Assalamu Alaykum,

Welcome to our monthly economic and market update! As we enter a new month, here’s a recap of the key economic and market developments in the U.S. from April. Let’s get started.

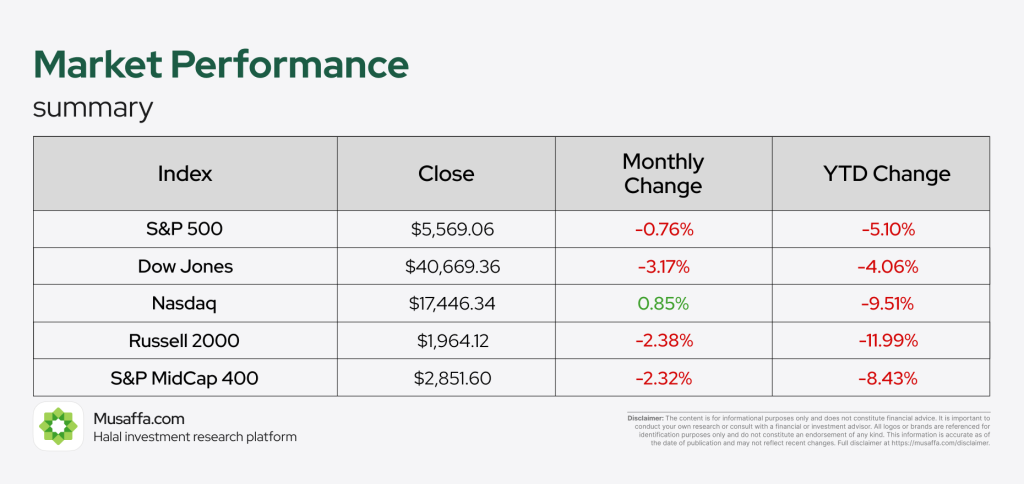

Stock market updates

April brought continued pressure for U.S. markets, with most major indices recording further declines. The S&P 500 edged down by 0.76% to close at $5,569, and the Dow Jones fell 3.17% to $40,669. The Russell 2000 also declined by 2.38%, ending at $1,964, while the S&P MidCap 400 slipped 2.32% to $2,851. However, the Nasdaq managed a modest gain of 0.85%, rising to $17,446 — a rare bright spot in an otherwise subdued month for U.S. markets.

- Eli Lilly has filed lawsuits against four compounding companies—Mochi Health, Fella Health and Delilah, Willow Health Services, and Henry Meds—for allegedly selling unauthorized versions of tirzepatide, the active ingredient in its blockbuster weight-loss and diabetes drug, Mounjaro. The legal action follows a recent U.S. court decision blocking pharmacies from producing copies of such medications now that supply is no longer officially considered in short supply.

- Gilead Sciences has agreed to pay $202 million to settle a whistleblower lawsuit accusing the company of paying illegal kickbacks to doctors who prescribed its HIV drugs, thereby defrauding federal healthcare programs like Medicare and Medicaid. The U.S. Department of Justice found that between 2011 and 2017, Gilead spent over $23.7 million on speaker fees, luxury meals, and travel for healthcare providers as part of promotional programs.

- Merck & Co. has revised its 2025 profit forecast downward, now expecting adjusted earnings between $8.82 and $8.97 per share, citing a $200 million impact from tariffs and charges related to a recent deal. The tariff burden stems largely from U.S.-China trade tensions, with some exposure to Canada and Mexico.

- Chevron Corp is dialing back its share buyback pace in Q2 2025, planning to repurchase $2.5–$3 billion of its stock, down from $3.9 billion in Q1. The move reflects pressure from weaker oil prices, which have fallen about 18% this year due to Trump’s new tariffs dampening global demand and OPEC+ increasing supply.

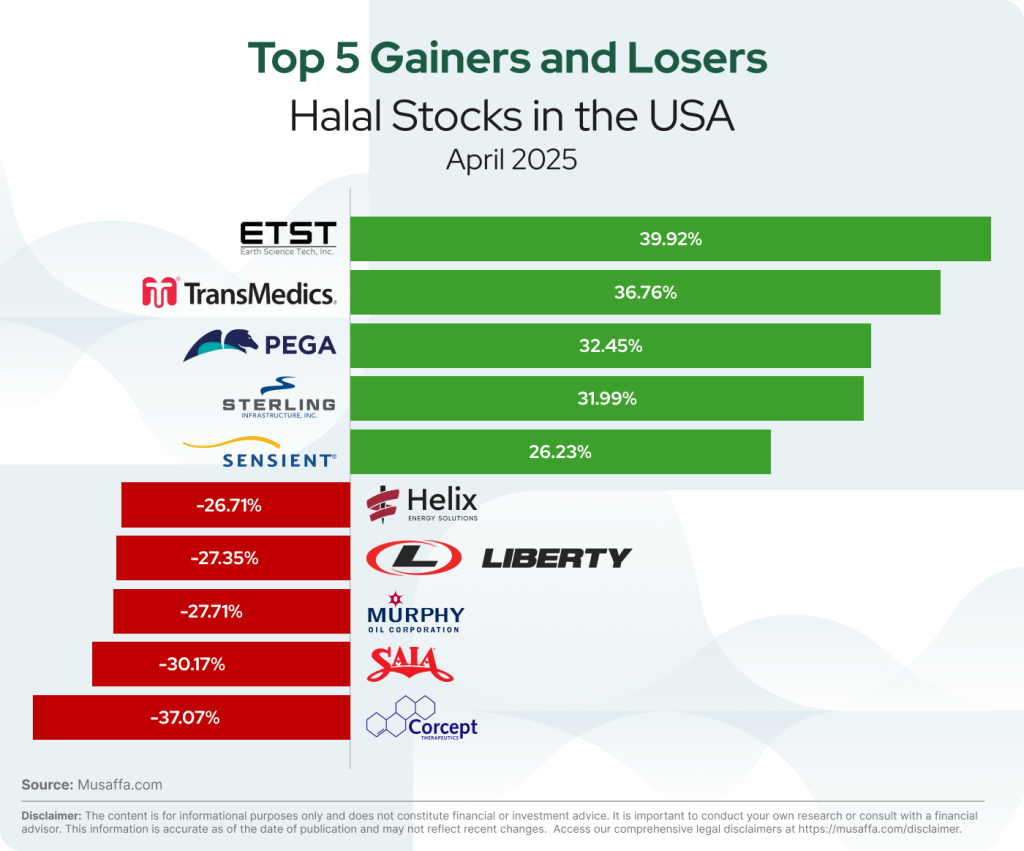

Top gainer and top loser Halal stocks in the USA

Economic updates

- U.S. recession risks have surged due to President Trump’s aggressive tariff policies, with a Reuters poll showing a 45% chance of recession within 12 months—up from 25% last month. The escalating trade war, especially with China, is worsening business sentiment and economic outlooks, with forecasters now expecting higher inflation and slower growth.

- U.S. pending home sales jumped 6.1% in March—the biggest gain since December 2023—far surpassing expectations, as falling mortgage rates spurred buyer interest. The Pending Home Sales Index rose to 76.5, with the drop in the 30-year fixed mortgage rate from 7.04% in January to 6.65% in March helping drive the surge.

- A 25% U.S. tariff on pharmaceutical imports could raise U.S. drug costs by nearly $51 billion annually and increase drug prices by up to 12.9%, according to an Ernst & Young report reviewed by Reuters. The U.S. imported $203 billion in pharmaceuticals in 2023—mostly from Europe—with total domestic drug sales at $393 billion.

- U.S. consumer confidence dropped to its lowest level in nearly five years in April, with the index falling 7.9 points to 86.0, the lowest since May 2020. The decline was driven by growing concerns over tariffs and their potential impact on the economy. The Expectations Index, which reflects consumers’ outlook on income and business conditions, fell sharply to 54.4, signaling a potential recession.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Go Premium

Go Premium