Assalamu Alaykum,

Welcome to our monthly economic and market update! As we enter a new month, here’s a recap of the key economic and market developments in the Canada from July. Let’s get started.

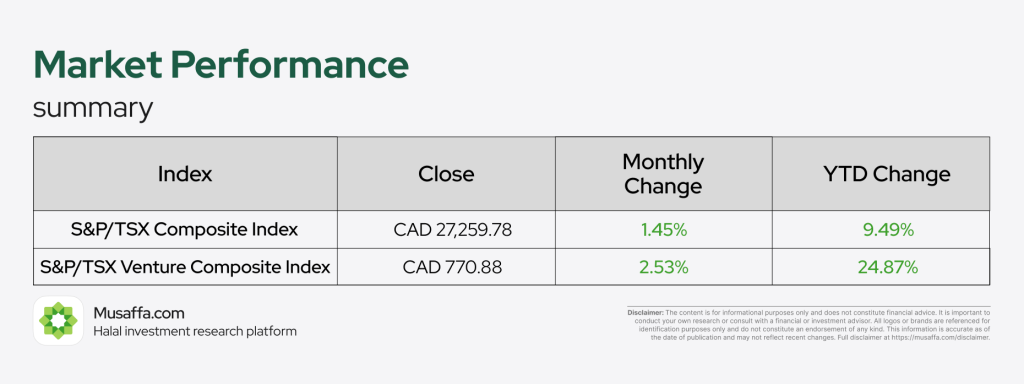

Stock market updates

Canada’s stock market posted steady gains in July, with both major indices ending in positive territory. The S&P/TSX Composite Index climbed 1.45% to close at CAD27,259.78, bringing its YTD return to 9.49%. The S&P/TSX Venture Composite outperformed with a 2.53% gain, ending at CAD770.88 and extending its strong YTD rally to 24.87%.

Viridian Metals has completed fieldwork at its 2,600 km² Sedna Copper Project in Labrador, identifying extensive reductant shale horizons and major structural corridors, key indicators of large sedimentary copper systems. Supported by government and BHP funding, the company now shifts focus to drilling its Kraken Polymetallic Project, targeting high-grade copper zones up to 4.1% Cu. At its AGM, shareholders approved all resolutions, including board re-elections and escrow agreement amendments, reflecting continued confidence in Viridian’s critical metals strategy.

Nextech3D.AI posted a 55% gross profit increase and a 58% cut in operating cash burn in its audited results for the 15 months ended March 31, 2025. While revenue fell 31% to $3.49M due to a strategic pivot, gross margins jumped to 64% from 29%, driven by its AI-powered 3D model business and scalable SaaS shift. CEO Evan Gappelberg emphasized the firm’s focus on high-margin, recurring revenue streams and highlighted growth in its Map D event platform and proprietary automation.

SHARC International Systems has shipped two SHARC 880 WET units to a U.S. government-linked project, marking a major milestone in the adoption of wastewater energy transfer technology. This move reflects rising demand for low-carbon heating and cooling solutions, and follows recent recognition in the Wall Street Journal. The company’s WET systems are gaining traction globally as cities pursue scalable, sustainable infrastructure.

Pampa Metals has finalized its acquisition of Rugby Resources, issuing 65M+ shares to Rugby shareholders and bringing in major copper assets, including the Cobrasco and Mantau projects. The combined entity now controls high-potential copper-gold prospects across Argentina, Colombia, and Chile, with a dual listing plan underway. Rugby CEO Bryce Roxburgh joins Pampa's board, while a spinout company, Aegis Resources, takes over select Rugby assets including royalties and joint venture interests.

LaFleur Minerals has appointed FMI Securities and FM Global Markets as advisors for a proposed CAD $5M debt financing to restart its Beacon Gold Mill in Val-d’Or, Québec. Additionally, it launched a $2.88M non-brokered LIFE unit offering and a $2.59M charity flow-through share offering to fund exploration at its Swanson Gold Project and mill operations. Proceeds will support project advancement, with closings expected by August 15, 2025.

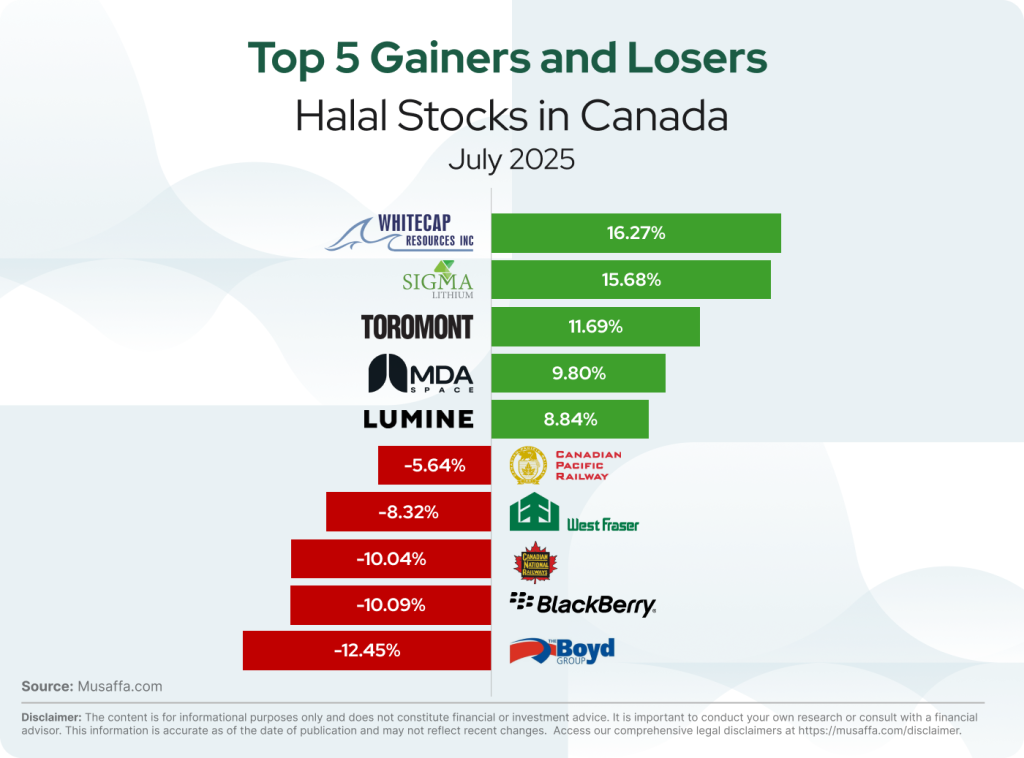

Top gainer and top loser Halal stocks in the USA

Economic updates

The Bank of Canada maintained its key interest rate at 2.75%, citing economic resilience despite ongoing global trade tensions led by the U.S. Governor Tiff Macklem highlighted that recent U.S. trade deals with Japan and the EU still include tariffs, showing no return to open trade, though the risk of an escalating trade war has lessened. While inflation remains near 2.5% and growth projections have softened, the Bank outlined three potential tariff scenarios, leaving the door open for a rate cut if conditions worsen, with economists expecting a possible cut in September.

U.S. President Donald Trump warned that Canada may face a 35% tariff starting August 1, stating a deal is unlikely and tariffs might be imposed without further negotiations. He criticized Canada's approach to trade and cited issues like fentanyl trafficking and border security, despite limited evidence. While Canadian officials stress they will only agree to terms in the nation’s best interest, the two sides remain apart, with talks ongoing but no clear resolution in sight.

Canada’s AI Minister Evan Solomon is watching court cases in Canada and the U.S. to shape the country's broader AI regulatory strategy, especially on copyright. A lawsuit by major Canadian media outlets accuses OpenAI of illegally using news content to train its AI models, while OpenAI challenges the Ontario court’s jurisdiction and seeks to seal commercially sensitive details. Meanwhile, recent U.S. rulings in similar cases offer mixed outcomes, signaling that the legal boundaries of AI training on copyrighted content remain unsettled.

Despite strong profits in Alberta’s oilpatch, companies are channeling much of their cash into dividends and stock buybacks instead of major expansion. Capital investment in Canada’s oil and gas sector has fallen from $80 billion in 2014 to around $30 billion in 2025, with most spending focused on maintaining current production levels. Analysts point to regulatory uncertainty, investor pressure for returns, and long-term demand forecasts as key reasons oil producers are prioritizing financial returns over growth.

Canada’s income inequality reached its highest level on record in Q1 2025, with the gap between the top and bottom 40% of earners widening to 49 percentage points, according to Statistics Canada. High-income households saw strong gains from wages and investments, while low-income Canadians faced falling wages and declining investment income, despite receiving more government transfers. Experts warn the growing divide threatens economic stability and call for renewed focus on fair wealth distribution and inclusive public policy.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Nusrat Ahmed

Nusrat Ahmed

Suhail Patel

Suhail Patel