Short Thesis

• Tesla is signaling deeper vertical integration: New in-house chips (AI5 nearly done, AI6 underway) plus a restarted Dojo 3 effort point to a more self-reliant autonomy stack.

• Nvidia is pushing for platform dominance beyond Tesla: “Alpamayo” positions Nvidia to power autonomy across multiple OEMs, even if Tesla stays closed-loop.

• Market reaction reflects a valuation split: TSLA barely moved ($437.52, -0.24%) despite bold roadmap talk and a rich 209.93x forward P/E, while NVDA sold off ($180.01, -3.76%) with heavy volume and a far lower 24.22x forward P/E.

What happened

Tesla (TSLA) sent new signals that it is reducing its reliance on Nvidia by strengthening its own autonomy hardware and training roadmap. Over the weekend, Elon Musk said Tesla’s AI5 self-driving chips are nearly complete, with the next-generation AI6 already underway. He also stated that Dojo 3 is being restarted, pointing to renewed investment in large-scale AI training rather than just in-car inference.

NVIDIA (NVDA), however, is also pressing its advantage. At CES 2026, Nvidia introduced “Alpamayo,” an open-source autonomous vehicle AI toolkit designed to become a default autonomy platform for many brands—effectively aiming to power the broader AV ecosystem while Tesla builds a closed loop.

In the market, TSLA was largely steady at $437.52 (-0.24% today; -0.78% over 5 days) on 60.22M shares traded, versus a 20-day average of 66.37 M. NVDA fell to $180.01 (-3.76% today; -1.69% over 5 days) on 187.97M shares versus a 158.27M 20-day average—suggesting heavier trading intensity on the Nvidia side.

Why It Matters

This is a direct “stack strategy” divergence in autonomy, and it matters for both competitive positioning and investor expectations.

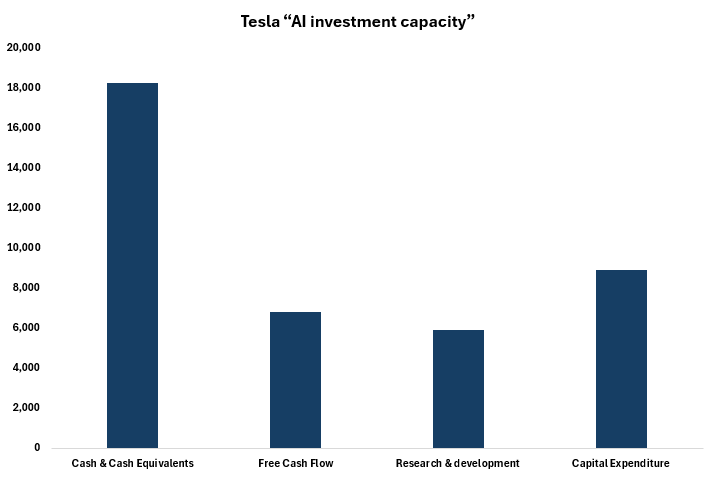

• Tesla’s in-house push improves control—but execution matters. Tesla’s ability to build a closed-loop AV stack is supported by its scale and spending capacity: $18.29B in cash (TTM), $6.83B free cash flow (TTM), and $5.90B R&D (TTM). That said, profitability remains a watch item with a 5.09% operating margin (TTM) and meaningful reinvestment (-$8.91B capex, TTM). Investors will likely reward follow-through—real autonomy progress and volume impact—more than roadmap headlines.

• NVIDIA’s opportunity is “everyone else.” Even if Tesla stays proprietary, Nvidia can still win by becoming the autonomy backbone for multiple OEMs. Its scale in AI infrastructure remains a core strength, highlighted here by $116.2B in Compute & Networking—a reminder that Nvidia’s leverage extends beyond any single automaker.

• Valuation sets a higher bar for Tesla than Nvidia. TSLA’s 209.93x forward P/E implies the market already prices significant future success in autonomy and new AI initiatives. NVDA’s 24.22x forward P/E suggests a comparatively lower expectation load. That helps explain why Tesla’s stock reaction was muted, while Nvidia’s was sharper, with above-average volume.

Bottom line: Tesla is doubling down on self-reliance in autonomy hardware and training, while Nvidia is positioning to standardize autonomy tooling across the industry. The strategic tug-of-war is real—but for investors, the differentiator will be measurable delivery of results, not announcements.

Sources:

All numerical data is coming from:

Gurufocus: https://www.gurufocus.com/

Thestreet: https://www.thestreet.com/technology/elon-musk-drops-a-surprise-curveball-on-nvidia

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Go Premium

Go Premium