Assalamu Alaykum,

Welcome to our monthly economic and market update! As we enter a new month, here’s a recap of the key economic and market developments in the Saudi Arabia from July. Let’s get started.

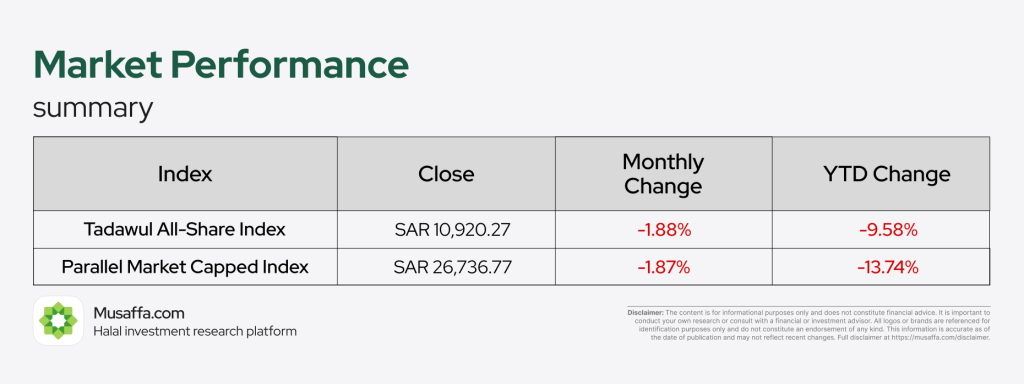

Stock market updates

Saudi equities extended their losses in July, weighed down by sector-wide pressures and cautious investor sentiment. The Tadawul All-Share Index declined 1.88% to close at SAR10,920.27, pushing its YTD performance to -9.58%. The Parallel Market Capped Index also dropped 1.87% to SAR26,736.77, deepening its YTD decline to 13.74%.

Leejam Sports reported a 15% drop in net profit to SAR143 million for H1 2025, as branch expansion drove an 18% rise in direct costs, while revenue slipped 9% to SAR744 million. Q2 net profit edged down 1% year-on-year to SAR72 million, with the board approving SAR44 million in dividends for the quarter, totaling SAR86 million for H1. Shares fell 0.6% to SAR139.20, extending a 25% decline year-to-date; major shareholder Hamad Ali Al-Sagri holds a 52% stake.

Sahara International Petrochemical Company (Sipchem) has opened nominations for its Board of Directors for the upcoming four-year term starting December 10, 2025, and ending December 9, 2029. Elections will take place at the upcoming General Assembly meeting, to be scheduled after regulatory approvals. The nomination process follows the Companies Law, CMA governance regulations, and Sipchem’s internal board membership policies.

United Electronics Company (eXtra) has approved a cash dividend of SAR160 million for the first half of 2025, with shareholders set to receive SAR2 per share (20% of par value). The eligibility date is August 3, 2025, and dividends will be distributed via Al Rajhi Bank on August 14, 2025. Non-resident investors are reminded of a 5% withholding tax unless exempted and are encouraged to update their banking details to avoid payout delays.

Ataa Educational Company announced that its wholly-owned subsidiary, Arabian Education and Training Group Holding Company, signed an agreement to sell its Al-Faisal International Academy for Training to Qiyam Real Estate Company for SAR 40 million. The move aligns with Ataa’s strategy to focus solely on the education sector, and the transaction’s financial impact will be reflected in Q1 FY2026. Proceeds will be used to strengthen the company’s financial position and enhance liquidity.

Munawla Cargo Company has secured a SAR 4.1 million Shariah-compliant facility from Yanal Finance Company to support its fleet expansion and land transport operations. The 3-year financing, backed by a promissory note, aims to boost the company’s logistical capacity. No related parties are involved in the transaction.

Top gainer and top loser Halal stocks in the Saudi Arabia

Economic updates

Saudi Arabia led Gulf IPO activity in Q2 2025, capturing 76% of the $2.4 billion raised across the GCC, driven by strong investor demand and major listings like Flynas and Specialized Medical Co. Despite fewer listings, investor appetite remained robust, with foreign inflows rising 50% QoQ to $4.2 billion—$1.4 billion of which went to Saudi Arabia. PwC and Kamco Invest highlighted ongoing strength in Saudi’s Nomu market and renewed interest in alternative assets like Dubai’s REIT IPO, with the IPO outlook for late 2025 remaining cautiously optimistic.

Expatriates in Saudi Arabia sent SR15.2 billion ($4.05 billion) abroad in May 2024, up 21% YoY, driven by higher wages, rising expat numbers, and digital remittance tools. Total expat transfers reached nearly SR70 billion in the first five months, while Saudi citizens remitted SR29.8 billion, up 13%. Improved career prospects, especially in healthcare and tech, combined with fintech growth and favorable transfer costs, continue to fuel strong remittance flows as the Kingdom advances its Vision 2030 goals.

Brent crude rose 2.4% to $70.07, and WTI gained 2.5% to $66.78, as markets reacted to a US-EU trade deal and Trump’s threat to accelerate tariffs on Russia over Ukraine. The pact includes a $750 billion EU commitment to buy US energy and removes uncertainty amid hopes for a continued US-China tariff truce. Despite bullish sentiment, analysts note that OPEC+ is unlikely to change current output plans, while fundamentals like a strong dollar and weak Indian demand still pose headwinds.

Saudi Arabia issued 22 new mining exploration licenses in H1 2025, up 144% year-on-year, reflecting growing investor interest and Vision 2030 goals to boost the mining sector’s GDP contribution to $75 billion by 2035. The licenses, covering 47 sq. km and attracting over SR134 million in investment, are expected to yield 7.86 million tonnes annually of various ores including clay, salt, and silica sand. With 239 active licenses and $32 billion already invested, the Kingdom continues to accelerate exploration and reforms, quadrupling spending to $100 per sq. km since 2018.

Saudi commercial banks’ real estate lending rose 15% year-on-year to SR922.2 billion ($245.9 billion) in Q1 2025, driven by a sharp rise in corporate loans for commercial projects. While retail mortgages still dominate at 75.8% of the portfolio, corporate real estate lending grew nearly 27.5% to SR223.4 billion—its fastest pace in a decade—reflecting banks’ shift from home loans to large-scale development financing. The trend aligns with Vision 2030, backed by mega-projects like NEOM, infrastructure expansion, and policy reforms fostering public-private partnerships and securitization to boost private-sector credit.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Hojiakbar Obobakir

Hojiakbar Obobakir