Assalamu Alaykum,

Welcome to our monthly economic and market update! As we enter a new month, here's a recap of the key economic and market developments in India from April. Let’s get started.

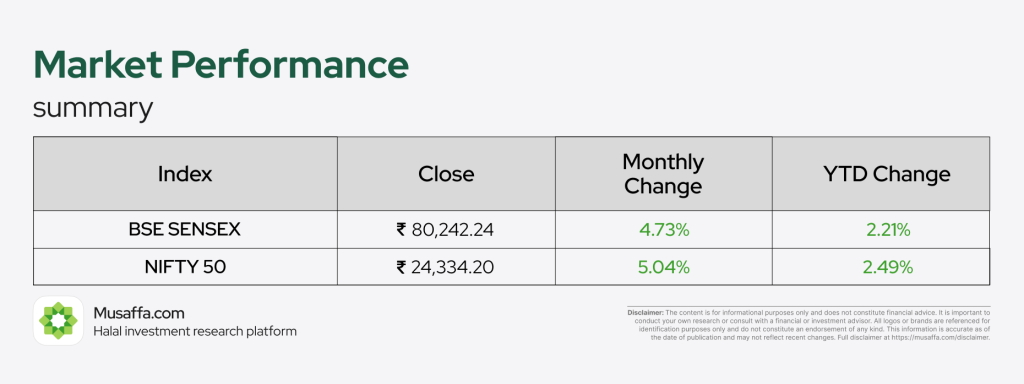

Stock market updates

April marked a strong recovery for India’s markets, with both major indices seeing impressive gains. The BSE SENSEX surged by 4.73%, closing at ₹80,242, while the NIFTY 50 rose by 5.04%, ending the month at ₹24,334. Investor sentiment improved, supported by positive economic indicators and a rebound in global markets, helping to reverse the losses from the previous months and boost market performance.

- Tata Technologies missed revenue expectations for the January–March quarter, reporting a 1.2% drop to ₹12.86 billion amid weakening global EV demand, slower decision-making in the auto sector, and trade-related uncertainty; while revenue from its tech solutions fell 14.5%, its services revenue rose 2.9%, and net profit increased to ₹1.89 billion, aided by higher other income.

- Aurobindo Pharma has received final USFDA approval to launch its generic version of Xarelto (Rivaroxaban 2.5mg) in the U.S., targeting a $447 million market, and also secured tentative approvals for the 10mg, 15mg, and 20mg strengths, positioning itself to tap into the broader $8.5 billion U.S. market for all dosages of the popular blood thinner.

- Maruti Suzuki reported a 4.3% year-on-year decline in Q4 FY25 net profit to ₹3,711 crore, missing analyst expectations, while revenue from operations rose 6.4% to ₹40,674 crore. The company's EBITDA fell 9% to ₹4,264 crore, with margins shrinking to 10.5% due to increased advertising and discounting costs. Despite the earnings miss, Maruti announced a final dividend of ₹135 per share for FY25.

- Apollo Hospitals is planning a series of acquisitions and greenfield projects to expand its footprint, particularly in northern India, aiming to meet rising demand for premium healthcare. With a current bed capacity of around 8,000, the company intends to add 3,500 more beds over the next 3–4 years, targeting key urban centers including Kolkata, Hyderabad, Mumbai, and cities in Karnataka.

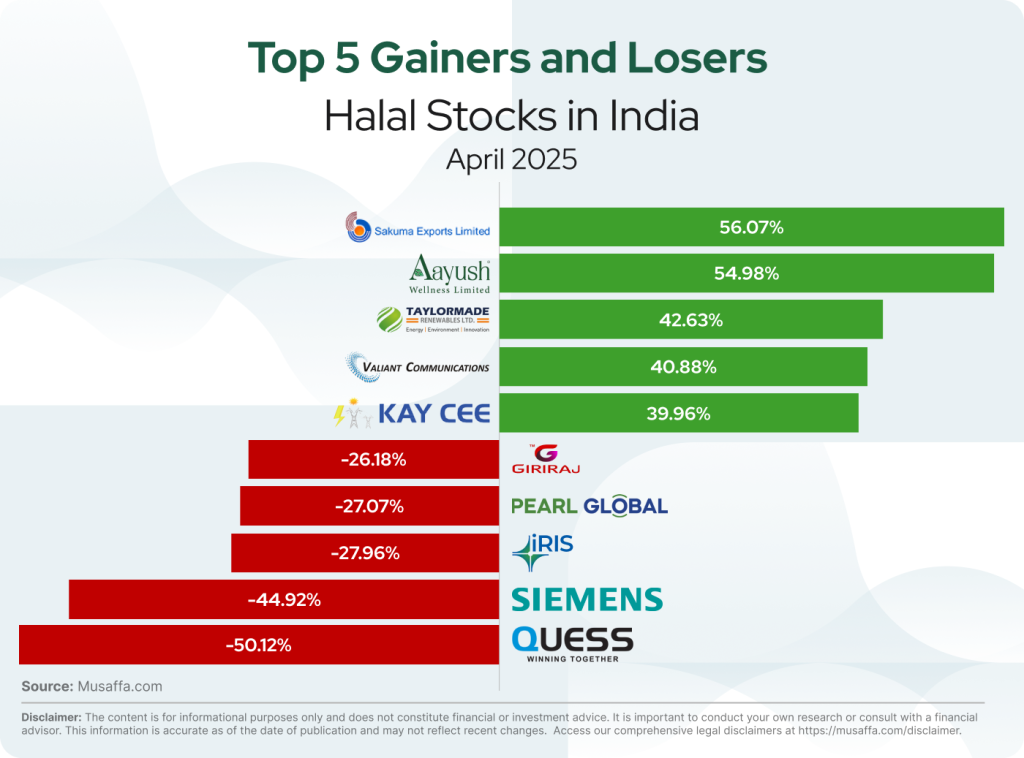

Top gainer and top loser Halal stocks in India

Economic updates

- India's Finance Secretary Ajay Seth warned that U.S. tariffs imposed by the Trump administration could directly reduce India's GDP growth by 0.2 to 0.5 percentage points this year, potentially dragging current growth from around 6.5%, while also raising concerns about broader global economic fallout from escalating trade tensions.

- India’s private sector activity surged in April, hitting an eight-month high as export demand for manufactured goods accelerated, with the HSBC India Composite PMI rising to 60.0 from 59.5 in March—its highest level since August—driven by strong performances in both manufacturing (58.4) and services (59.1).

- The World Bank has downgraded India’s GDP growth forecast for FY26 to 6.3%, down from its earlier 6.7% projection, citing heightened global uncertainty, weak export demand due to shifting trade policies, and a generally challenging external environment; while monetary easing and improved public investment may support domestic demand, the positive effects are likely to be tempered by slower global growth and ongoing policy unpredictability.

- India’s retail inflation fell to a 67-month low of 3.34% in March, down from 3.61% in February, driven by easing food prices; this marks the second straight month inflation has stayed below the Reserve Bank of India’s 4% target, strengthening expectations for another rate cut in June following two consecutive 25 basis point cuts that have already lowered the policy rate to 6%.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Nusrat Ahmed

Nusrat Ahmed