Canada's economy showed resilience in January, adding 91,000 jobs while unemployment dipped to 6.7%. Home sales cooled from November but remained significantly higher year-over-year. Inflation eased to 1.8%, aided by a sales tax relief program. The Bank of Canada cut its key interest rate to 3% amid concerns over potential U.S. tariffs. Stock markets rebounded, with the S&P/TSX Composite Index rising 3.26%. Key corporate developments included a strategic mining partnership, AI-driven product photography expansion, an Australian market entry for Beyond Oil, and a copper project acquisition.

Canada economy update

- Canada's economy added 91,000 jobs in December, representing a 0.4% increase, while the unemployment rate edged down to 6.7%. Key employment gains were observed in educational services, transportation, warehousing, finance, insurance, health care, and social assistance.

- Canadian home sales cooled in December, falling 5.8% from November, but surged 19.2% compared to the same month last year. In the fourth quarter, sales rose 10% from the previous quarter, marking one of the strongest periods for activity in two decades outside the pandemic, according to the Canadian Real Estate Association (CREA).

- Canada is preparing countermeasures on up to C$150 billion ($105 billion) worth of U.S. imports if President-elect Donald Trump enforces a proposed 25% tariff on Canadian goods and services, according to a source familiar with the situation. While the specific targets remain confidential, the measures would follow public consultations and depend on the scope of U.S. actions.

- Canada's annual inflation rate eased to 1.8% in December, down from 1.9% in November, according to Statistics Canada. This slowdown was primarily driven by a mid-month sales tax relief program that reduced prices for alcohol, restaurant foods, and children's clothing.

- The Bank of Canada cut its key policy rate by 25 basis points to 3%, citing concerns over potential inflationary pressures from looming U.S. tariffs. President Trump's proposed 25% tariff on Canadian imports threatens to disrupt trade, which accounts for 75% of Canada's exports to the U.S. Governor Tiff Macklem highlighted the risks of a long-lasting trade conflict harming economic activity and warned against the potential for a tariff-induced price surge to drive persistent inflation.

Canada stock market update

January brought a strong rebound for Canadian markets! The S&P/TSX Composite Index rose by 3.26%, closing at CAD$ 25,533. The S&P/TSX Venture Composite Index also saw impressive growth, gaining 4.33% to reach CAD$ 623.75. A month of renewed optimism and solid performance across key indices.

- EnviroGold Global Limited has formed a strategic alliance with Fraser Alexander, a global leader in tailings storage and sustainable mining solutions. This collaboration aims to advance innovative approaches to monetize mine waste, reduce environmental liabilities, and promote sustainability in the mining industry.

- Nextech3D.ai has secured its first customer, Marmi Stone, for its AI-Powered Photography Studio. This milestone represents the company's expansion from 3D modeling to AI-driven product photography. Marmi Stone, a premier provider of high-quality stone products, will use the platform to generate lifestyle product photos and 3D models, enhancing its product catalog presentation.

- Beyond Oil Ltd. has entered the Australian market through a five-year distribution agreement with T&J Oil Pty Ltd., valued at approximately $4.9 million. The deal grants T&J Oil exclusivity for specific restaurant sectors, contingent on meeting annual purchase commitments. Effective January 22, 2025, T&J Oil will distribute Beyond Oil's proprietary oil treatment products to non-chain and local chain restaurants without filter machines.

- Interra Copper Corp. has completed the acquisition of the Stars Property from Aurwest Resources Corporation, pending exchange approval. The 3,761-hectare porphyry copper-molybdenum project is located in British Columbia's Bulkley Porphyry Belt, a prime exploration and mining district.

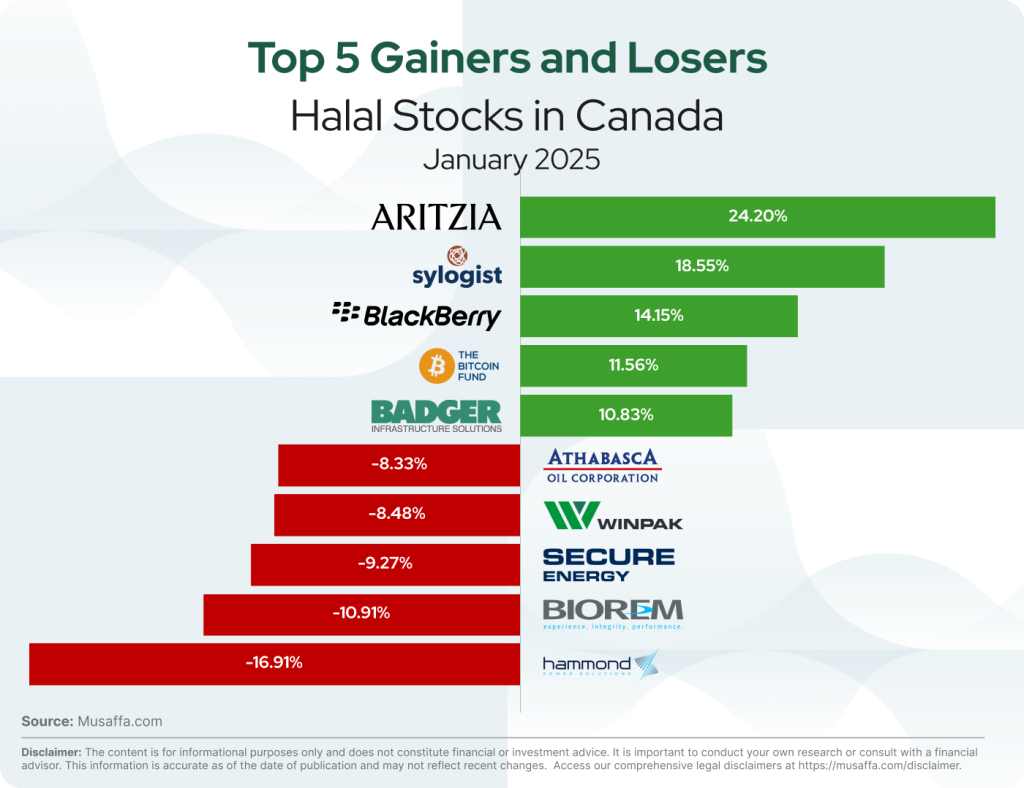

Canadian top gainer and top loser stocks for January

Summary

Canada's economy remained stable in January, with job growth, cooling inflation, and a rate cut from the Bank of Canada. Trade tensions with the U.S. loomed over economic outlooks, while stock markets posted strong gains. Corporate activity saw notable partnerships and expansions in mining, AI, and sustainability.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Nusrat Ahmed

Nusrat Ahmed