The UK economy continues to navigate inflationary pressures, with the Bank of England maintaining interest rates despite signs of economic slowdown. Rising costs in essential sectors, including water and energy, are expected to impact consumers, while inflation remains a challenge. The stock market faced declines, reflecting broader economic concerns, while key industries, such as automobile manufacturing, struggled with production setbacks. However, the financial sector saw notable developments, including the UK’s growing role in sustainable finance, major corporate acquisitions, and pharmaceutical advancements.

UK economy update

- The Bank of England is expected to keep interest rates unchanged as inflationary pressures persist, despite recent signs of economic cooling. Policymakers are balancing the need to control inflation with concerns about slowing growth and fragile consumer spending.

- Water bills in England and Wales are set to increase by 36% between 2025 and 2030 as part of a plan to address critical issues in the water sector, according to the UK water regulator. The additional funding will be used to improve infrastructure, reduce pollution, and tackle aging systems.

- Britain's energy price cap is set to increase by 3% in April, according to Cornwall Insight, potentially raising costs for millions of households. The adjustment reflects rising wholesale energy prices and ongoing market volatility. While the cap aims to protect consumers from extreme price surges, the increase may add to financial pressures on households already facing a high cost of living.

- UK inflation reached an eight-month high of 2.6% in November, driven by rising energy and food prices, according to official data. However, core inflation, which excludes volatile items, remained steady, suggesting underlying price pressures are stabilizing.

UK stock market update

December was a tough month for UK markets. The FTSE 100 Index saw a decline of 1.38%, closing at £8,173, while the FTSE All-Share Index dropped by 1.26%, ending at £4,467. A month of losses for both key UK indices amid ongoing economic pressures.

- UK car manufacturing plummeted to its lowest November level in 44 years, highlighting persistent challenges in the auto industry, according to industry data. Factors such as weaker export demand, supply chain disruptions, and ongoing labor issues have contributed to the decline.

- Merck & Co Inc has secured UK approval for its new therapy targeting a rare lung condition, a drug acquired as part of its $11 billion purchase of Prometheus Biosciences. The approval marks a significant milestone for Merck, expanding its portfolio in specialized treatments and addressing unmet medical needs in respiratory diseases.

- The London Stock Exchange has welcomed the debut Tier 1 sustainable sukuk issuance by The Saudi Investment Bank. This milestone highlights the growing global demand for sustainable finance solutions and strengthens ties between the UK and Saudi Arabia in capital markets.

- Windward Ltd shares surged following a £216 million takeover offer, signaling strong market confidence in the deal. The proposed acquisition highlights the strategic value of Windward’s maritime analytics technology, which has drawn interest from global investors.

- Eden Research PLC has received regulatory approval in Mexico for its biofungicide Novellus+, expanding its reach in the global agricultural market. The approval marks a significant milestone for the company, enabling it to offer sustainable crop protection solutions to Mexican farmers.

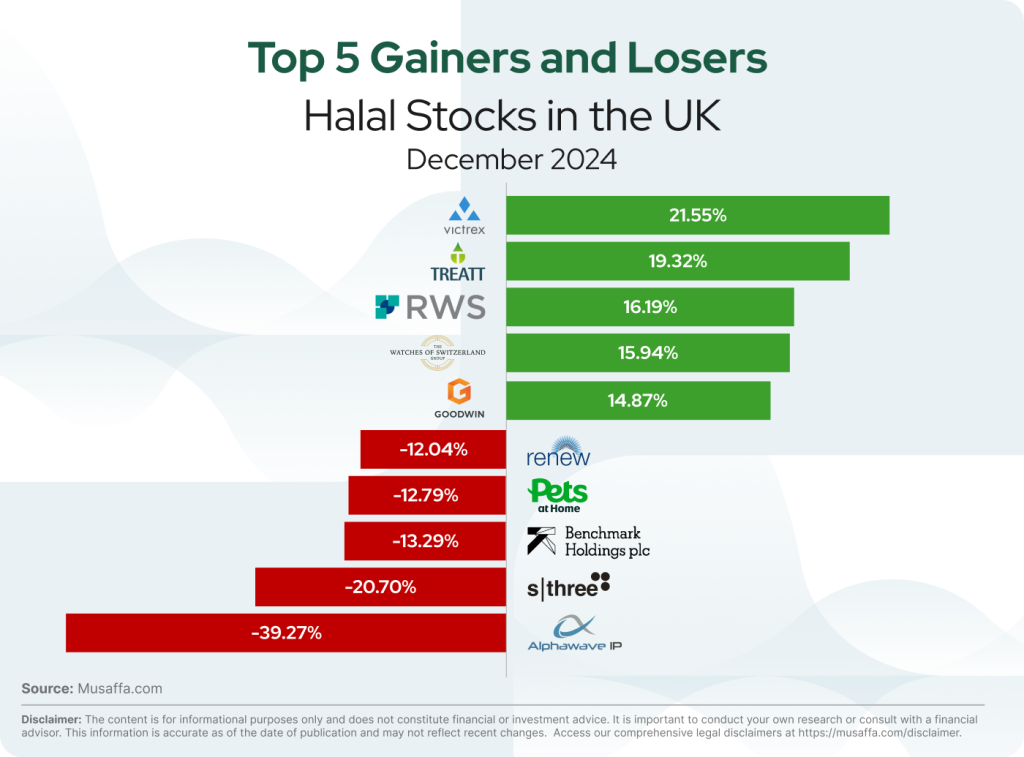

UK top gainer and top loser stocks for December

Summary

The UK economy is grappling with persistent inflation, rising utility costs, and slowing growth. While inflation hit an eight-month high, policymakers remain cautious about rate changes. The stock market experienced losses, and the automotive industry faced significant production declines. Despite economic headwinds, the UK made strides in sustainable finance, with the London Stock Exchange hosting a major sukuk issuance. Additionally, notable corporate moves in healthcare, maritime analytics, and agriculture signal continued investment in innovation and global market expansion.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Nusrat Ahmed

Nusrat Ahmed