Short Thesis

• Analyst tone is cautious into earnings: Barclays stays Equal Weight and Goldman remains Neutral, highlighting that near-term fundamentals may not be the market’s primary driver right now.

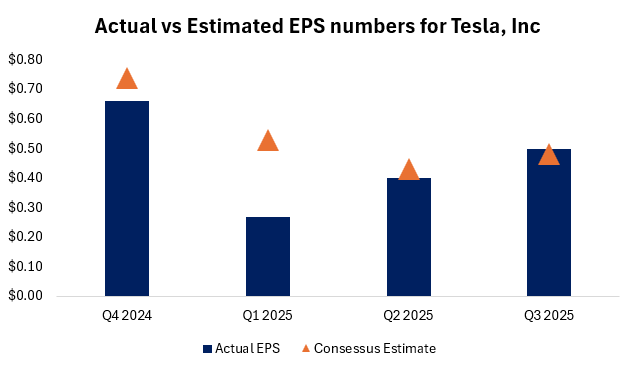

• Expectations are wide, keeping volatility elevated: 4Q EPS consensus is $0.40 with a broad range ($0.18–$0.68), and 2026 deliveries are estimated at ~1.75M with meaningful dispersion (~1.597M–~1.83M).

• Upside looks modest on the base case, but tails are large: TSLA at ~$437.7 implies roughly ~7.5% upside to the median target (~$470.7) versus ~37% to the bull case ($600), while the average target (~$400.8) suggests downside risk remains.

What Happened

Tesla (TSLA) remains in focus as an “AI-adjacent” equity, but recent analyst commentary suggests investors are prioritizing narrative and positioning over near-term fundamentals. On January 16, Barclays reiterated TSLA as Equal Weight, arguing that fundamentals are still an “afterthought.” A day earlier, Goldman Sachs reiterated a Neutral stance ahead of Tesla’s late-January earnings, flagging limited visibility into near-term performance.

From an earnings standpoint, the Street’s 4Q EPS consensus is $0.40 (range: $0.18–$0.68) on an estimated $24.76B of revenue. On deliveries, consensus expectations for 2026 are ~1.75M units (range: ~1.597M to ~1.83M), compared with 1.64M actual deliveries in 2025. Analysts also expect a softer start to 1Q26, with some optimism that a refreshed/expanded Model Y lineup could support volumes later in the year.

In the market, TSLA is trading around $437.67, down 0.81% over the past week. Volume is 60.22M shares versus a ~66.37M 20-day average—active, but not signaling a clear “capitulation” or “euphoria” move on its own.

Why It Matters

This setup highlights a common Tesla dynamic: expectations and sentiment can drive the stock more than quarterly fundamentals, especially into earnings.

• Earnings sensitivity is high. With consensus EPS at $0.40 but a wide estimate range ($0.18–$0.68), the market is signaling uncertainty. Any surprise in margins, guidance tone, or delivery commentary could outweigh the headline revenue number ($24.76B estimate).

• Deliveries are the key fundamental debate. The Street is looking for ~1.75M deliveries in 2026, implying growth from 1.64M in 2025—but the forecast range is wide. That dispersion supports Barclays’ point: investors may be trading probabilities, not a single “base case.”

• Targets are split, implying volatile positioning. With TSLA at $437.50–$437.67, the median target (~$470.65) implies roughly ~7.5% upside, while the high target ($600) implies about ~37% upside. At the same time, the average target (~$400.76) sits below the current price (roughly ~8% downside). That mix aligns with a “Hold” consensus and reinforces that conviction is not uniform.

Net: Into earnings, TSLA looks less like a clean fundamentals-driven trade and more like a sentiment-and-guidance stock—where the narrative (AI/autonomy, product cycle, volumes in 2H26) can dominate near-term financial precision.

Sources:

Yahoo.com: https://finance.yahoo.com/news/barclays-says-tesla-tsla-fundamentals-203402767.html

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Go Premium

Go Premium