In summary:

• Apple teams up with Google Gemini to make Siri smarter with advanced AI

• iPhone sales and Apple services expected to grow

• Alphabet gains access to 2B+ Apple devices, creating more revenue

• Investors see stronger growth, higher margins, and future stock potential

Apple is dealing with Google to enhance its artificial intelligence features, including a major Siri upgrade. This partnership will be based on Google’s Gemini and cloud technology for Apple Foundation models. Why did Apple choose Gemini and not OpenAI? Apple said that Google’s technology provides the most capable foundation for Apple’s Foundation Models, and that this will be an innovative experience that benefits its users. (cnbc)

Is this alliance a good sign for both companies?

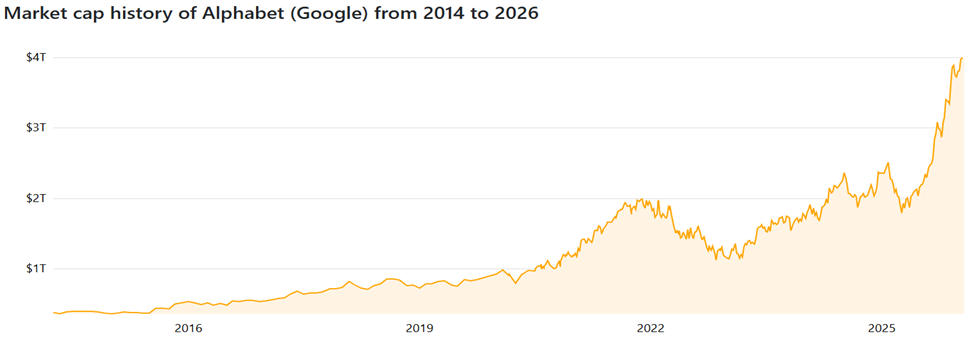

Currently, Google’s parent company, Alphabet, has reached a market capitalization of $4 trillion and become the fourth member of the $4 trillion club.

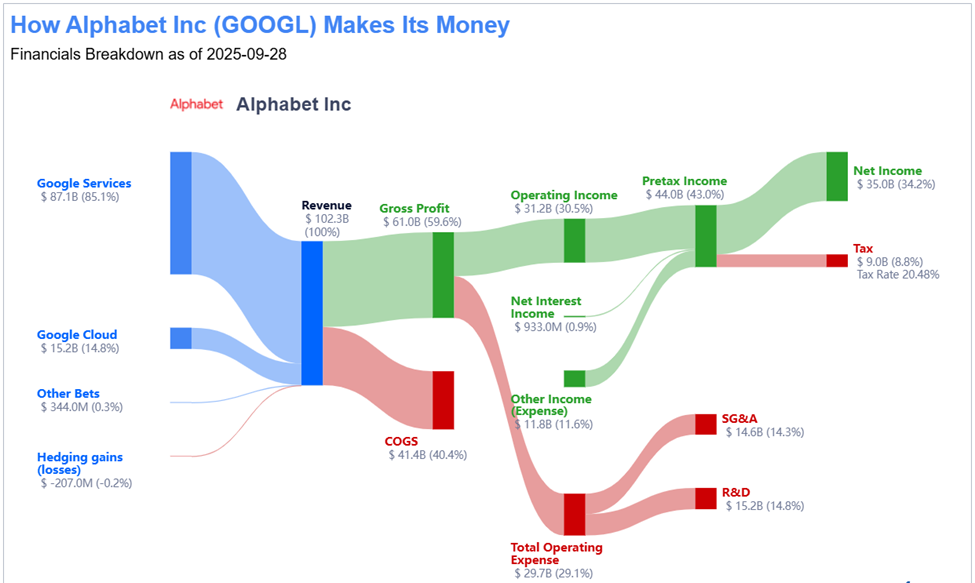

Overall, its current financial health is robust, marked by strong revenue, high net income growth, significant cash reserves, and low debt. In addition, the company achieved record revenue of $102.35 billion in Q3 2025, a 16% year-over-year increase. (companiesmarketcap)

After Apple said it would integrate Google’s Gemini as the foundation of its artificial intelligence models, Alphabet’s stock price increased by 1% on Monday, closing at $331.86, leading Alphabet’s market capitalization to just over $4 trillion. We may see that this deal would be profitable not only for Apple but also for Alphabet. (cnbc)

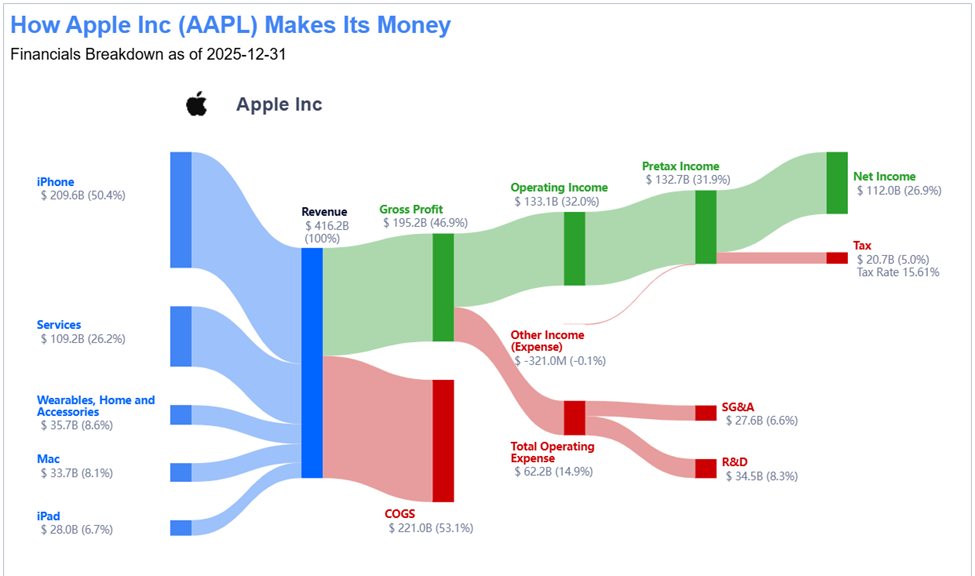

From Apple’s perspective, it also has a strong financial position, highlighted by a market capitalization of over $3.7 trillion, robust revenue growth in its services segment, and significant cash flow from operations. Its main core product, the iPhone, accounts for nearly half of sales (50.4%) and leads the global smartphone market in both share and growth for 2025. (cnbc)

After integrating Gemini, these sales are expected to increase, as the integration will bring a more advanced Siri, contextual awareness, and multimodal capabilities, such as combining text, images, and voice for interactions. Likewise, Google will gain access to over 2 billion active Apple devices and earn more revenue from this deal.

For investors of Apple and Alphabet:

• This deal is expected to bring greater capital efficiency and improved margins thanks to enhanced Siri.

• Revenue is likely to increase as Gemini becomes the default AI across all Apple devices.

• This integration is anticipated to bring new features to all iPhone products, to strengthen these companies’ financial health, and to drive future stock growth for both companies.

Sources:

Apple Inc: https://www.gurufocus.com/stock/AAPL/summary

Apple picks Google’s Gemini to run AI-powered Siri coming this year: https://www.cnbc.com/2026/01/12/apple-google-ai-siri-gemini.html

Market capitalization of Alphabet (Google) (GOOG): https://companiesmarketcap.com/alphabet-google/marketcap/

Alphabet hits $4 trillion market capitalization: https://www.cnbc.com/2026/01/12/alphabet-4-trillion-market-cap.html

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Go Premium

Go Premium