Assalamu Alaykum,

Welcome to our monthly economic and market update! As we enter a new month, here’s a recap of the key economic and market developments in the UK from April. Let’s get started.

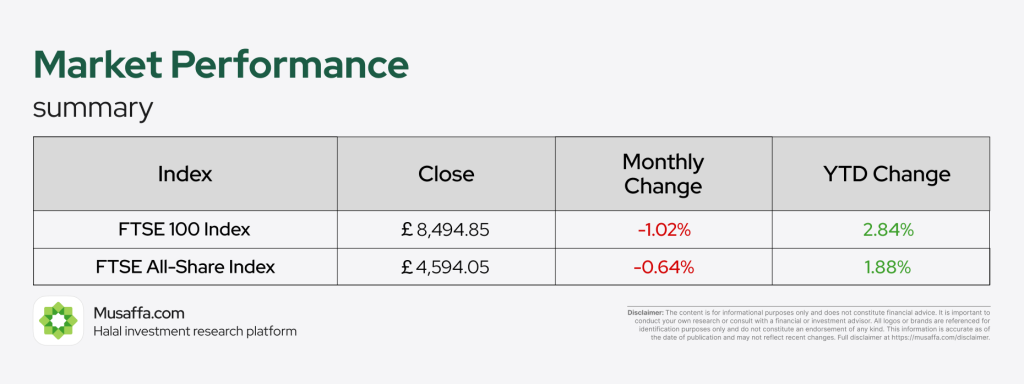

Stock market updates

April continued the downward trend for UK markets. The FTSE 100 Index saw a slight decline of 1.02%, closing at £8,494, while the FTSE All-Share Index dropped by 0.64%, ending at £4,594. Investor caution persisted, reflecting ongoing market challenges and broader economic concerns.

- UK-based medical device maker Belluscura warned that its products sold in the U.S. could soon face tariffs of up to 20%, as the company grapples with the impact of proposed U.S. trade measures targeting Chinese-made goods. Since a significant share of components for its portable oxygen concentrators are sourced from China, the company has withdrawn its 2025 outlook and is exploring alternative manufacturing and sourcing strategies to offset rising costs.

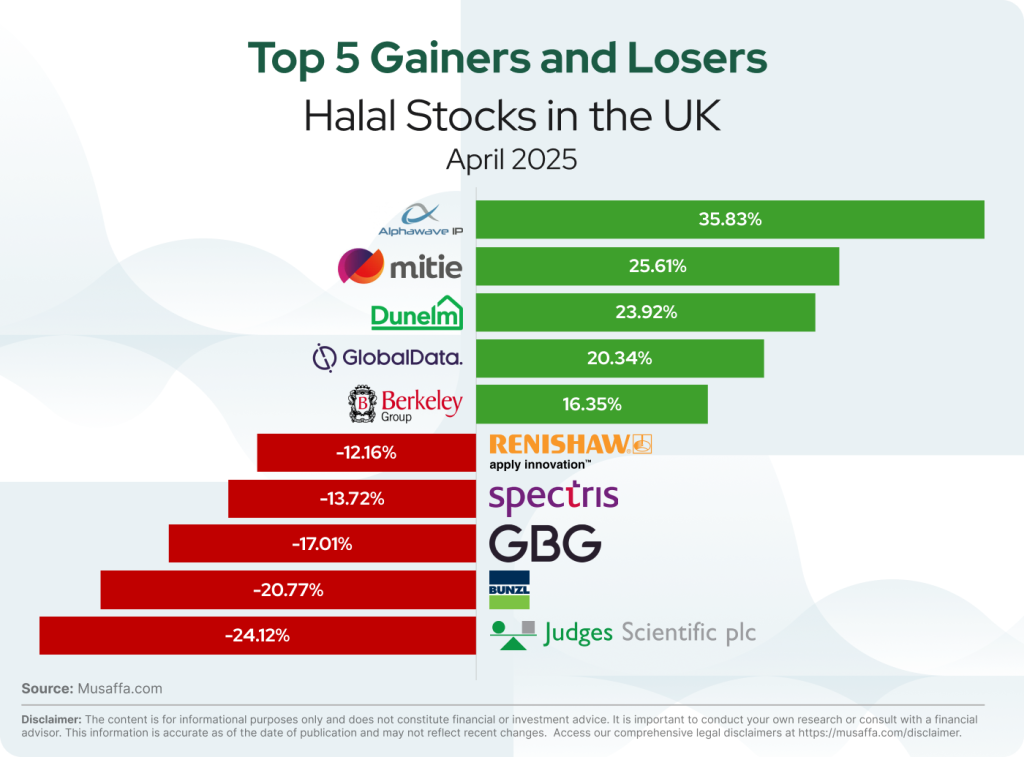

- British distributor Bunzl slashed its 2025 forecast and paused its £200 million share buyback program, citing revenue softness in its key North American market and ongoing global uncertainty tied to U.S. tariff threats. Shares plunged more than 25%, hitting a nearly four-year low. While Bunzl expects moderate revenue growth next year, it warned that group operating margins will dip slightly below the 8% recorded in 2024.

- AstraZeneca reported a strong first quarter for 2025, with revenue rising 10% at constant exchange rates to $13.59 billion, driven by solid growth in oncology and biopharmaceuticals across major markets. Product sales climbed 9% to $12.88 billion, while reported EPS jumped 34% to $1.89, and core EPS increased 21% to $2.49.

- Trainline shares dropped up to 8% after the company forecast slower sales and revenue growth for fiscal 2026, citing economic uncertainty and the expansion of Transport for London’s contactless travel zone, which reduces reliance on its platform. The company now expects net ticket sales growth of 6%–9%, down from 12% last year, with revenue projected to grow just 0%–3%.

Top gainer and top loser Halal stocks in the UK

Economic updates

- UK house prices fell 0.6% in April, the biggest monthly drop since August 2023, as the end of a property tax discount prompted buyers to rush purchases in March, according to Nationwide. This marked the first monthly decline since last August and came in below all forecasts, with annual growth slowing to 3.4% from 3.9% in March.

- UK inflation eased to 2.6% in March from 2.8% in February, below expectations, as falling fuel and computer game prices offset a rebound in clothing costs, according to the ONS. While the Bank of England’s target is 2%, experts warn this dip is temporary, with April expected to bring a spike to around 3% due to higher utility bills and employer taxes.

- The U.S. is reportedly pushing for the UK to reduce its 10% automotive tariff to 2.5% as part of broader trade negotiations under President Trump’s administration, according to the Wall Street Journal. British finance minister Rachel Reeves is set to meet U.S. Treasury Secretary Scott Bessent this week to discuss the matter, with Washington also seeking eased restrictions on U.S. agricultural exports like beef.

- UK grocery inflation rose slightly to 3.8% in April from 3.5% in March, adding pressure on consumers already dealing with higher utility and tax bills, according to Kantar. Total grocery sales jumped 6.5%, aided by a late Easter, while supermarkets intensified price cuts and promotions to boost competitiveness.

- Britain has expanded export finance support by £20 billion ($26 billion), raising UK Export Finance’s capacity to £80 billion, to help businesses, especially those hit by U.S. tariffs under President Trump’s trade regime. The move includes £10 billion earmarked for those most affected by the tariffs, which include 25% duties on steel, aluminium, and cars, and a 10% baseline on most other UK imports.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Go Premium

Go Premium