In November, the UK economy showed resilience, with inflation easing faster than expected, supported by declining transport costs. Consumer confidence improved, reflecting falling interest rates and wage growth, though food inflation remained a challenge. The Chancellor’s Autumn Budget reinforced Labour’s taxation strategy but left future spending reviews uncertain. Despite fiscal challenges, government borrowing remained above forecasts, highlighting ongoing economic pressures.

UK economy update

- The UK economy is showing signs of resilience, with inflation falling faster than expected. The Consumer Price Index (CPI) averaged just above the Bank of England's 2% target, bolstered by declining transport costs. However, food inflation has risen slightly, reflecting ongoing challenges in certain sectors.

- The GfK Consumer Confidence Index rose by three points, attributed to falling interest rates and increasing wages. This uptick suggests easing financial pressures on households.

- The Office for Budget Responsibility (OBR) highlighted encouraging signs of inflation easing ahead of the Bank of England's next rate decision. Growth forecasts remain cautious amid global economic uncertainties.

- Chancellor Rachel Reeves delivered the Autumn Budget, maintaining Labour's focus on substantial tax increases, including higher levies on businesses and stricter inheritance tax policies. However, plans for multiyear spending reviews were deferred, extending uncertainty for government departments.

- Government borrowing in October exceeded expectations at £17.4 billion, emphasizing the fiscal challenges facing the Chancellor despite recent policy changes.

UK Stock Market Update

November brought a rebound for UK markets! The FTSE 100 Index rose 2.18%, reaching £8,287.30. The FTSE All-Share Index also saw a gain of 2.10%, closing at £4,524.88. It was a month of positive growth and recovery across UK indices!

- Sage Group PLC saw its shares jump by 19% following the announcement of a £400 million share buyback and an increase in its dividend. This move is part of Sage’s broader strategy to enhance shareholder returns and strengthen its market position in financial software.

- Dr Martens PLC experienced a rare uplift in its stock price following positive market updates, marking a potential turning point after a challenging year. This development has been well-received by long-term investors.

- Mondi PLC faced challenges with the permanent closure of its Stambolijski paper mill in Bulgaria after a devastating fire in September. This move impacts around 300 employees and is expected to incur €100 million in closure costs.

- Reckitt Benckiser Group PLC and Abbott Laboratories saw stock gains following a U.S. court's ruling that they were not liable in a lawsuit involving baby formulas for premature infants. Reckitt's stock surged by 10%, marking its largest increase in 16 years.

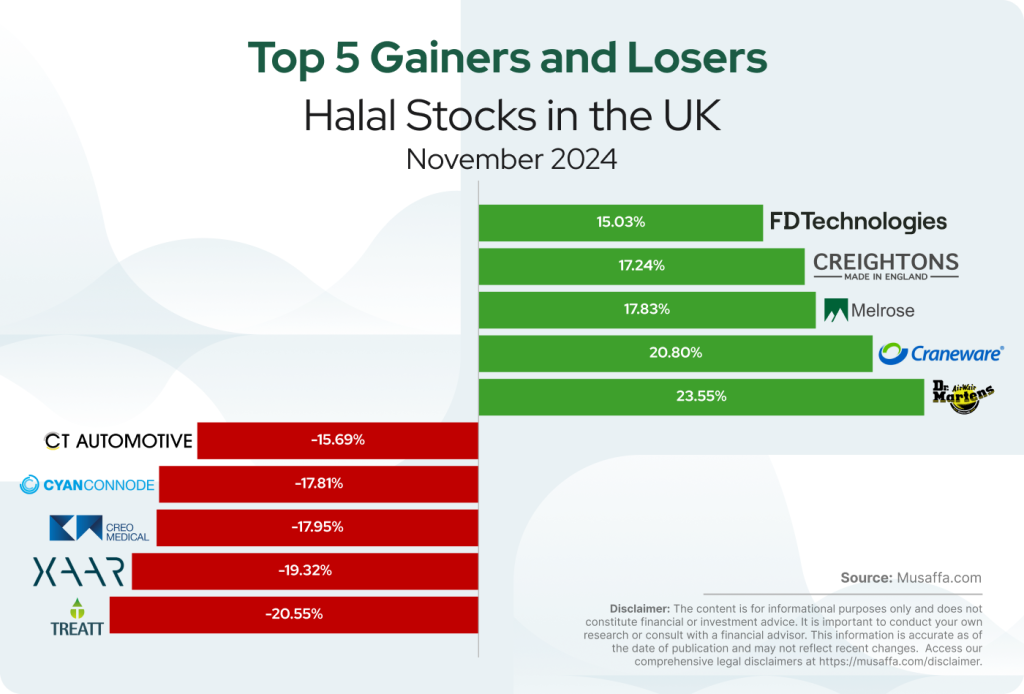

UK top gainer and top loser stocks for November

Summary

November saw a recovery in UK stock markets, with major indices posting gains. Investor optimism was fueled by strategic corporate actions, including share buybacks and legal victories. Sage Group’s buyback announcement drove a significant stock surge, while Reckitt Benckiser saw its largest increase in 16 years. Meanwhile, economic uncertainty persisted amid cautious growth forecasts and fiscal policy adjustments.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.