Welcome to our monthly economic and market update! As we enter a new month, here's a recap of the key economic and market developments in the UK from February. Let’s get started.

UK economy update

- The Bank of England cut interest rates to 4.5% from 4.75%, with some policymakers pushing for a deeper cut to 4.25%, as it seeks to counter slowing economic growth. The BoE slashed its 2025 growth forecast to 0.75% and warned that inflation could peak at 3.7% this year—nearly double its 2% target—before easing. Investors now anticipate 2-3 more rate cuts in 2025, though the central bank remains cautious amid global economic uncertainty.

- Britain’s housing market slowed in January, with house price growth and buyer demand cooling, according to a RICS survey. The net balance of house prices fell to +22 from +26 in December, missing expectations of +27. Growth in buyer enquiries and sales also weakened, partly due to early January’s bond market turbulence, which drove up mortgage rates before easing.

- Britain has launched the 'Clean Industry Bonus' incentive scheme to boost offshore wind investment as part of its plan to decarbonize the energy system by 2030. The scheme will provide £27 million ($33.5 million) per gigawatt (GW) of capacity to successful bidders, encouraging both wind farm development and supply chain infrastructure. With offshore wind central to its clean energy strategy, Britain aims to increase capacity from around 15 GW to 43-50 GW by 2030.

- Britain’s domestic energy price cap is expected to rise by nearly 5% in April, marking the third consecutive quarterly increase, according to Cornwall Insight. This comes as cold weather and low gas storage levels in Europe keep wholesale energy prices high. The predicted rise to £1,823 per year (from £1,738) is a setback for the government’s efforts to lower energy bills.

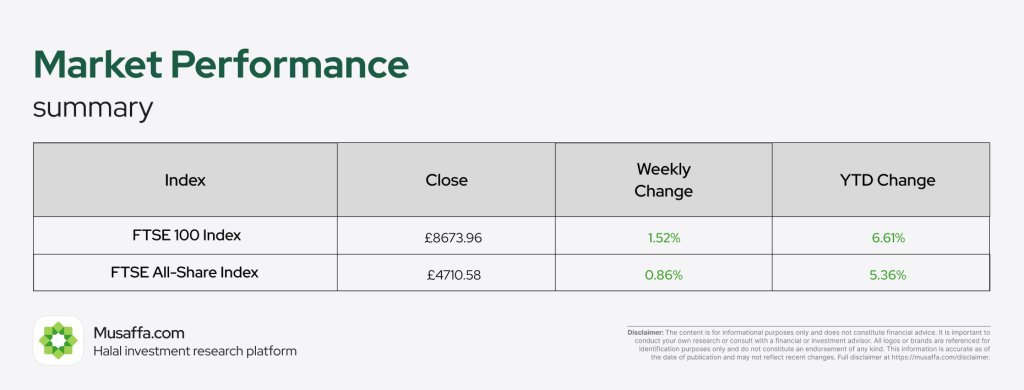

UK stock market update

February continued the upward trend for UK markets! The FTSE 100 Index gained 1.52%, closing at £8,805.69, while the FTSE All-Share Index saw a modest rise of 0.86%, ending at £4,750.89. A month of steady growth and resilience in the UK market.

- British homebuilder Bellway PLC reported an 18.6% rise in weekly reservation rates per outlet, despite affordability concerns due to the slower-than-expected pace of interest rate cuts. Its forward order book grew to £1.31 billion from £1.01 billion a year earlier, reflecting near-term demand.

- British recruiter Hays PLC reported a 58% drop in first-half operating profit due to a hiring slowdown across major European economies. Economic and political uncertainty in Germany, France, and the UK has led to lower placement volumes and longer hiring times, impacting both permanent and temporary roles. Hays posted a pre-exceptional operating profit of £25.5 million for the six months to December 31, down from £60.1 million a year earlier.

- AstraZeneca PLC has launched a biomethane plant in the UK to power all its British R&D and manufacturing operations with clean energy by the end of 2025. Developed in partnership with Future Biogas, the plant will generate 100 gigawatt hours of renewable energy annually, covering 20% of AstraZeneca’s global gas consumption.

- Pearson PLC shares hit a 10-year high after reporting a 10% rise in full-year adjusted operating profit, driven by strong performance in assessments, qualifications, and English language learning. The company credits AI integration across its product portfolio for boosting growth, with AI-powered personalized learning tools enhancing student exam preparation.

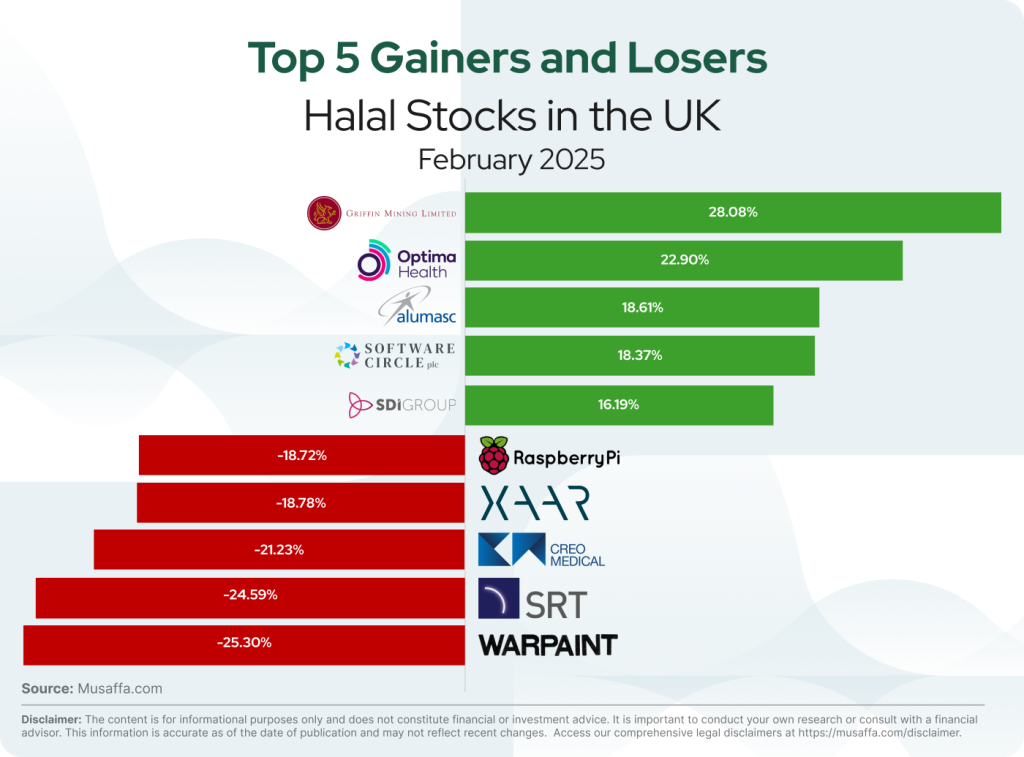

UK top gainer and top loser stocks for February

Summary

To sum up the Bank of England cut interest rates to 4.5% amid slowing economic growth, with inflation expected to peak at 3.7% in 2025. The housing market cooled in January, while the UK launched a £27 million per GW ‘Clean Industry Bonus’ to boost offshore wind investment. Energy prices are set to rise 5% in April. The FTSE 100 gained 1.52%, continuing its upward trend. Bellway PLC saw strong homebuyer demand, while Hays PLC suffered a 58% profit drop due to hiring slowdowns. AstraZeneca launched a biomethane plant, and Pearson PLC hit a 10-year stock high, fueled by AI-driven education growth.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Nusrat Ahmed

Nusrat Ahmed