Assalamu Alaykum,

Welcome to our monthly economic and market update! As we enter a new month, here’s a recap of the key economic and market developments in Saudi Arabaia from June. Let’s get started.

Stock market updates

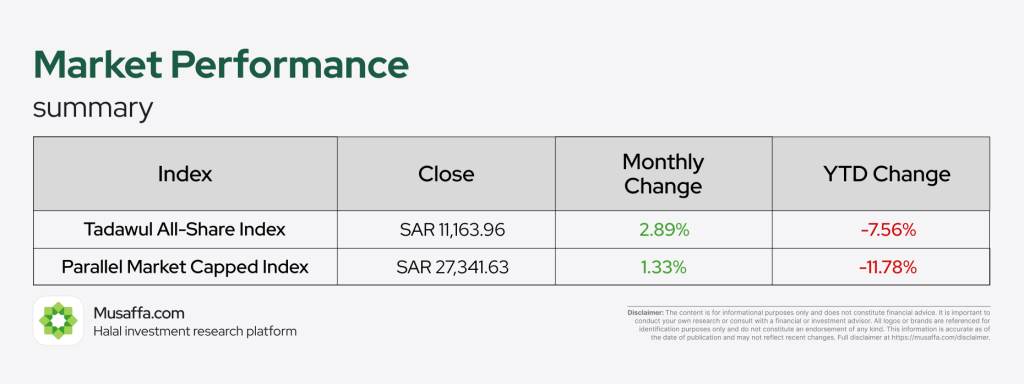

Saudi markets showed positive momentum in June, with the Tadawul All-Share Index gaining 2.89% to close at SAR 11,163.96, though it remains down 7.56% year-to-date. The Parallel Market Capped Index rose 1.33% to SAR 27,341.63, with an 11.78% decline since the beginning of the year.

Saudi Arabia’s CMA approved Paper Home Company’s plan to increase its capital from SAR 20 million to SAR 60 million by issuing two bonus shares for every one held. The SAR 40 million increase will be funded via retained earnings, raising total shares from 2 million to 6 million. The move awaits shareholder approval at an EGM within six months, with the entitlement date to be set later.

Almarai is acquiring 100% of Saudi-based Pure Beverages Industry for SAR1.04 billion ($280 million), aiming to expand its beverage offerings. The deal includes popular bottled water brands Ival and Oska, and will be funded through Almarai’s internal cash flows, pending regulatory approval. This acquisition supports Almarai’s long-term strategy to diversify its product range and tap into Saudi Arabia’s high bottled water demand.

Saudi Telecom Company (STC) is expanding 5G coverage to 75 cities using Juniper Networks’ 400G routers, achieving an 864-port increase per rack and 43% lower energy use. Its Supercore upgrade with PTX10008 routers boosts 100G capacity by over 1,300% and supports future 800G needs, while MX10008 routers in data centers reduce space use by 90% and power consumption by 87%. Enhanced with model-driven automation, the initiative supports Saudi Arabia’s Vision 2030 goals of digital transformation and sustainability.

Seera Group's board has recommended an 8.65% capital cut from SAR 3 billion to SAR 2.74 billion by canceling 25.95 million treasury shares, including 2.03 million from its employee share program. The move, pending CMA and EGM approval, will have no material impact on the company’s financials or operations. As of Q1 2025, Seera posted a net profit of SAR 53 million, down 13.11% year-on-year.

Etihad Atheeb Telecom (GO Telecom) has completed the acquisition of a 51% stake in EJAD TECH Co. on June 22, 2025, for a total value of SAR 86.7 million, funded entirely through internal resources. The payment includes SAR 40 million upfront, with the remaining SAR 46.7 million to be paid in two performance-based installments—SAR 23.7 million by the end of 2025 and SAR 23 million by the end of 2026. The acquisition supports GO Telecom’s strategy to expand into new technology sectors and drive shareholder value through targeted growth initiatives.

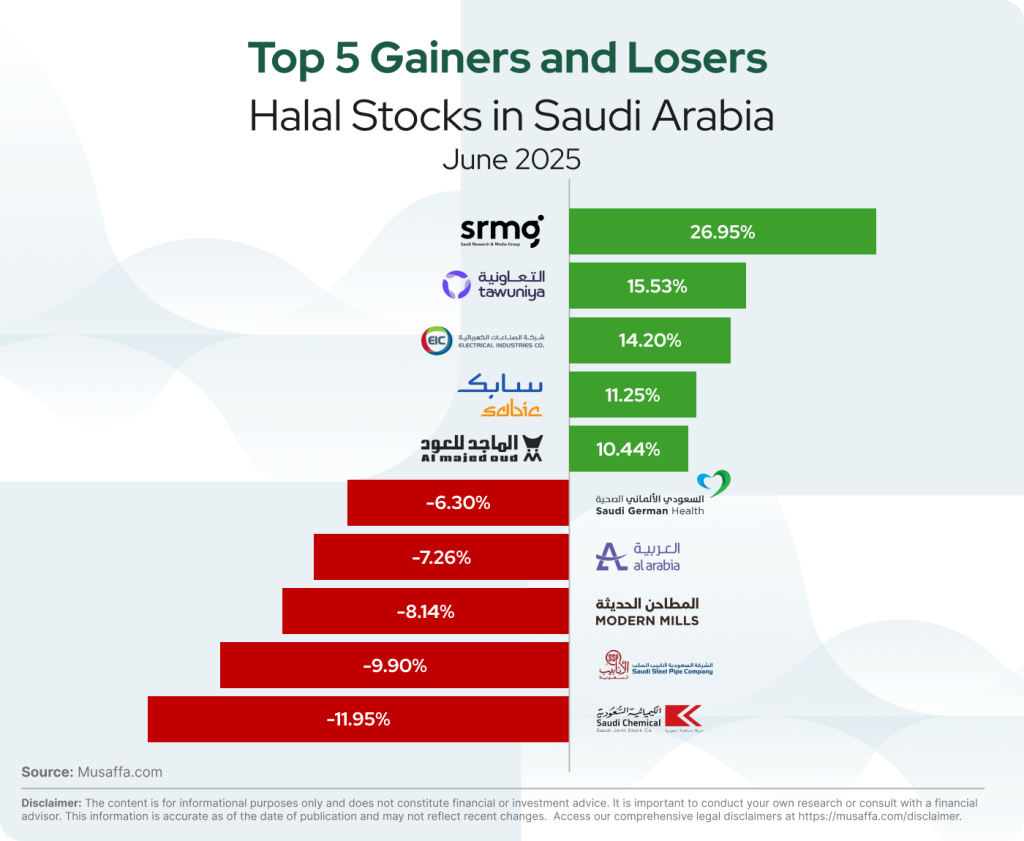

Top gainer and top loser Halal stocks in the Saudi Arabia

Economic updates

Zahr Al Khuzama Aluminum, Sahat Almajd Trading, and Quality Education Co. secured approval to list on Saudi Arabia’s Nomu market on June 18, reflecting surging investor interest in SME offerings. The Capital Market Authority’s rare triple nod comes amid capital market reforms and Vision 2030 goals, with each firm set to offer 11–20% of its shares to qualified investors. Despite a dip in the Nomu index, trading volumes remain robust, signaling ongoing appetite as Saudi Arabia targets 50–60 IPOs over the next two years.

Saudi Arabia’s Tadawul All Share Index dropped 1.15% to 10,591.13, with only 18 gainers against 231 decliners, while the MSCI Tadawul Index fell 0.86% to 1,366.6. The Nomu parallel market also declined 254.4 points to 26,203.84, despite 30 stocks advancing. Meanwhile, flynas closed its market debut at SR77.30, 3% below its IPO price, and Saudi National Bank announced full redemption of its SR4.2 billion Tier-1 sukuk by June 30.

At the Paris Air Show, Saudi Arabia outlined over SR10 billion ($2.6 billion) in aviation investment opportunities, covering airport infrastructure, air navigation, and advanced technologies. Deals signed included MoUs between Saudi Ground Services, France’s Alvest Group, and Arabian Alvest for localizing smart ground equipment and workforce training. The discussions, reinforcing Saudi-France economic ties, also backed the Kingdom’s aviation strategy to boost capacity to 330 million passengers and 250+ destinations by 2030

S&P Global has granted the UAE a consolidated sovereign credit rating of “AA/A-1+” with a stable outlook, citing its strong net asset position and resilient economic growth. The agency forecasts 4% annual growth through 2028, driven by robust non-oil activity, fiscal surpluses, and public investment in tourism, LNG, and cultural projects. While the dirham’s US dollar peg limits monetary flexibility, ongoing reforms, including FDI liberalization and talent-focused visa programs, are set to boost the UAE’s long-term economic trajectory.

The Islamic Development Bank Group and Turkiye’s Industry Ministry have launched an initiative to modernize industrial zones and promote climate-resilient infrastructure in support of Turkiye’s 2053 net-zero emissions target. Aligned with the country’s 12th Development Plan and 2030 tech strategy, the project emphasizes sustainable clustering of industries, efficient water use, and green infrastructure. While Climate Action Tracker rates Turkiye’s overall climate plan as “poor,” IsDB sees the initiative as key to enabling long-term, eco-friendly industrial transformation.

As of June 12, foreign investors held SR394.6 billion in Saudi stocks — down 1.1% year-on-year — yet their market share rose to 4.32% as overall market value fell to SR9.14 trillion. Saudi nationals remain dominant with SR8.68 trillion in holdings, while GCC investors’ stake dipped slightly to SR67.5 billion. Despite short-term volatility driven by geopolitical tensions and a 1.5% drop in the Tadawul Index, long-term foreign interest remains buoyed by Vision 2030 reforms, growing IPO diversity, and improved market infrastructure.

ENOWA signs deal for 30 million carbon credits to offset emissions, support Saudi net-zero target

ENOWA, NEOM’s energy and water arm, signed a long-term deal with the Public Investment Fund’s Voluntary Carbon Market Co. to acquire over 30 million tonnes of high-integrity carbon credits by 2030. The credits, sourced globally with a focus on the Global South, will help ENOWA offset current emissions while developing NEOM’s renewable energy systems. This milestone supports Saudi Arabia’s 2060 net-zero goal and scales up its voluntary carbon market infrastructure, with the first batch set for delivery in December 2025.

The UAE’s non-oil foreign trade surged 18.6% year-on-year in Q1 2025 to AED 835 billion, with exports jumping 41%, far outpacing global averages. Vice President Sheikh Mohammed bin Rashid Al-Maktoum said the country is set to reach its AED 4 trillion non-oil trade target by 2026—four years ahead of the 2031 goal—reflecting robust diversification progress. Non-oil sectors now contribute 75.5% to GDP, as the UAE continues to lead regional economic transformation alongside Saudi Arabia and Bahrain.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Foziljon Kamolitdinov

Foziljon Kamolitdinov

Marifat Fayz

Marifat Fayz