Written by Ibraheem Ahmad

Senior Finance Writer and Scholar in Residence | LinkedIn

Date: April 18, 2025

The modern economy is built on easy access to credit for many people, and this convenience has become a trap. Buy-now-pay-later schemes, high-interest credit cards, and quick personal loans are marketed as solutions, but in reality, they often deepen financial fragility. For Muslims, the stakes are even higher. The prohibition of riba (usury) is not a mere Islamic legalistic restriction, but a protection mechanism. Debt is not haram in itself, but unnecessary or exploitative debt certainly is.

Yet, we’re living in an age where debt feels almost inevitable. Housing, education, weddings, even medical bills are increasingly debt-financed. Many Muslims find themselves caught between modern financial pressures and their faith-based values. But the truth is: becoming debt-free the halal way is not only possible — it’s practical. And it’s one of the most liberating financial goals you can pursue.

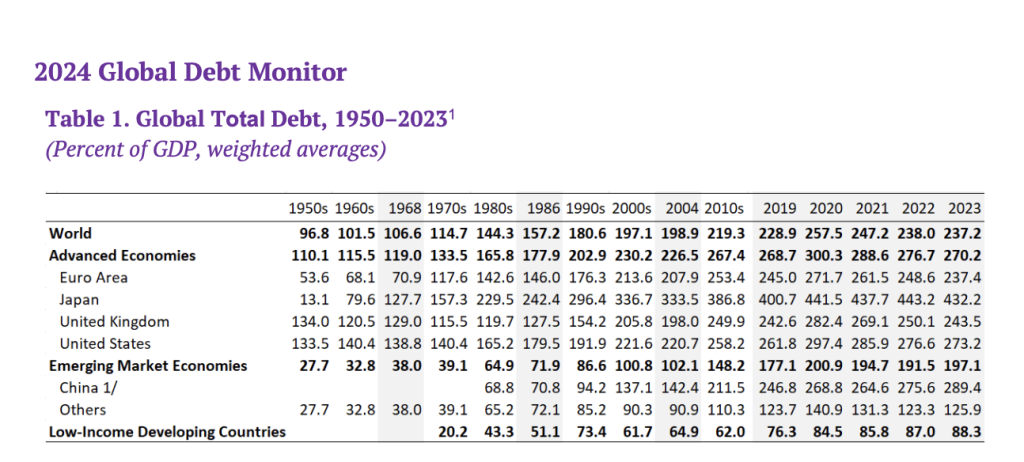

Understanding the Landscape: Debt in a Globalized, Credit-Fueled World

According to the IMF 2024 report, global household debt is skyrocketing. In some developed economies, debt-to-income ratios have crossed 150%. In Muslim-majority regions, access to Islamic alternatives remains limited — pushing people toward conventional loans or credit systems out of desperation, not choice.

Meanwhile, consumer culture rewards instant gratification. The result? Financial instability disguised as convenience. When you zoom out, it becomes clear: being debt-free is not about frugality — it’s about freedom. And from an Islamic lens, it’s about financial dignity, accountability, and spiritual clarity.

Debt in Islam: A Weight Not to Be Taken Lightly

While Islam permits borrowing under valid circumstances, it consistently discourages habitual or careless debt. The Prophet ﷺ spoke of its spiritual consequences, and scholars have long advised that Muslims should enter debt only when necessary, and exit it as soon as reasonably possible.

But here's the problem: too many Muslims today either fear all forms of borrowing — becoming immobilized — or swing to the other extreme, using debt as a default strategy. Staying in the middle ground is not just possible, it’s sustainable.

Halal Pathways to Debt Freedom: The Strategic Framework

1. Know Your Debt – and Categorize It Wisely

Start with a debt audit. List every liability you have — Islamic or conventional — and categorize it by:

- Necessity vs lifestyle debt

- Halal (like Qard Hasan or legitimate Murabaha) vs riba-based

- Short-term vs long-term

Your first priority is to eliminate riba-based and lifestyle debts. These are the heaviest burdens spiritually and financially.

2. Stop the Leak Before You Fix the Pipe

Too many debt-payoff plans fail because people keep borrowing while paying off what they owe. Halal financial planning means changing behavior, not just fixing numbers. Cut off any new debt unless it’s unavoidable and Sharia-compliant. This may mean lifestyle adjustments like fewer subscriptions, smaller weddings, or simpler holidays. It’s not about deprivation. It’s about clarity and intentionality.

3. Snowball or Avalanche — Do It the Halal Way

Adopt a payoff strategy that aligns with your psychology:

- Snowball Method: Pay off the smallest debts first. Great for momentum.

- Avalanche Method: Tackle highest-cost (interest-bearing) debt first. Ideal for saving money and exiting riba faster.

Islamically, the avalanche method often aligns better since it prioritizes eliminating the most spiritually compromising debts first — but either method is valid if it helps you commit and follow through.

4. Rebuild With Halal Foundations

Once you’re free or in control, make a commitment to stay debt-free the Islamic way:

- Use Islamic savings schemes instead of credit.

- Consider Zakat obligations carefully — but don’t expect Zakat to solve personal overspending.

- Leverage community-based alternatives like rotating savings (Jama'iyya, Susu, or Cooperative) where Sharia-compliant and ethical.

Start Your Halal Stock Screening Journey

New to halal investing? Musaffa makes it easy to screen stocks, check Shariah compliance, and purify your portfolio — all in one place. Make informed, ethical decisions every step of the way.

Islamic Finance Tools You Might Be Overlooking

Many people assume Islamic finance only applies to big investments, however, there are simple tools that help everyday Muslims stay debt-free:

- Qard Hasan: Interest-free loans from family, masjids, or trusted institutions.

- Halal micro-finance: Some Islamic banks or fintechs offer micro-loans for small needs — wedding costs, school fees, etc.

- Prepaid alternatives: From Islamic credit cards with real asset backing to subscription-style services that prevent impulse debt.

These tools aren’t perfect, and availability varies by country — but they are growing, and the more Muslims demand them, the more the industry evolves.

The Psychological Edge of Being Debt-Free

Beyond the numbers, debt takes a mental and emotional toll. It creates anxiety, dependency, and shame — which often leads to more avoidance and worse decisions. Islam prioritizes inner peace (sakina) and intentional living. Being debt-free gives you back your focus, your control, and your faith in your financial path.

It also empowers you to give more. To save with purpose. To invest ethically. And to live without the hidden hand of interest shaping your choices.

Final Word: Financial Liberation Starts with Discipline, Not Income

Don’t wait for a higher salary or a miracle. Start now, with what you have. Becoming debt-free the halal way is less about money, and more about method, mindset, and mission.

Let your journey toward financial clarity begin with one decision: to align your finances with your faith — and to never again sacrifice your long-term barakah for short-term ease.

Because dignity is not in credit limits. It’s in control. And the halal way is always the most dignified path forward.

Disclaimer: The information provided in this article is for educational purposes only and reflects the status at the time of its composition. Musaffa is not a licensed financial advisor, broker, or dealer, and this content should not be construed as financial, legal, tax, or investment advice. All investments and financial decisions carry risk. We strongly recommend consulting with your own financial, legal, or Islamic advisors before making any decisions. Access our full disclaimer at https://musaffa.com/disclaimer.

Nusrat Ahmed

Nusrat Ahmed