Welcome to our monthly economic and market update! As we enter a new month, here's a recap of the key economic and market developments in Canada from February. Let’s get started.

Canada economy update

- Canada’s budget deficit for the first nine months of the 2024/25 fiscal year fell to C$21.72 billion ($15.05 billion), down from C$23.61 billion a year earlier, as revenue growth outpaced spending. Government revenues rose 11.8%, driven by higher tax collections, while program expenses increased 10.7% across all major categories. Public debt charges surged 17.3% due to higher interest rates.

- Toronto home sales rebounded 10% in January as new listings increased, though prices remained stable after two months of gains, according to TRREB data. Seasonally adjusted sales reached 5,971 units, recovering from an 18.2% drop in December but still 10.7% lower than January 2024.

- Canada’s economy added 76,000 jobs in January, bringing the unemployment rate down to 6.6%, according to Statistics Canada. The strong job growth exceeded expectations and aligns with the Bank of Canada’s optimistic outlook. Andrew Kelvin of TD Securities noted that while a March rate cut is still likely, continued strong employment data could boost confidence that the economy has achieved a soft landing.

- Canada’s annual inflation edged up to 1.9% in January, driven by rising gasoline and natural gas prices, despite a sales tax reprieve lowering broader costs. Core inflation measures also increased, marking the sixth consecutive month where inflation remained at or below the Bank of Canada’s 2% target midpoint. As a result, market bets for a March interest rate cut dropped to 37% from 44% before the data release.

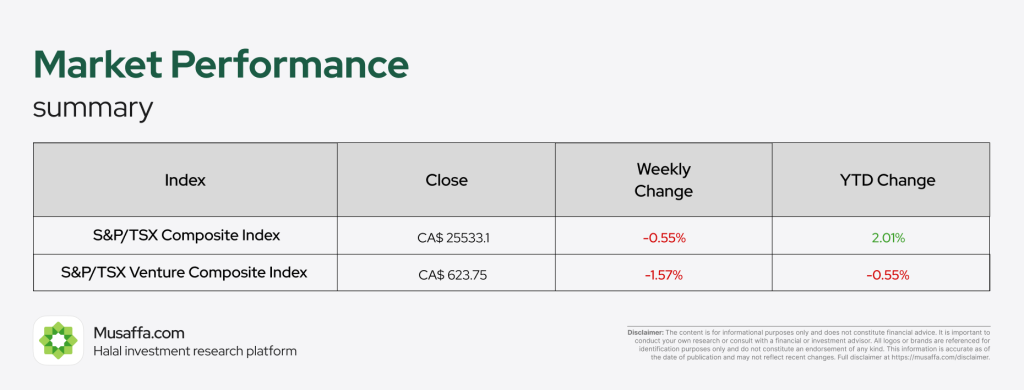

Canada stock market update

February brought slight declines for Canadian markets. The S&P/TSX Composite Index edged down by 0.55%, closing at CAD$ 25,392.37, while the S&P/TSX Venture Composite Index dropped 1.57% to CAD$ 613.95. A month of minor setbacks as market conditions remained uncertain.

- The Canadian Securities Exchange (CSE) reported strong trading activity in January 2025, with a total trading volume of 1.5 billion shares and a trading value of $519 million. The exchange saw 104 financings completed, raising $118 million in total, and welcomed two new listings, bringing the total to 772 securities.

- Ritchie Bros. Auctioneers generated over $250 million in gross transaction value (GTV) at its 2025 Premier Global Auction in Orlando, FL, held from February 17-21. The five-day event featured over 16,000 equipment items, trucks, and vehicles, attracting more than 19,000 bidders from 75+ countries.

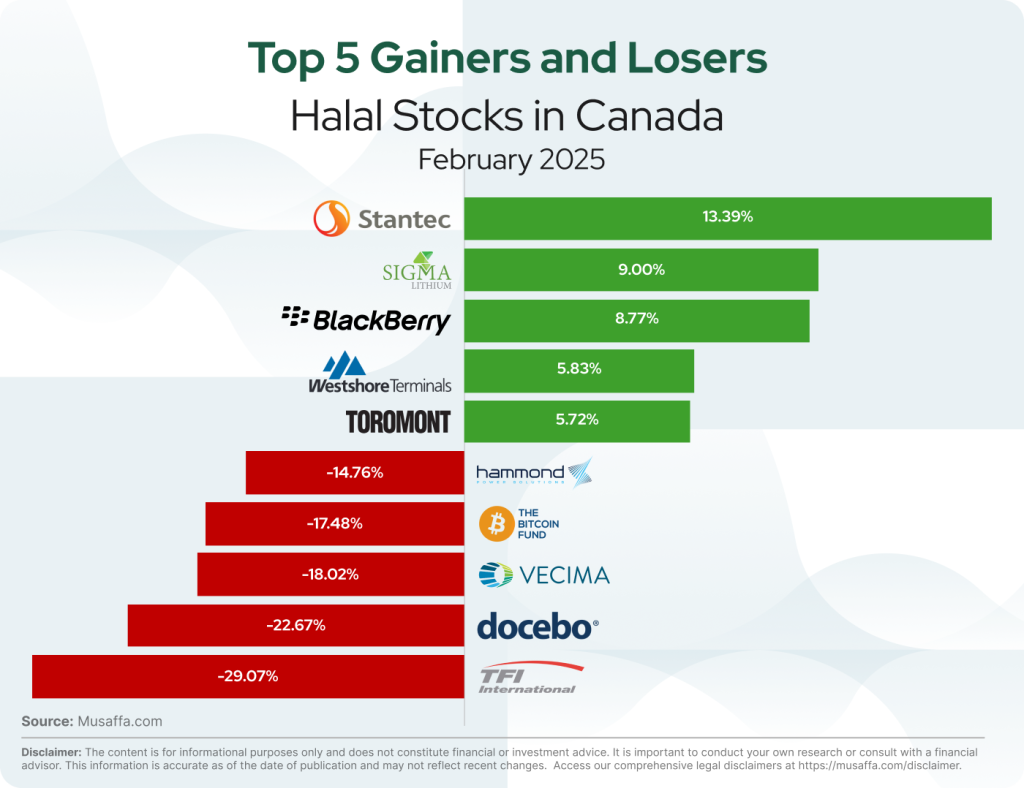

- Stantec Inc reported Q4 earnings of $0.79 per share, surpassing the Zacks Consensus Estimate of $0.69 per share and marking a 14.49% earnings surprise. This compares to $0.60 per share in the same quarter last year. The company also exceeded expectations in the previous quarter, delivering an earnings surprise of 5.56%.

- WSP Global Inc. reported Q4 earnings of $166.9 million, up from $130.6 million a year ago, with revenue rising to $4.7 billion from $3.7 billion. Basic net earnings per share increased to $1.28 from $1.05, while the company's backlog grew to $15.6 billion. For the full year, earnings reached $681.4 million on $16.2 billion in revenue.

Canadian top gainer and top loser stocks for February

Summary

Overall, Canada’s budget deficit narrowed to C$21.72 billion in the first nine months of the 2024/25 fiscal year as revenue growth outpaced spending. Toronto home sales rebounded 10% in January, while the economy added 76,000 jobs, lowering the unemployment rate to 6.6%. Inflation edged up to 1.9%, reducing expectations of a March rate cut. The stock market saw minor declines, with the S&P/TSX Composite Index down 0.55%. Ritchie Bros. reported $250 million in GTV at its Orlando auction, while Stantec and WSP Global exceeded earnings expectations.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Nusrat Ahmed

Nusrat Ahmed