In November, India’s economy showed mixed signals, with GDP growth slowing to 5.4% in Q2 FY24—its lowest in nearly two years—while the FY25 outlook remained optimistic at 6.8%. The fiscal deficit rose significantly, requiring careful management to stay within the government’s target. Foreign exchange reserves declined, pressuring the rupee, though core sector growth and easing inflation provided some relief. The Reserve Bank of India is expected to maintain interest rates to balance growth and inflation.

India economy update

- India's economy showed signs of slowing down, with GDP growth dropping to 5.4% in Q2 of FY24, marking the lowest in nearly two years. However, the country's growth forecast for FY25 remains optimistic at 6.8%, despite challenges.

- On the fiscal side, the government is grappling with a high fiscal deficit, which stands at ₹7.50 lakh crore for the period April-October, reaching 46.5% of the annual target. This indicates the need for careful management to keep the deficit within the targeted 4.9% of GDP for the year.

- India's foreign exchange reserves fell to a five-month low of $656.5 billion, dropping by $47 billion over a span of seven weeks. This has raised concerns about the strength of the rupee, which hit an all-time low.

- India's core sector, which includes critical industries like coal, cement, and steel, showed signs of recovery with a growth of 3.1% in October, a promising indicator for industrial output.

- Retail inflation eased to 4.9% in October, down from 5.5% in September, primarily due to a decline in food prices. The Reserve Bank of India (RBI) is expected to maintain the key interest rate at 6.5%, balancing growth support with inflation control.

India stock market update

November continued to pose challenges for India's markets. The BSE SENSEX saw a slight decrease of 0.43%, closing at ₹79,043.79, while the NIFTY 50 dropped 0.31% to ₹24,131.10. Despite the losses, the market remains under pressure from ongoing economic concerns.

- Asian Paints Ltd faced a sharp decline of 8.34% to ₹2538.45, attributed to selling pressure during a volatile session. Despite the drop, the company maintains a strong market cap of over ₹24 lakh crores.

- Maruti Suzuki India Ltd launched the eSwift, its first electric hatchback, in India. Priced competitively at ₹8.5 lakh, the eSwift is expected to revolutionize affordable EV options, targeting a significant market share in the growing EV segment.

- November was active for IPOs, with Rajesh Power Services oversubscribed 59 times. Upcoming listings like Agarwal Toughened Glass India and Suraksha Diagnostics also generated investor interest.

- Siemens Ltd delivered a strong Q4 performance in FY2024, marking a 45% YoY rise in net profit to ₹803 crore, driven by robust execution of infrastructure and digitalization projects. Revenue increased by 11% YoY, reflecting consistent demand across industrial technology sectors. Following these results, Siemens shares surged by up to 5% intraday, demonstrating investor confidence in its growth trajectory.

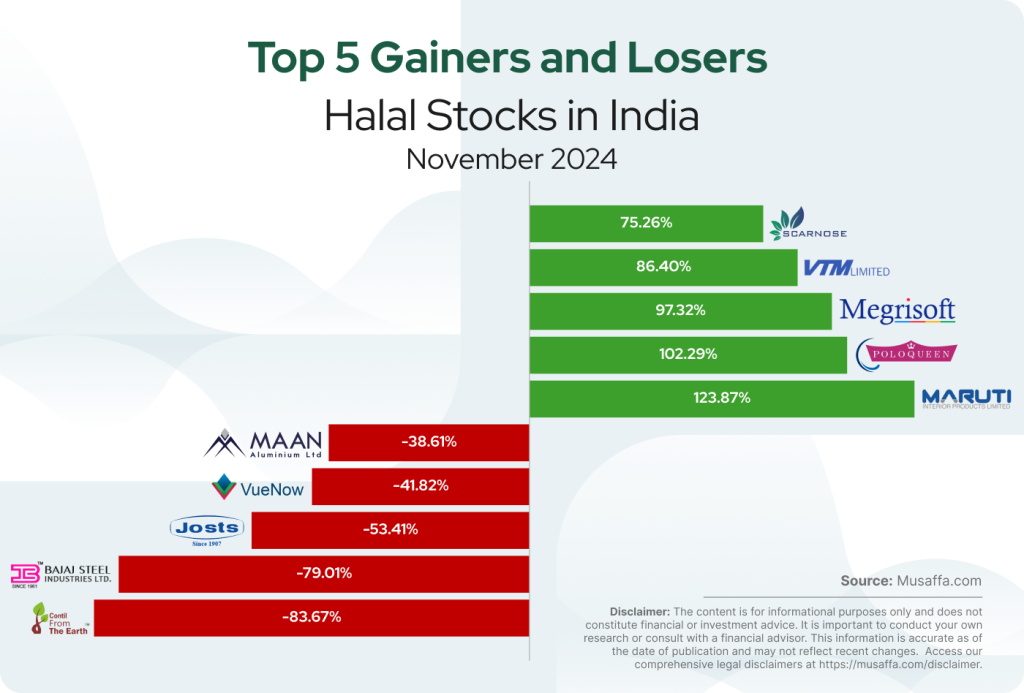

Indian top gainer and top loser stocks for November

Summary

India's stock markets faced slight declines in November amid economic pressures. While some major stocks saw volatility, strong IPO activity and corporate moves like Maruti Suzuki’s eSwift launch and Siemens’ robust earnings fueled investor interest. Despite near-term challenges, industrial growth and strategic developments signal resilience in key sectors, shaping the country's economic trajectory.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.