Assalamu Alaykum,

Welcome to our monthly economic and market update! As we enter a new month, here’s a recap of the key economic and market developments in the India from July. Let’s get started.

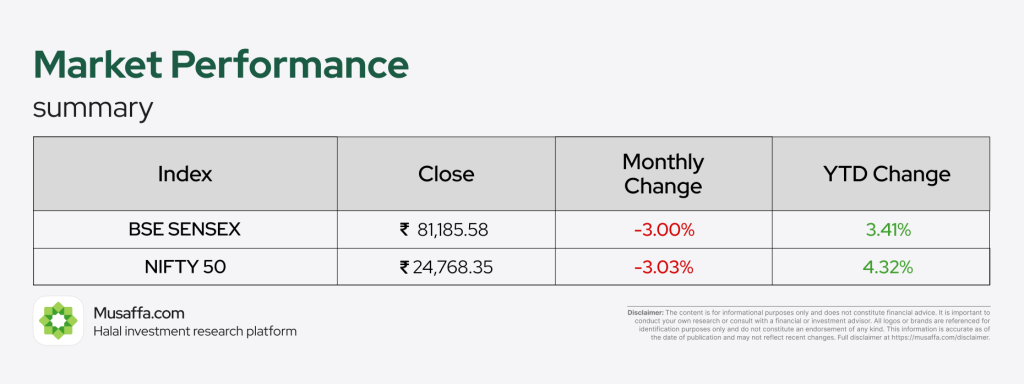

Stock market updates

Indian markets faced a sharp correction in July as profit-taking and global uncertainties weighed on investor sentiment. The BSE SENSEX declined by 3.00% to close at ₹81,185.58, trimming its year-to-date gain to 3.41%. Similarly, the NIFTY 50 dropped 3.03%, ending the month at ₹24,768.35, reflecting cautious market momentum after recent record highs.

Dixon Technologies has entered three major JVs in the past month, including a 50:50 partnership with Signify Innovations to form Lightanium Technologies for the lighting business. The deal involves transferring Dixon’s lighting division and stake in DTSPL in exchange for equity, while Signify injects ₹140.3 crore for its Vadodara LED unit. Dixon also signed JVs with Q Tech India for camera modules and Chongqing Yuhai for precision components, prompting bullish calls from Nomura and CLSA, citing enhanced value addition in smartphones.

Maruti Suzuki has made six airbags a standard feature in its Ertiga and Baleno models, aligning with the government’s enhanced safety push, resulting in price hikes of 1.4% and 0.5% respectively. The move follows Road Transport Minister Nitin Gadkari’s call for six airbags in all M1 category vehicles. Despite a 6% year-on-year sales dip in June, Maruti’s stock closed slightly higher at ₹12,569 on the NSE.

Procter & Gamble has appointed Shailesh Jejurikar, its current COO, as the new CEO starting January 2026, amid rising global tariffs and softening demand. The company is undergoing a two-year restructuring plan targeting 7,000 non-manufacturing job cuts to drive productivity, after profit margins dropped to 17.7% in 2024. Jejurikar faces mounting challenges including a $600 million tariff headwind in FY26, cost inflation, and the need to grow brand penetration across underserved markets while balancing pricing and efficiency.

Hitachi Energy India reported a sharp rise in net profit to ₹131.6 crore in Q1 FY26, up from ₹10.4 crore a year earlier, driven by higher revenues, strong operational execution, and a favorable base. Revenue rose 15% YoY to ₹1,529.8 crore, supported by high-margin orders, export momentum, and improved efficiency. A robust order inflow of ₹11,339.2 crore, led by the Bhadla-Fatehpur HVDC project and bulk transformer orders from POWERGRID, pushed the backlog to ₹29,125.3 crore, providing solid revenue visibility amid India’s ongoing grid expansion and energy transition efforts.

Waaree Energies posted a 93% YoY rise in net profit to ₹773 crore in Q1 FY26, fueled by a revenue jump to ₹4,597 crore and record quarterly module production of 2.3 GW. Backed by strong demand, the company has approved ₹2,754 crore capex to expand cell and ingot-wafer capacities across Gujarat and Maharashtra. With a ₹49,000 crore order book and over 100 GW in its global pipeline, Waaree reaffirmed its FY26 EBITDA guidance of ₹5,500–₹6,000 crore, reflecting robust financial momentum and expansion plans.

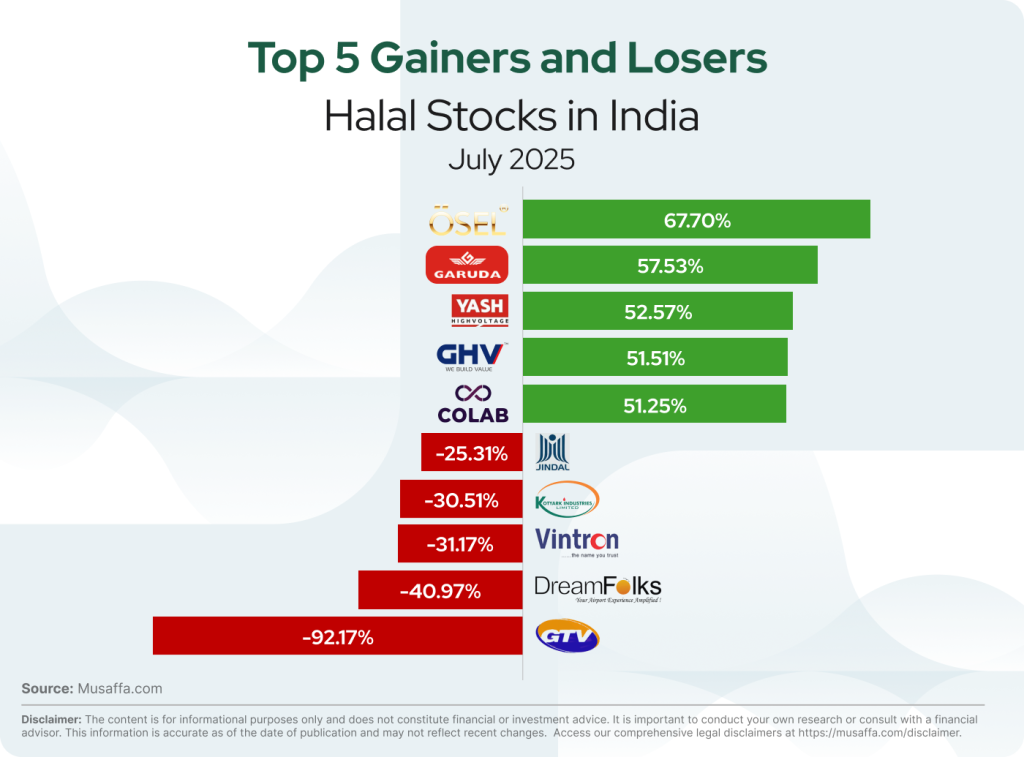

Top gainer and top loser Halal stocks in the USA

Economic updates

India’s Free Trade Agreement with the European Free Trade Association (EFTA)—comprising Switzerland, Norway, Iceland, and Liechtenstein—will come into effect on October 1, 2025. Under the TEPA deal, India will receive $100 billion in investments over 15 years and gradually reduce or remove duties on Swiss goods like watches, chocolates, and gold, while gaining access to services and EU markets via Switzerland. Commerce Minister Piyush Goyal emphasized the deal’s strategic importance, job creation potential, and India’s commitment to protecting national interests in all trade negotiations.

India is expected to grow at 6.5% in FY26, driven by low inflation, rate cuts, strong monsoon, and higher public capex, said EAC-PM Chairman S Mahendra Dev. Despite global geopolitical and trade uncertainties, domestic indicators remain resilient, with food inflation easing and crude oil prices under control. Dev emphasized that rising private consumption, improving FDI flows, and multiplier effects from public infrastructure will support medium-term growth, while further reforms and stronger demand may boost private investment ahead.

The Central Government’s net direct tax collections dropped 1.3% year-on-year to ₹5.6 lakh crore by July 10, 2025, driven by a sharp 38% rise in refunds. Despite gross collections rising 3.2% to ₹6.6 lakh crore, both corporate and non-corporate tax collections declined, with corporate tax down 3.7% and non-corporate tax slightly lower by 0.04%. The contraction highlights subdued tax momentum in early FY26 amid elevated refund outflows.

India installed 22 GW of renewable energy in the first half of 2025 — a 56% YoY increase — pushing its clean energy capacity above fossil fuels for the first time. The milestone boosts confidence in India’s 2030 target of 500 GW from non-fossil sources, though coal still dominates nearly 75% of power generation. Experts warn that without rapid grid upgrades and energy storage expansion, India’s net-zero ambitions may remain out of reach.

Indian policymakers will gain vital insights into household debt, financial stress, and investment behavior with the 2026-27 All-India Debt and Investment Survey, the first since 2019. Scheduled to begin in July 2026, the survey will guide policy decisions as private consumption drives over 60% of GDP. It will assess credit dependence post-pandemic, investment trends by region and income, and fixed capital formation, while a parallel Economic Census will build a comprehensive business database to support new high-frequency indicators.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Marifat Fayz

Marifat Fayz