U.S. inflation continued rising modestly, with the Federal Reserve projecting a year-end inflation rate of 2.4%, moderating to 2.5% in 2025. Consumer spending remained strong during the holiday season, with retailers reporting record-breaking Black Friday and Cyber Monday sales. The Fed held interest rates steady at 4.25%-4.50% in December but signaled gradual rate cuts in 2025. Meanwhile, the labor market showed signs of cooling, with slower hiring in tech and retail sectors.

USA economy update

- Inflation continued to rise modestly, with the Federal Reserve projecting a year-end inflation rate of 2.4% and 2.5% for 2025. Consumer spending showed signs of sustained strength during the holiday season, boosted by extended promotions and rising incomes. Retailers reported strong December sales following record-breaking Black Friday and Cyber Monday performances.

- Core personal consumption expenditures (PCE) inflation, which excludes volatile food and energy prices, is projected to remain elevated, reaching 2.8% by the end of 2024 and moderating to 2.5% in 2025. These figures represent an increase from earlier forecasts of 2.6% for 2024 and 2.2% for 2025.

- The Federal Reserve maintained its target range for the short-term borrowing benchmark at 4.25%-4.50% in December. Policymakers project the benchmark lending rate to decrease gradually, ending 2025 in the 3.75%-4.00% range. This reflects the Fed's cautious approach as it balances inflation control with supporting economic growth.

- The U.S. labor market showed signs of cooling in December, with fewer people finding jobs compared to earlier in the year. Despite the addition of 200,000 jobs in November, hiring slowed in key sectors such as technology and retail, reflecting cautious business sentiment amid economic uncertainty.

USA stock market update

December saw mixed results for U.S. markets. The S&P 500 decreased by 2.50%, closing at 5,881.63, while the Dow Jones experienced a more significant decline of 5.27%, ending at 42,544.22. In contrast, the Nasdaq showed a modest gain of 0.48%, reaching 19,310.79. The Russell 2000 struggled the most, dropping by 8.40%, closing at 2,230.16. Overall, December was a month of losses for most indices, with a few exceptions.

- The U.S. Food and Drug Administration (FDA) announced that the shortage of Eli Lilly's popular weight-loss drug has been resolved as of December. The resolution comes after months of supply chain challenges and increased demand, driven by the drug's growing popularity for managing obesity and related health conditions.

- Dealmakers anticipate over $4 trillion in M&A activity in 2025, driven by pro-business policies under President Trump’s second term. Easing regulations and tax reforms are expected to spur major deals, particularly in technology, healthcare, and energy.

- Broadcom INC reached a trillion-dollar valuation following bullish forecasts for surging demand in AI-related chips. The company expects its AI-driven semiconductor business to significantly boost revenues, driven by the rising adoption of generative AI and cloud computing technologies. Investors see Broadcom as a key player in the growing AI hardware market.

- Federal Reserve Chair Jerome Powell clarified that the Fed is not permitted to hold Bitcoin or other cryptocurrencies and has no intention of seeking to change this policy. He emphasized the Fed’s focus on regulating digital assets to ensure financial stability while maintaining its cautious stance on direct cryptocurrency involvement.

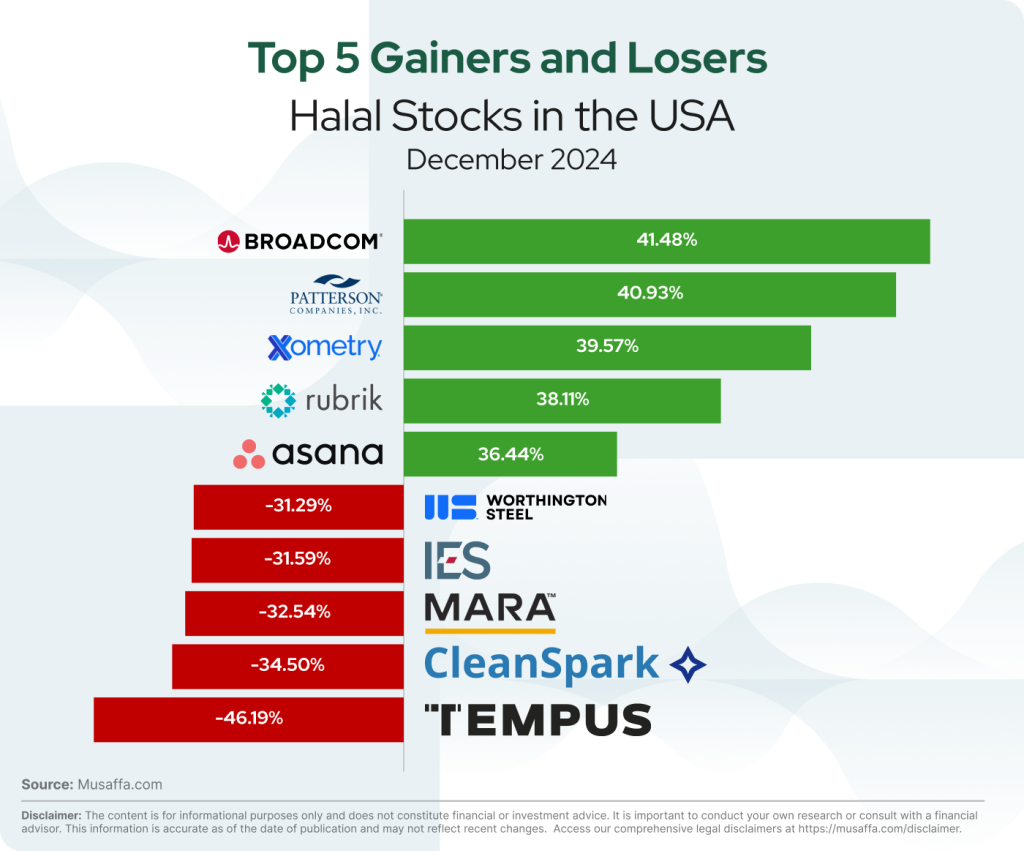

USA top gainer and top loser stocks for December

Summary

December brought mixed results for U.S. stock markets. The S&P 500 declined 2.50%, the Dow Jones dropped 5.27%, and the Russell 2000 struggled with an 8.40% loss. However, the Nasdaq posted a slight gain of 0.48%. Broadcom surged to a $1 trillion valuation, fueled by strong demand for AI chips, while dealmakers anticipate over $4 trillion in M&A activity in 2025 under pro-business policies. The FDA resolved the shortage of Eli Lilly’s weight-loss drug, and Federal Reserve Chair Jerome Powell reaffirmed the Fed’s regulatory stance on digital assets, maintaining its distance from Bitcoin and cryptocurrencies.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.