Assalamu Alaykum,

Welcome to our monthly economic and market update! As we enter a new month, here’s a recap of the key economic and market developments in the Malaysia from July. Let’s get started.

Stock market updates

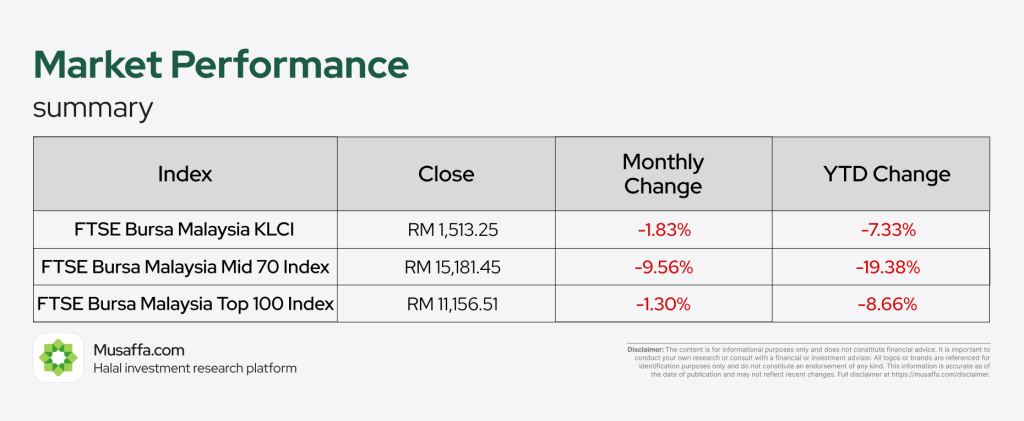

Malaysian markets continued their downward trend in July amid persistent headwinds and weak investor sentiment. The FTSE Bursa Malaysia KLCI slipped 1.83% to RM1,513.25, bringing its YTD loss to 7.33%. The broader FTSE Bursa Malaysia Top 100 Index fell 1.30%, while the Mid 70 Index saw a steep 9.56% drop, reflecting deeper pressures on mid-cap stocks.

Zetrix AI Bhd, previously known as MyEG Services, is no longer involved in renewing foreign worker permits after the Home Ministry awarded an exclusive contract to Bestinet Sdn Bhd for its Foreign Workers Centralised Management System (FWCMS). The decision, confirmed by Home Ministry officials, ended MyEG’s involvement after its contract was not renewed, despite earlier indications of a possible extension. Under the new arrangement effective February 2025, all ePASS applications must go through FWCMS exclusively, with RM86.3 million in claims submitted by Bestinet so far, of which RM12.7 million has been paid.

Pekat Group Bhd fell 2% after announcing its first-ever private placement, raising up to RM85 million through a 10% share issuance at RM1.28 per share. Analysts flagged up to 10% EPS dilution over two years, with Phillip Capital downgrading the stock and Kenanga cutting its target price. However, both note that the funds will support high-return CRESS solar projects, with Kenanga calling the reinvestment sensible given strong IRR potential versus debt repayment.

IOI Corporation Bhd is expected to report a 4QFY2025 net profit of RM310 million, up 11% QoQ, driven by a sharp rise in plantation output and resilient selling prices due to forward contracts. UOB Kay Hian highlighted improved downstream margins and lifted its FY2025 forecast to RM1.31 billion, slightly above consensus, with FY2026 profit seen flat at RM1.32 billion amid softer palm oil prices. The research house raised its target price to RM3.60 but maintained a ‘hold’ rating due to fair valuation.

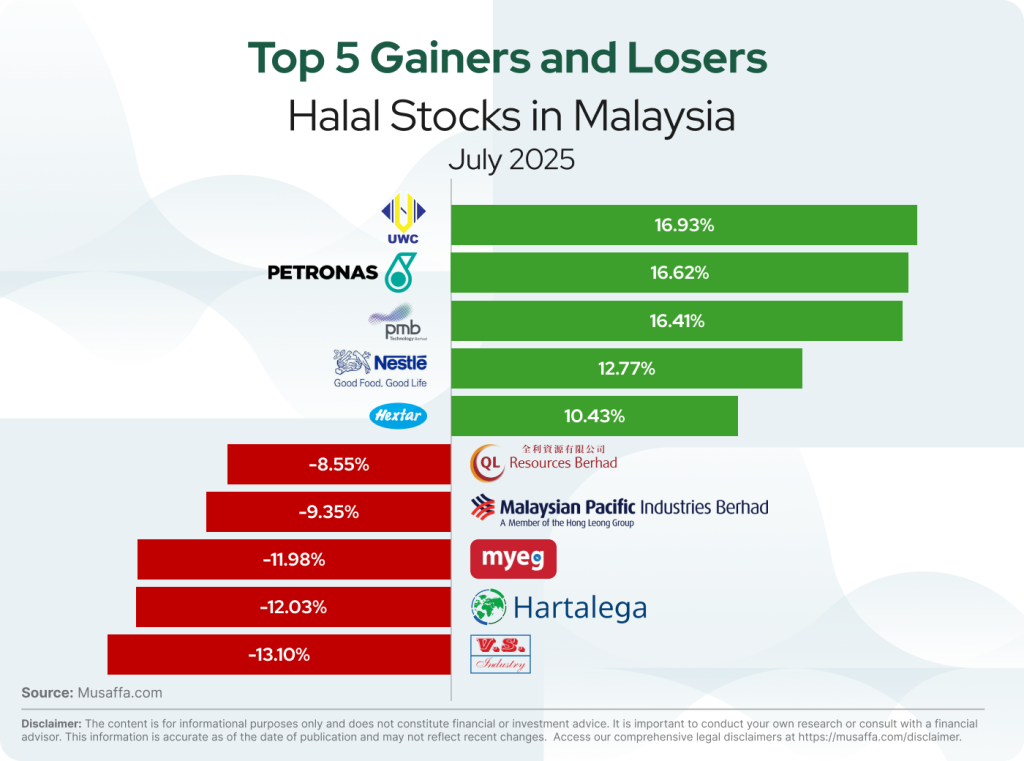

Nestle Malaysia’s Q2 FY25 net profit rose 20% YoY to RM112.1 million on stronger export and domestic sales, reversing earlier setbacks from consumer boycotts and high costs. Revenue grew 9.5% to RM1.67 billion, while H1 net profit still dipped 5.4% due to prior-year weakness. With improving brand sentiment and recovery in demand, analysts have upgraded their outlook, with RHB raising its target price to RM95, citing Nestle’s structural strength and renewed investor interest.

Gamuda Bhd, via its 60%-owned SRS Consortium, has received the Notice to Proceed from MRT Corp to begin civil works on the first phase of the Penang LRT project—a 24km stretch with 19 stations from Komtar to Island A. The RM8.31 billion contract, awarded earlier this year, now officially kicks off with a six-year completion timeline. Part of the larger RM13 billion Mutiara Line, the project aims to improve urban mobility with expected daily ridership of up to 60,000 and full system completion by 2031.

Top gainer and top loser Halal stocks in the USA

Economic updates

Malaysia’s proposed multi-tier levy mechanism may raise foreign worker levies by RM300–RM500 to help fund management costs, according to a Home Ministry official in the PAC report. The levy, part of broader cost-recovery measures, complements higher visa and processing fees and stems from the government’s contract with Bestinet for the Foreign Workers Centralised Management System (FWCMS), which runs until 2031. As of May 2025, Bestinet has claimed RM86.3 million, with the Finance Ministry allocating RM44.6 million and further funding applications pending.

Bank Negara Malaysia has revised its 2025 GDP growth forecast to 4.0%-4.8%, down from 4.5%-5.5%, citing uncertainty over US tariff threats and global trade headwinds. Despite the downgrade, BNM says the economy remains resilient, supported by structural reforms and strong domestic demand. Inflation is also expected to ease to 1.5%-2.3%, while policy support such as cash aid, fuel subsidies, and toll freezes aim to cushion cost-of-living pressures.

Gold prices slipped to a near two-week low after the US and EU reached a trade deal imposing reduced tariffs, easing market tensions and boosting demand for risk assets. Spot gold fell 0.1% to $3,332.18/oz as risk appetite rose and the US dollar softened slightly, offering limited support to bullion. Investors now await key US economic data and Fed policy signals, while silver, platinum, and palladium posted modest gains.

Bank Muamalat has introduced Malaysia’s first Step-Up Profit Rate (Super) under the Housing Credit Guarantee Scheme (SJKP), offering lower instalments for the first five years to ease early homeownership burdens. The SMART Mortgage SJKP Super targets first-time buyers, especially those with informal income, with financing up to RM500,000 and flexible repayment terms. A separate Madani Super variant offers up to 120% financing, including costs for renovations and furnishings, further supporting inclusive homeownership aligned with government goals.

Prime Minister Anwar Ibrahim announced that Malaysia has secured over RM63 billion in semiconductor investments under the National Semiconductor Strategy (NSS) by March 2025, with RM58 billion from foreign investors and RM5 billion domestically. Major foreign-led projects include contributions from Infineon, Carsem, NXP, Plexus, and Syntiant, while 13 local companies — such as Inari Amertron, Pentamaster, and ViTrox — are emerging as national champions. The government is also allocating RM1.2 billion to develop 60,000 engineers over five years and plans to boost R&D funding, improve market access, and strengthen talent collaboration across sectors to position Malaysia as a global semiconductor hub.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Danesh Ramuthi

Danesh Ramuthi