Assalamu Alaykum,

Welcome to our monthly economic and market update! As we enter a new month, here’s a recap of the key economic and market developments in the Saudi Arabia from April. Let’s get started.

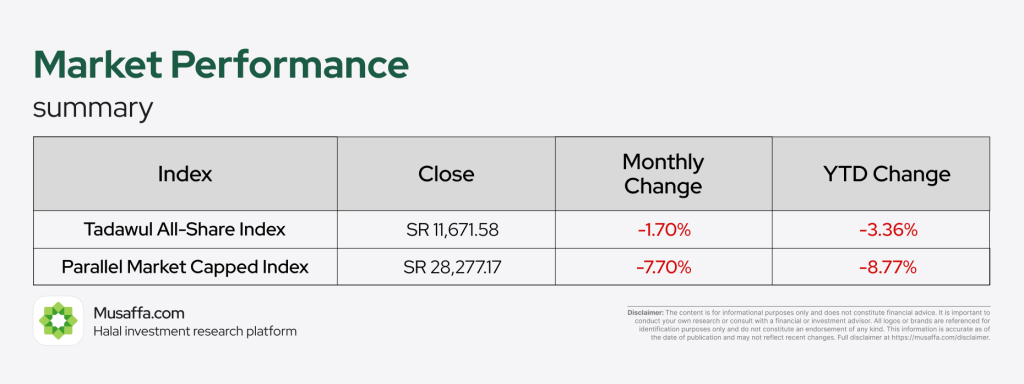

Stock market updates

April was another tough month for Saudi markets, with both major indices seeing declines. The Tadawul All-Share Index fell by 1.70%, closing at SR11,671, reflecting ongoing market pressure. The Parallel Market Capped Index experienced a sharper decline of 7.70%, ending the month at SR28,277. These losses indicate continued investor caution and persistent economic challenges, which have been weighing on market performance across the board.

- Saudi Arabia’s Public Investment Fund (PIF) successfully priced a $1.25 billion international sukuk, which was over 6.5 times oversubscribed with demand exceeding $9 billion—highlighting strong investor confidence in PIF’s creditworthiness and its central role in driving Saudi Arabia’s economic transformation.

- Saudi Aramco has lowered its May 2025 official selling prices for liquefied petroleum gas (LPG), cutting propane by $5 to $610 per tonne and butane by $15 to $590 per tonne. These reductions reflect ongoing market softening and follow similar declines in April.

- Alkhorayef Water and Power Technologies Co. has announced it has been awarded a contract for the supply, installation, testing, and commissioning of pumps and Variable Frequency Drives (VFDs) in the Jazan region. The project aligns with the company’s core focus on water infrastructure development and reflects ongoing investment in energy-efficient solutions to enhance regional water services.

- Dr. Soliman Abdel Kader Fakeeh Hospital Co. (Fakeeh Care Group) has signed a Memorandum of Understanding with Shanghai Fosun Pharmaceutical Group to introduce next-generation cell and gene therapies, including CAR-T treatments, and AI-driven diagnostic technologies in Saudi Arabia.

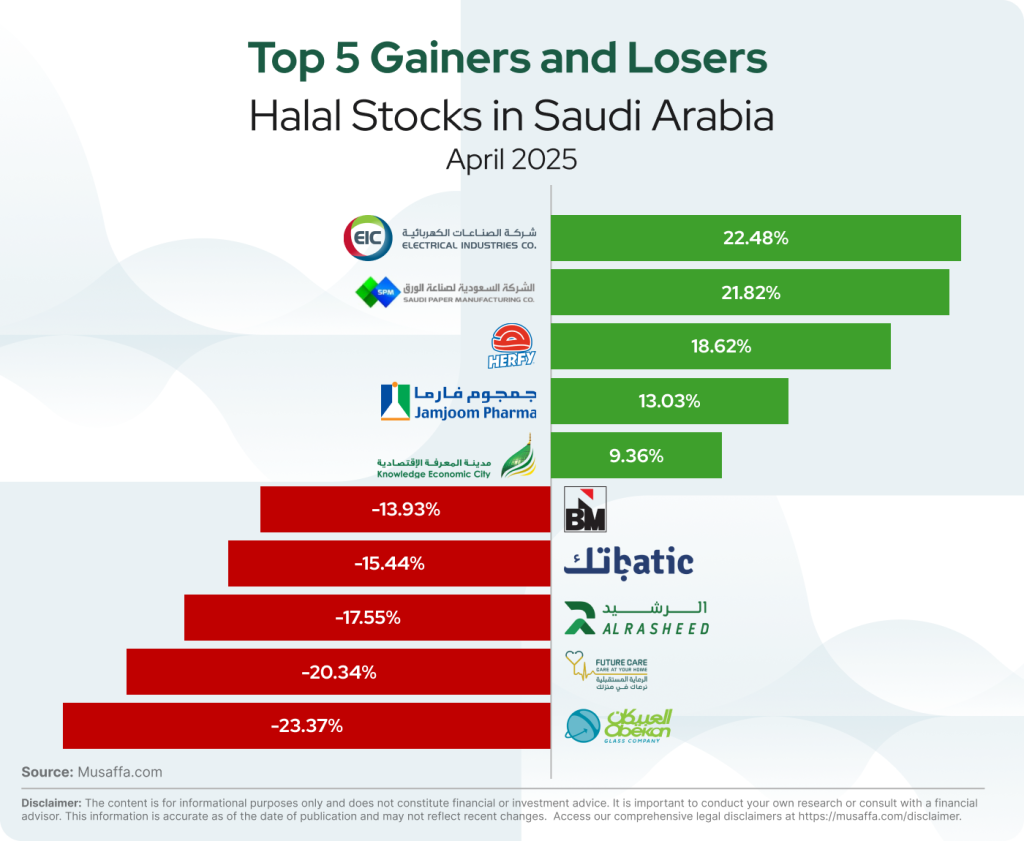

Top gainer and top loser Halal stocks in Saudi Arabia

Economic updates

- Saudi Arabia’s capital investment surged to $355 billion (SR1.33 trillion) in 2024, exceeding its target by 38%, driven primarily by an 11% rise in private sector investment, which now makes up over 89% of total gross fixed capital formation (GFCF). Government investment, on the other hand, fell by 29.4%. GFCF reached 29% of GDP, surpassing the 26% target under the National Investment Strategy.

- Saudi Arabia posted a $15.65 billion budget deficit in Q1 2025, mainly due to a 17.65% drop in oil revenues caused by OPEC+ production cuts, even as spending increased to support Vision 2030 projects. Total revenues fell 10.16% year-on-year to SR263.61 billion, with oil income accounting for a reduced 56% share of the total.

- Saudi Arabia’s economy grew 2.7% year-on-year in Q1 2025, with non-oil activities expanding by 4.2%—marking 17 straight quarters of growth—as the Kingdom continues to diversify under Vision 2030. Government services also rose 3.2%, while oil-related activities contracted 1.4%, reflecting the ongoing impact of OPEC+ production cuts.

- Saudi Arabia’s inflation rate remained steady at 2.3% in March 2025, driven mainly by rising housing rents and food prices, according to the General Authority for Statistics. Housing-related expenses, which make up 25.5% of the Consumer Price Index, climbed 6.9%, primarily due to an 8.2% increase in actual housing rents, with apartment rents soaring by 11.9%.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Go Premium

Go Premium