India's economy faced multiple challenges in December, with a widening fiscal deficit, a depreciating rupee, and declining stock market performance. Government spending on subsidies and infrastructure pushed the fiscal deficit to 52.5% of the annual target, while the rupee hit a record low due to global currency pressures, prompting the Reserve Bank of India (RBI) to intervene. Policymakers are considering a temporary tax on steel imports to shield domestic producers from cheap Chinese goods, while airlines' request to include aviation fuel under the GST regime was rejected. Despite these hurdles, the government maintains a 6.5% GDP growth projection for FY25, driven by strong consumption and investment. The stock market struggled, with the BSE SENSEX and NIFTY 50 recording losses, but corporate activity remained robust, with major acquisitions such as UltraTech Cement’s takeover of India Cements and Lupin’s expansion into diabetes care. Additionally, Adani Wilmar shares fell as the Adani Group exited its stake, while Greaves Cotton saw a surge amid IPO anticipation for its electric mobility unit.

India economy update

- India's fiscal deficit for the April-November period reached 52.5% of the full-year target, according to official data. The deficit reflects government spending outpacing revenue collection during the period, driven by increased allocations for subsidies and infrastructure projects.

- The Indian rupee fell to a lifetime low, pressured by a weakening Chinese yuan and increased offshore dollar demand in non-deliverable forward (NDF) markets. The currency's decline reflects broader regional pressures and global risk aversion, as investors move towards the U.S. dollar amid uncertain economic conditions.

- India is considering imposing a temporary tax of up to 25% on certain steel imports to counter the influx of cheaper Chinese products, aiming to protect its domestic industry. The proposed measure comes amid rising concerns about unfair pricing practices that threaten local steelmakers.

- India's tax panel has rejected a proposal from airlines to include aviation fuel under the Goods and Services Tax (GST) regime, citing potential revenue implications for state governments. Airlines have been advocating for this change to reduce costs, as jet fuel accounts for a significant portion of their operating expenses.

- The Reserve Bank of India (RBI) is reportedly selling U.S. dollars in the spot and forward markets to curb the rupee's depreciation, according to traders. This intervention comes as the rupee faces pressure from global factors, including a strong U.S. dollar and a weakening Chinese yuan.

- The Indian government projects the economy to grow at approximately 6.5% in the fiscal year 2025, highlighting sustained resilience despite global uncertainties. Key drivers of this growth include strong domestic consumption, robust investment activity, and continued policy support.

India stock market update

December brought further challenges for India's markets. The BSE SENSEX declined by 1.14%, closing at ₹78,139.01, while the NIFTY 50 saw a larger drop of 2.02%, ending at ₹23,644.80. Economic pressures continued to weigh on investor sentiment, leading to losses across both major indices.

- India's competition watchdog has approved UltraTech Cement's acquisition of India Cements, a move expected to further consolidate the country's cement industry. This acquisition will enhance UltraTech's market position, enabling it to expand its production capacity and strengthen its foothold in key regions.

- Shares of Adani Wilmar dropped more than 6% after the Adani Group announced plans to sell its entire 44% stake in the company in a $2 billion deal. The group aims to refocus its efforts on strengthening its infrastructure businesses. As part of the deal, Adani Group will sell a 31% stake to its joint venture partner, Singapore's Wilmar International, at a price of up to 305 rupees per share, representing a 7.2% discount to the stock's previous closing price

- India's competition regulator has approved the acquisition of a 72.8% stake in Prataap Snacks by Authum Investment & Infrastructure and investor Mahi Madhusudan Kela. In September, the two investors acquired a majority 46.85% stake in the Indore-based snack maker from venture capital firm Peak XV Partners, and later announced an open offer for an additional 26% stake.

- Pharmaceutical company Lupin has acquired the Huminsulin brand in India from Eli Lilly, strengthening its diabetes care portfolio. Previously marketed under an agreement with Lilly India, Huminsulin is used to treat Type 1 and Type 2 diabetes mellitus.

- Greaves Cotton shares surged up to 12% on December 30 following a large trade where 43.45 lakh shares, representing 1.87% of its equity, worth ₹131 crore changed hands at an average price of ₹312 per share. This rise comes amid heightened investor interest, partly driven by its subsidiary, Greaves Electric Mobility, which recently filed a draft prospectus for a ₹1,000 crore IPO.

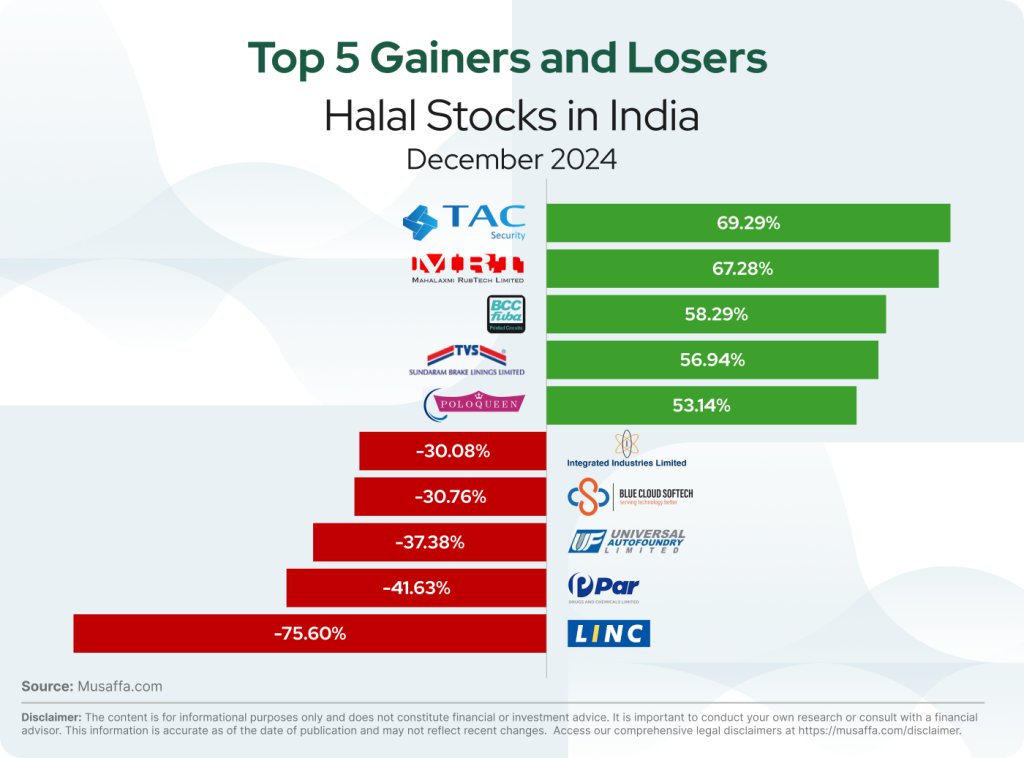

Indian top gainer and top loser stocks for December

Summary

India’s economy faced headwinds in December, with a widening fiscal deficit, a record-low rupee, and stock market losses, though the government maintains a 6.5% growth outlook for FY25. The RBI intervened to stabilize the rupee, while policymakers considered protective trade measures. Corporate restructuring remained active, with major acquisitions and stake sales reflecting industry shifts amid economic uncertainty.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Nusrat Ahmed

Nusrat Ahmed