Short Thesis

• Canada’s tariff rollback reopens a pragmatic supply route for Tesla: A reduced 6.1% tariff within a 49,000-EV annual quota could let Tesla resume China-built Model Y shipments faster than relying on higher-cost alternatives.

• The policy is helpful, but structurally limited for Tesla’s pricing: 50% of the quota is geared toward EVs under C$35,000, while Tesla’s Model Y starts at C$49,990, meaning the “affordable” bucket is not accessible.

• Near-term impact depends on execution and demand recovery: Tesla’s 2025 Canada unit sales fell to 18,359 (from ~55,000), with EV share dropping to ~10%—so the upside hinges on how quickly Tesla restarts shipments and converts lower costs into competitiveness.

What Happened

Canada reached a preliminary agreement to sharply reduce tariffs on an annual quota of Chinese-made EVs, cutting the rate from 100% to the Most-Favoured-Nation (MFN) rate of 6.1% for vehicles within quota limits. The initial quota is 49,000 EVs per year, and it may rise to 70,000 within five years.

This creates a clearer path for Tesla (TSLA) to resume China-based exports to Canada. Tesla’s largest factory is in Shanghai, and it has previously shipped a Canada-specific Model Y from China. Those exports were halted when the tariff increased in 2024, pushing Tesla to rely more on European production routes. With the new quota, Tesla could restart shipments relatively quickly, supported by its existing footprint (e.g., stores and logistics presence).

In markets, TSLA traded near $437.52 on Jan 19, down 0.24% on the day and 0.78% over the last five trading days, on 60.22M shares versus a 66.37M 20-day average volume—suggesting the market response was measured rather than decisive.

Why It Matters

This policy change matters because it potentially lowers Tesla’s landed costs in Canada—but it does not automatically translate into a demand rebound.

• Margin and flexibility tailwind: Cheaper China-built imports can help Tesla compete more effectively, especially given Tesla’s latest reported automotive gross margin of 17.0% (Q3 2025). Any cost improvement has leverage when margins are not exceptionally high.

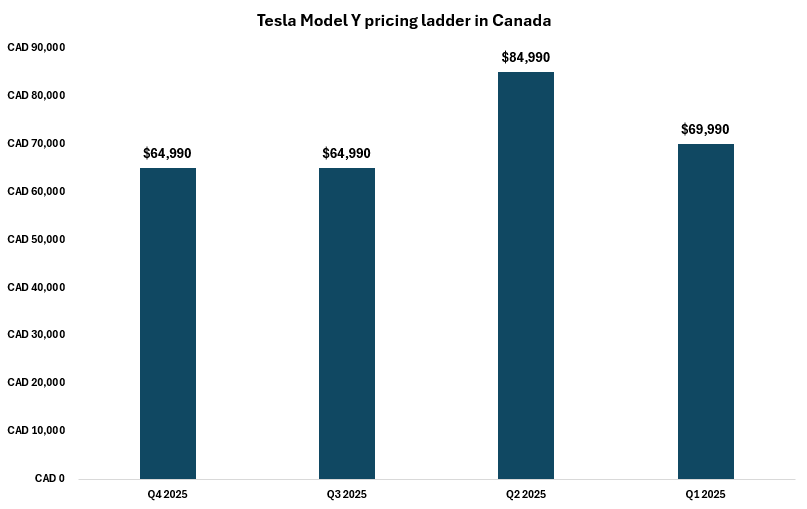

• A key constraint remains pricing: Half of the quota is reserved for EVs under C$35,000, and Tesla does not qualify. The Model Y starts at C$49,990 (with higher trims at C$64,990–C$74,990+), meaning Tesla’s benefit is concentrated in the non-affordable portion of the quota. That leaves room for lower-priced competitors to gain access to the incentivized bucket.

• Canada demand has weakened materially: Tesla’s estimated EV market share fell to around ~10% in 2025 from ~32% in 2024, while annual units sold dropped to 18,359 from about ~55,000 (a -66.7% change). Investors will focus on whether tariff relief leads to a fast restart of Shanghai shipments and, more importantly, whether that translates into regained share.

Bottom line: the tariff deal is a tangible operational opportunity for Tesla, but the investment significance depends on speed of execution and whether pricing improvements can reverse the sharp Canada sales decline.

Sources:

- Clutch blog – Tesla Model Y Canada: Complete Buyer’s Guide for 2025: https://www.clutch.ca/blog/posts/tesla-model-y-canada#:~:text=Tesla%20Model%20Y:%20Canadian%20Pricing,subtle%20design%20and%20comfort%20tweaks.

- News Car Dealership guy – Canada’s Chinese EV tariff deal sets stage for new competition in North America:

https://news.dealershipguy.com/p/canada-s-chinese-ev-tariff-deal-sets-stage-for-new-competition-in-north-america-2025-01-19 - Medium – Tesla Q4 Earnings Preview: Margins Likely To Slip Again:

https://beth-kindig.medium.com/tesla-q4-earnings-preview-margins-likely-to-slip-again-5cca652686a1 - Motorillustrated – Tesla Sales in Canada Dropped 63.5% in 2025:

https://motorillustrated.com/tesla-sales-in-canada-dropped-63-5-in-2025/173266/

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Go Premium

Go Premium