Assalamu Alaykum,

Welcome to our monthly economic and market update! As we enter a new month, here’s a recap of the key economic and market developments in Indonesia from April. Let’s get started.

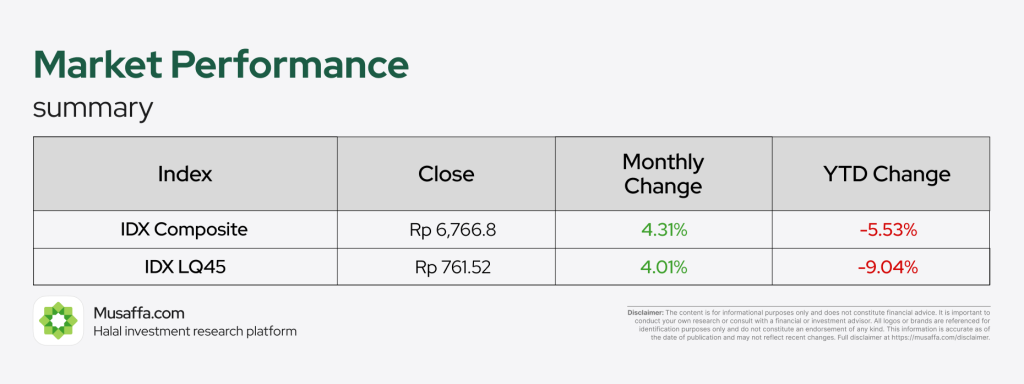

Stock market updates

April continued the positive trend for Indonesia’s markets, with both major indices showing notable gains. The IDX Composite rose by 4.31%, closing at 6,766, while the IDX LQ45 increased by 4.01%, ending the month at 761. The strong performance indicates sustained investor optimism and confidence, as the market continues to recover from earlier challenges and maintains its positive momentum.

- PT Bank Syariah Indonesia Tbk reported a 10% year-on-year rise in Q1 2025 net profit to IDR 1.87 trillion, driven mainly by a 39% surge in fee-based income and a 6.7% increase in net margin income supported by 16.2% growth in credit distribution to IDR 287 trillion.

- PT Barito Renewables Energy Tbk reported an 18.7% year-on-year increase in net profit for Q1 2025, reaching US$34.24 million (Rp 567.09 billion), supported by a 5.1% rise in EBITDA to US$130 million and a 3.5% increase in revenue to US$150.47 million (Rp 2.49 trillion).

- PT Triputra Agro Persada Tbk has earmarked IDR 940 billion in capital expenditure for 2025, with 65% (IDR 611 billion) allocated to constructing a new palm oil mill in East Kalimantan. This mill—TAPG’s 19th—will boost the company’s total installed processing capacity to around 1,040 tons/hour.

- PT Petrindo Jaya Kreasi Tbk has declared a cash dividend of USD 2 million for FY 2024, following a remarkable 929.28% surge in net profit to USD 160.79 million. This is the first dividend payout after no distribution in the previous year. The dividend represents 1.2% of the annual net profit, while the remaining earnings were allocated to reserves (USD 1.6 million) and retained earnings (USD 157.2 million).

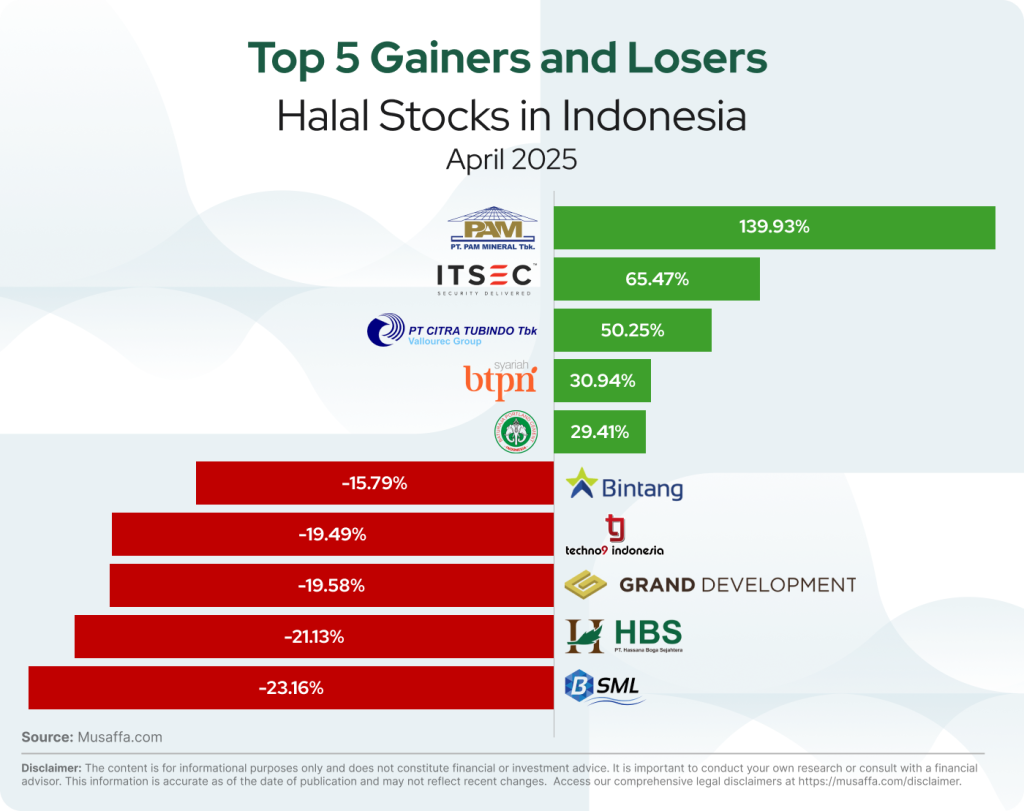

Top gainer and top loser Halal stocks in Indonesia

Economic updates

- Indonesia’s economy grew by 4.87% year-on-year in Q1 2025, missing expectations and marking a slowdown from the previous quarter’s 5.02% growth. The lower-than-expected performance reflects growing pressures from global uncertainties, including U.S. tariffs, fiscal strain from a widening budget deficit, and ongoing unemployment concerns.

- Indonesia’s central bank kept its benchmark interest rate unchanged at 5.75% for the third consecutive meeting, in line with market expectations, as it aims to stabilize the rupiah amid currency pressure. The decision reflects a cautious stance by Bank Indonesia, balancing between supporting economic growth—which slowed to 4.87% in Q1—and containing inflation and currency volatility triggered partly by global trade tensions and the strong U.S. dollar.

- Indonesia and Qatar have agreed to establish a $4 billion joint investment fund, with each nation contributing $2 billion, as President Prabowo Subianto concluded his Middle East tour. The fund will be managed through Danantara Indonesia, the sovereign wealth fund Prabowo launched earlier this year, and will target investments in strategic sectors like minerals processing, renewable energy, healthcare, and technology.

- Indonesia’s gross tax revenue rebounded to IDR 467 trillion in March 2025, marking a 7.6% year-on-year increase after contractions in the first two months of the year, according to Deputy Finance Minister Anggito Abimanyu. Even after refunds, net tax revenue rose 3.5%, signaling a potential recovery trend.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Go Premium

Go Premium