Assalamu Alaykum,

Welcome to our monthly economic and market update! As we enter a new month, here’s a recap of the key economic and market developments in Malaysia from April. Let’s get started.

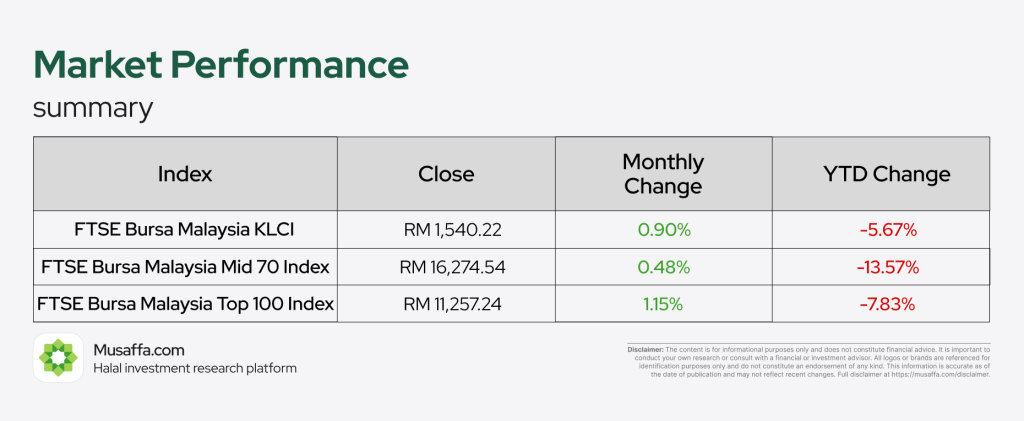

Stock market updates

April brought a much-needed recovery for Malaysia’s stock market, with all major indices posting gains. The FTSE Bursa Malaysia KLCI increased by 0.90%, closing at RM1,540. The FTSE Bursa Malaysia Mid 70 Index rose by 0.48%, ending at RM16,274, while the FTSE Bursa Malaysia Top 100 gained 1.15%, closing at RM11,257. This positive momentum reflected an easing of market volatility and an improvement in investor sentiment, helping to reverse the losses of the previous month.

- Gamuda Bhd has sold a 389-acre land parcel in Port Dickson to Google affiliate Pearl Computing Malaysia Sdn Bhd for RM455.23 million, and will undertake RM1.01 billion worth of enabling infrastructure works for a new data centre on the site. Originally acquired for RM424.4 million in December 2024, the land will now host a major hyperscale data centre project.

- SD Guthrie Bhd has successfully completed its first tariff-free export of RSPO-certified sustainable palm oil (CSPO) to the UK under the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). The 8,000-tonne shipment, fully traceable and tested for safety standards, was received at the company’s Liverpool refinery, which supplies over half of the UK’s palm oil demand.

- Sime Darby Property Bhd has raised RM800 million in its third sukuk issuance under a RM4.5 billion programme, with the offering oversubscribed by 6.74 times, attracting RM5.4 billion in orders from 51 institutional investors. The sukuk, with tenors of 7 to 15 years and average profit rates of 4.02%, achieved the company’s tightest credit spreads to date despite global market uncertainty.

- HCK Capital Group Bhd is launching a RM2 billion sukuk wakalah programme through its wholly owned unit, HCK Cap Access Bhd, involving both senior sukuk and perpetual sukuk. The senior sukuk has received an AIS rating from MARC Ratings and is guaranteed by key subsidiaries, while the perpetual sukuk is unrated and not guaranteed. Proceeds will be used for Shariah-compliant inter-company financing.

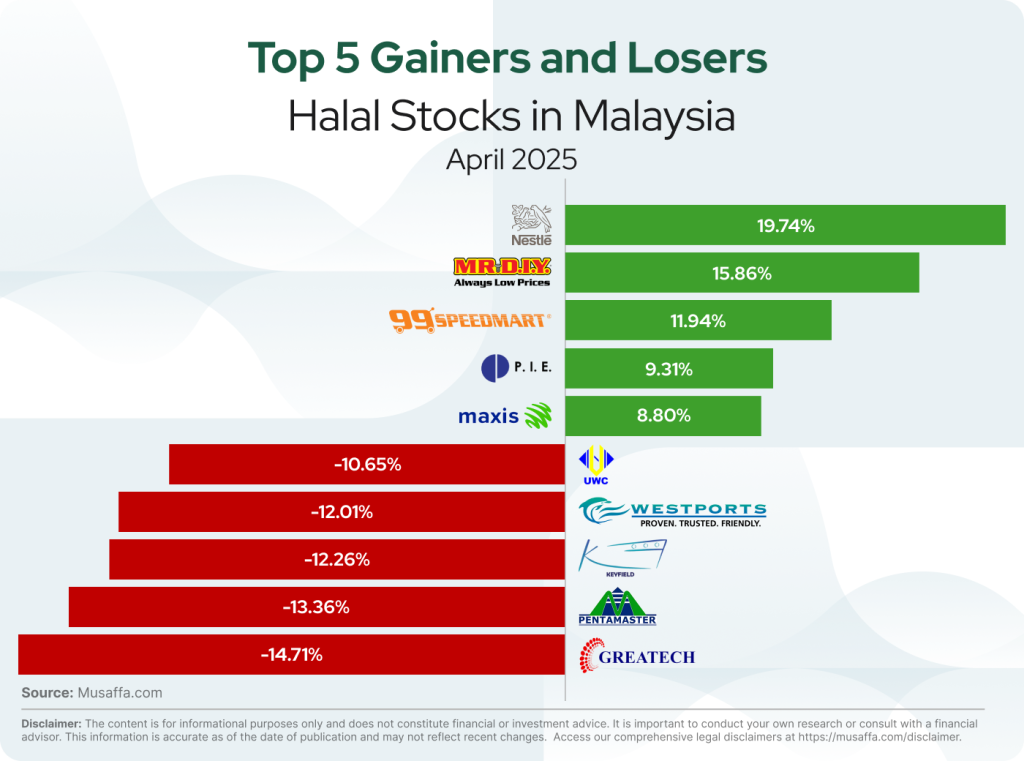

Top gainer and top loser Halal stocks in Malaysia

Economic updates

- CIMB Securities expects Bank Negara Malaysia to cut its overnight policy rate by 25 basis points to 2.75% at its July 9 meeting, skipping a rate change this month to allow more time to assess the impact of U.S. tariffs and upcoming GDP data.

- Malaysia’s halal product exports have reached RM61.79 billion in 2024, a 15% increase from RM53.72 billion in 2023, according to Tengku Datuk Seri Zafrul Aziz, Minister of Investment, Trade, and Industry. Malaysia continues to lead the Global Islamic Economy Indicator rankings for the 10th consecutive year, ahead of Saudi Arabia, Indonesia, and the UAE.

- With inflation easing to a four-year low, Bank Negara Malaysia (BNM) has room to cut interest rates to support economic growth, which is facing external threats from international trade tensions. Economists are anticipating potential rate cuts of 25 to 75 basis points for the rest of the year, with markets already pricing in these reductions.

- The Socio-Economic Research Centre (SERC) has revised Malaysia’s 2025 GDP growth forecast down to 4%, from the previously projected 5%, due to rising uncertainty over US tariff policies. The adjustment comes in response to the announcement of reciprocal tariffs by US President Donald Trump. The forecast could change further based on the outcome of trade negotiations and potential additional US restrictions.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Go Premium

Go Premium