In November, Malaysia’s economy displayed resilience, with steady inflation at 1.9% and a Q3 GDP growth of 5.3%, supported by strong investments and exports. While the ringgit showed a year-to-date appreciation of 3.1%, it weakened against the U.S. dollar due to global currency trends. Bank Negara Malaysia maintained the overnight policy rate at 3%, signaling confidence in economic stability despite external pressures. Key industries, particularly manufacturing and tourism, continued to benefit from sustained demand and strategic investments.

Malaysia economy update

- The Malaysian ringgit showed mixed performance, appreciating by 3.1% year-to-date but facing a 7.8% decline against the U.S. dollar in October and November due to a stronger greenback. Export-driven sectors benefited from higher capital imports and robust external demand, particularly in manufacturing and tourism.

- Inflation remained steady at 1.9%, with stable food and beverage prices offsetting higher costs in diesel and vehicle insurance. The Consumer Price Index saw fewer items with price increases, reflecting effective mitigation measures to curb inflationary pressures.

- Malaysia's economy grew by 5.3% in Q3 2024, supported by robust investment activity, improved export performance, and resilient household spending. Key investments in multi-year public and private sector projects bolstered economic momentum, with significant contributions from the global tech upcycle and increased demand for manufactured goods.

- In November 2024, Bank Negara Malaysia (BNM) maintained the country's overnight policy rate (OPR) at 3%, signalling confidence in the economic outlook despite external challenges. The central bank emphasized that Malaysia’s economy remains resilient, with strong domestic consumption and improving exports. While inflation is expected to stay moderate, BNM projected growth of 4-5% for 2024. The decision aligns with economists' expectations and aims to support continued economic stability.

Malaysia stock market update

November saw mixed results for Malaysia’s key stock market indices. The FTSE Bursa Malaysia KLCI decreased by 0.96%, closing at RM1,586.39. In contrast, the FTSE Bursa Malaysia Mid 70 Index rose by 1.46%, reaching RM17,859.82. The FTSE Bursa Malaysia Top 100 Index also saw a slight increase of 0.08%, closing at RM11,823.79. Overall, investor sentiment remained mixed amidst ongoing economic challenges.

- AME Elite Consortium, known for its expertise in sustainable industrial development, announced a joint venture with Kuala Lumpur Kepong to create a new industrial park in Ijok, Selangor. This collaboration aims to enhance the industrial landscape with a focus on eco-friendly solutions, likely influencing stock price movements in both companies.

- PETRONAS Chemicals Group Bhd signed two Memorandums of Understanding (MOUs) in early November to advance exploration and production (E&P) technology. These partnerships focus on integrating AI solutions to enhance data-driven decisions, aiming to optimize operations in Malaysia's oil and gas sector.

- Bermaz Auto Berhad launched an advanced version of its flagship Mazda CX-5 model in Malaysia. This upgraded SUV features innovative technology, aiming to strengthen BAuto’s position in the premium vehicle segment.

- Top Glove Corporation Berhad has confirmed its strategic cost-cutting initiatives are paying off, with November’s sales figures exceeding expectations due to improved production efficiencies. Analysts predict that these measures will continue to enhance profitability, potentially boosting investor confidence in the coming months.

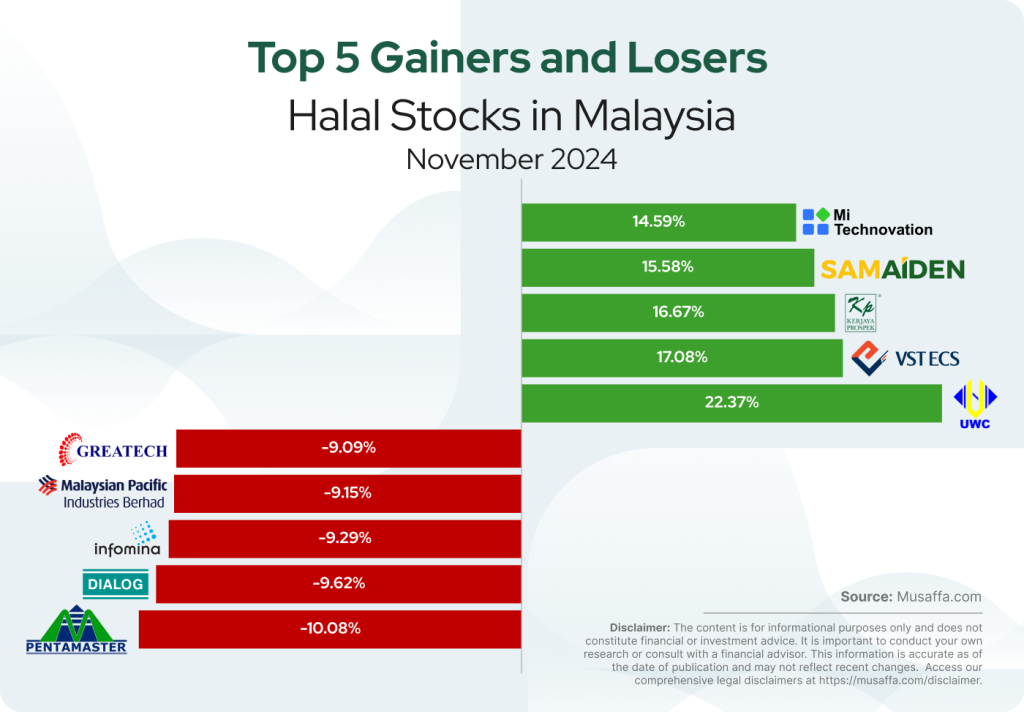

Malaysian top gainer and top loser stocks for November

Summary

Malaysia's stock market saw mixed movements in November, with declines in the FTSE Bursa Malaysia KLCI but gains in the Mid 70 and Top 100 indices. Investor sentiment remained cautious amid economic challenges, but corporate actions, including industrial park ventures, AI-driven oil and gas initiatives, and cost-cutting strategies in manufacturing, helped sustain market interest. The country’s economic outlook remains optimistic, driven by domestic consumption, industrial growth, and strategic business expansions.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Nafisahon

Nafisahon