Welcome to our monthly economic and market update! As we enter a new month, here’s a recap of the key economic and market developments in the U.S. from February. Let’s get started.

USA economy update

- U.S. economic growth slowed to an annualized 2.3% in the fourth quarter from 3.1% in the previous quarter, as confirmed by the Commerce Department’s revised estimate. While government spending and exports saw slight upgrades, consumer spending and investment were revised lower.

- U.S. President Donald Trump will decide on tariff policies for all countries, including Mexico and Canada, after a study is released on April 1, according to White House economic adviser Kevin Hassett. In an interview with CNBC, Hassett said Trump extended the tariff decision timeline, indicating that trade measures for North American partners will likely be addressed alongside broader global policies.

- Atlanta Fed President Raphael Bostic signaled caution on cutting interest rates, citing uncertainty around inflation and potential policy changes from the Trump administration. Speaking to business executives in Atlanta, Bostic noted that inflation spiked in January, while new import tariffs on metals and other goods added further complexity.

- U.S. weekly jobless claims fell by 7,000 to 213,000 for the week ending February 8, indicating a stable labor market. This was slightly better than economists’ expectations of 215,000 claims. Despite job stability, hiring has slowed, with nonfarm payrolls rising by 143,000 in January and the unemployment rate holding at 4.0%.

- Consumer inflation expectations surged in February, with the University of Michigan survey showing a one-year inflation outlook of 4.3%, up 1 percentage point from January and the highest since November 2023. The sharp rise in inflation fears coincided with lower consumer sentiment, as the index fell to 67.8, down 4.6% from the previous month and 11.8% lower than a year ago.

USA stock market updates

February was a challenging month for U.S. markets, with all major indices facing declines. The S&P 500 fell by 1.29%, closing at $5,954.48, while the Dow Jones dropped 1.58% to $43,839.56. The Nasdaq saw a more significant decline of 4.02%, ending at $18,837.77. The Russell 2000 struggled the most, falling by 5.44% to close at $2,163.18. A tough month for investors as market pressures weighed on performance.

- S&P 500 earnings growth for Q4 2024 is set to be the highest since late 2021, with earnings rising an estimated 15.1% year-over-year, up from the initial 9.6% forecast in January, according to LSEG. This surge is driven by strong performances in communication services, financials, and other sectors.

- Chevron plans to cut 15% to 20% of its workforce as part of a cost-cutting initiative to save $2 billion to $3 billion by the end of 2026. With a headcount of 45,600 employees in 2023, this reduction could mean over 9,000 job losses. The company’s decision comes amid declining refining margins, which led to a fuel business loss in Q4 2024.

- U.S. aviation industry groups are urging Congress to approve emergency funding for air traffic control technology and staffing following a deadly midair collision near Washington, D.C., the worst U.S. air disaster since 2001. In a letter to lawmakers, industry leaders—including Boeing, major airlines, private aviation firms, and labor unions—emphasized the need for robust investment in airspace safety.

- Eli Lilly announced a $27 billion investment to build four new U.S. manufacturing sites, bringing its total domestic investment to over $50 billion in recent years. The move is driven by surging demand for its weight loss and diabetes drugs, as well as the development of new treatments.

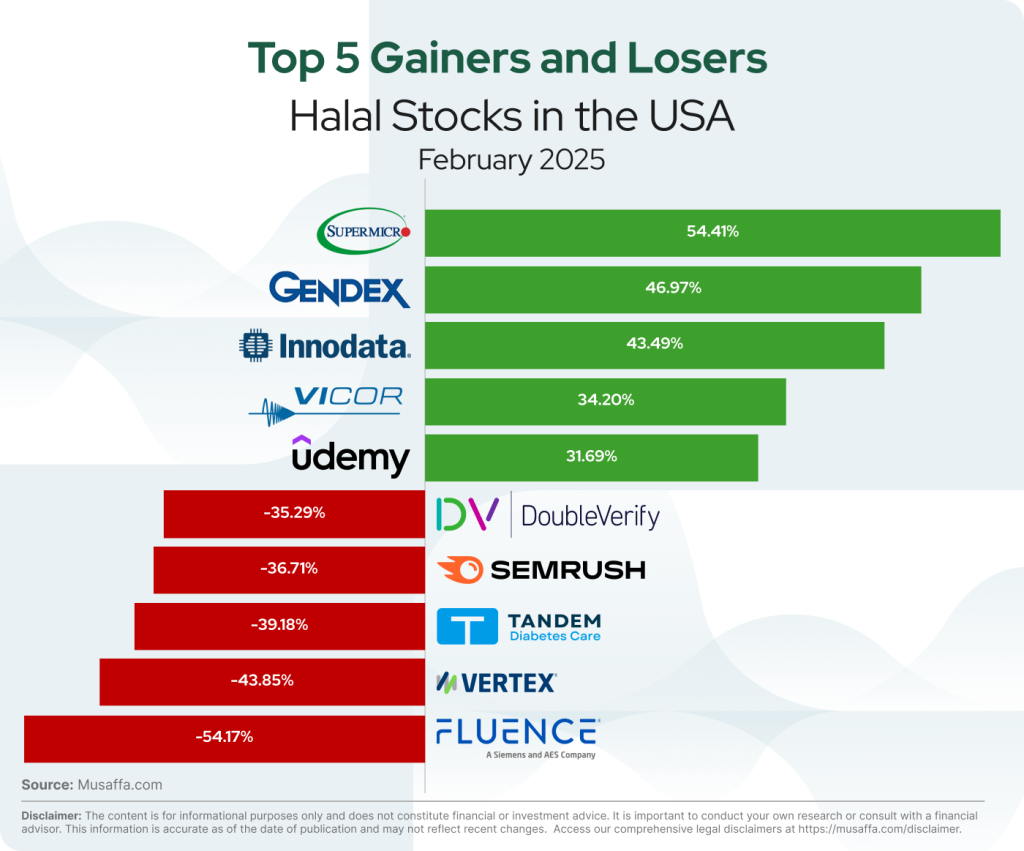

USA top gainer and top loser stocks for February

Summary

The U.S. economy slowed to 2.3% growth in Q4 2024 amid weaker consumer spending and investment. Inflation concerns rose, while jobless claims fell but hiring remained weak. Stock markets faced declines, with the Nasdaq dropping 4.02%. Chevron announced major job cuts, while Eli Lilly committed $27 billion to new U.S. facilities.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Go Premium

Go Premium