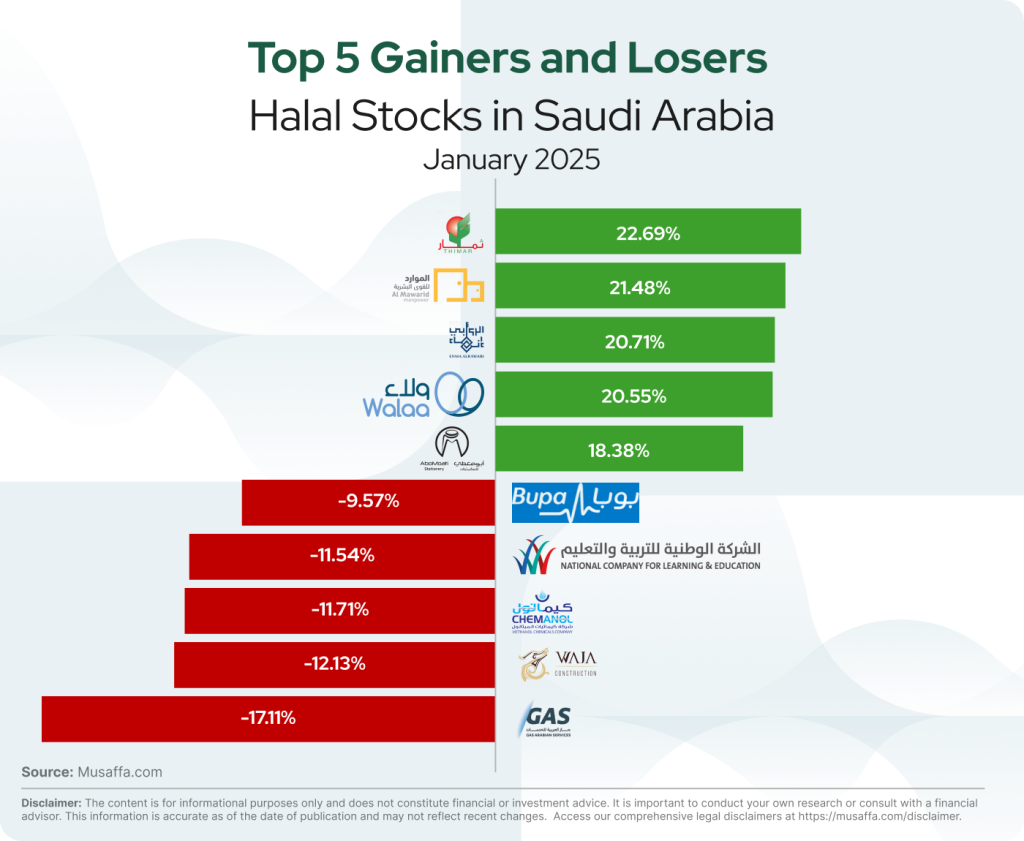

Saudi Arabia top gainer and top loser stocks for January

Summary

Saudi Arabia’s inflation reached 1.7% in 2024, mainly due to rising housing costs. Oil production increased, while gas output is set to grow in 2025. The stock market saw mixed performance, with Tadawul rising 2.67%. Key developments included foreign investment authorization in Makkah and Madinah real estate, Walaa Insurance’s strong rating, $274 billion raised for economic diversification, and a SR3.72 billion sukuk issuance.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Go Premium

Go Premium