Assalamu Alaykum,

Welcome to our monthly economic and market update! As we enter a new month, here’s a recap of the key economic and market developments in the UK from July. Let’s get started.

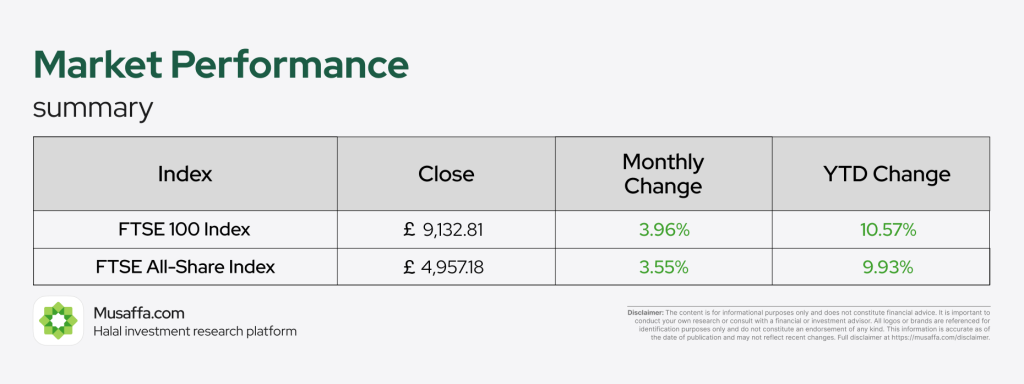

Stock market updates

UK markets posted solid gains in July, driven by resilient corporate earnings and improving investor sentiment. The FTSE 100 Index rose 3.96% to close at £9,132.81, extending its year-to-date growth to 10.57%. The broader FTSE All-Share Index also advanced 3.55%, ending the month at £4,957.18, reflecting strength across large-cap and mid-cap segments.

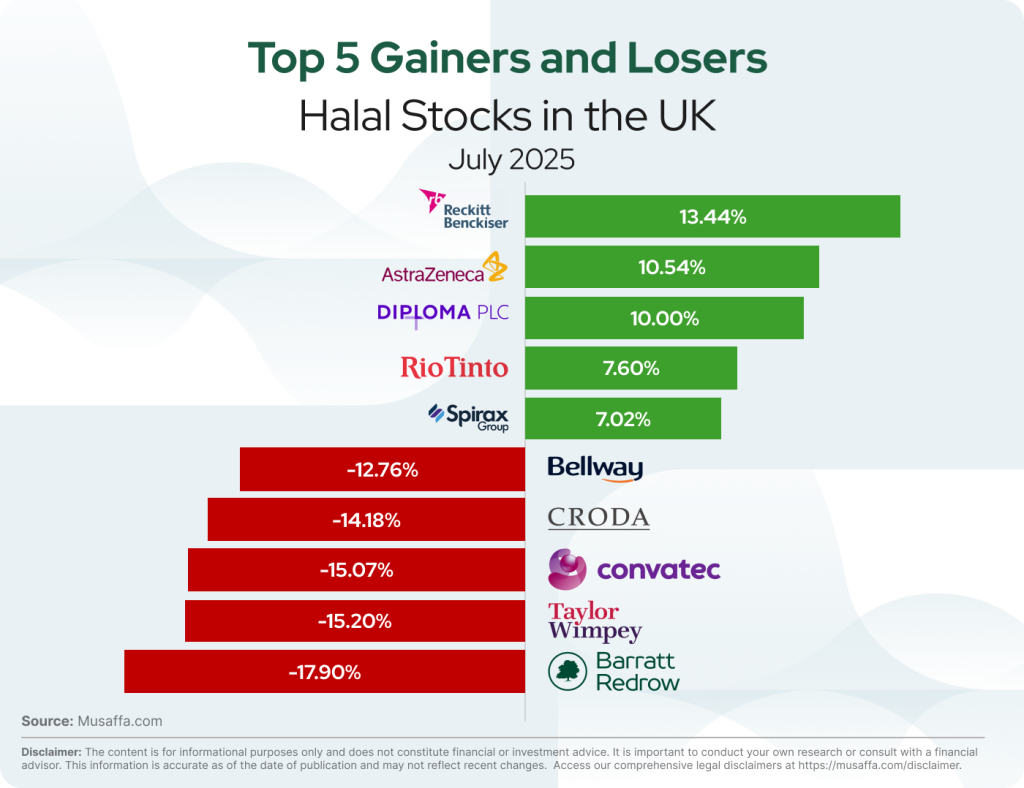

Reckitt Benckiser is divesting a controlling stake in its Essential Home division to Advent International in a $4.8bn deal, retaining 30% ownership. The move supports Reckitt’s strategic shift toward a streamlined portfolio of 11 high-growth, high-margin “Powerbrands,” with proceeds funding a $2.2bn special dividend and share consolidation. The company expects $0.8bn in one-off costs but aims to cut fixed costs by at least 300bps by 2027.

Pharos Energy delivered stable H1 production of 5,642 boepd and solid free cash flow, reaffirming its 2024 output guidance of 5,000–6,200 boepd and a total dividend of 1.21p per share. Vietnam operations drove most output, with a new six-well campaign planned and exploration extensions secured, while Egypt saw new production from East Saad-1X and ongoing seismic work. Revenue held steady at $65.3m, cash rose to $22.6m, and the firm remains debt-free with capex guidance unchanged at $33–$40m.

GSK has gained FDA approval for a new prefilled syringe version of its shingles vaccine, Shingrix, eliminating the need for reconstitution and streamlining administration for healthcare providers. The new format maintains the same indications for adults over 50 and immunocompromised individuals 18+, aligning with CDC’s two-dose recommendation. GSK is also seeking regulatory approval in Europe and other markets as part of its broader push to expand adult immunisation.

AstraZeneca announced that its investigational drug anselamimab failed to meet the primary endpoint in a phase III trial for AL amyloidosis, showing no statistical significance versus placebo for reducing mortality and cardiovascular hospitalisations. However, a prespecified patient subgroup experienced clinically meaningful improvement, suggesting potential for targeted use. Despite the overall result, AstraZeneca sees promise in anselamimab as the first fibril-depleting treatment to demonstrate clinical benefit in AL amyloidosis.

Rio Tinto reported that U.S. tariffs on Canadian aluminium added $300m to first-half costs, with higher sales premiums initially offsetting the impact before tariffs rose to 50% in June. The miner raised its annual copper production outlook to the higher end of guidance after a 13% Q2 output rise, driven by Oyu Tolgoi and Escondida. Pilbara iron ore hit its best Q2 output since 2018, though full-year shipments are still expected at the lower end of estimates.

Top gainer and top loser Halal stocks in the UK

Economic updates

UK inflation rose to 3.6% in June, exceeding the Bank of England’s 2% target, driven by rising food and fuel prices. Despite four interest rate cuts since August 2024 bringing rates to 4.25%, core inflation also rose to 3.7%, suggesting persistent price pressures. With wage growth outpacing inflation but unemployment rising to 4.7%, analysts still expect a rate cut on 7 August amid broader global economic uncertainty and weaker demand.

Rightmove reports a 1.2% (£4,531) monthly fall in average asking prices for new sellers in July—the steepest drop since 2002—driven by the end of stamp duty discounts and a surge in property listings. London saw the largest declines, especially in inner boroughs, as higher stamp duty on second homes and investment properties hit demand. Despite the price drop, sales and buyer inquiries are up year-on-year, supported by falling mortgage rates and rising wages, with Rightmove revising its 2025 price growth forecast from 4% to 2%.

Chancellor Rachel Reeves is launching the UK’s biggest mortgage reform in a decade, allowing renters with strong payment histories to secure loans with little or no deposit, alongside a permanent mortgage guarantee scheme. Despite warnings from the FCA about increased repossession risks, Reeves aims to expand homeownership and stimulate growth, backed by recent Bank of England moves to ease borrowing limits. Her Mansion House speech will also outline broader financial reforms, including reviews of capital rules, consumer duty, and stock listing regulations—though major pension changes are postponed until next week.

British car and van production in H1 2025 fell to its lowest level since 1953, with car output down 7.3% and van production plunging 45% due to the Vauxhall Luton plant shutdown. Uncertainty over US tariffs led some manufacturers to pause production, though a new trade deal reducing tariffs to 10% and EV grants up to £3,750 aim to restore industry confidence. While electrified vehicles hit a record share of over 40%, the SMMT says reaching the UK’s 2035 target of 1.3 million vehicles annually will require new entrants and clearer EV grant criteria.

UK food inflation rose for the sixth straight month in July to 4%, driven by rising costs of staples like meat and tea and tax hikes from the previous Budget, the British Retail Consortium reported. The BRC warned that expected tax increases in the autumn could force retailers to raise prices further, worsening the strain on households. While non-food prices fell 1% year-on-year due to discounts, overall shop price inflation still climbed to 0.7%, likely reinforcing the Bank of England’s cautious stance on interest rate cuts.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Go Premium

Go Premium