Assalamu Alaykum,

Welcome to our monthly economic and market update! As we enter a new month, here’s a recap of the key economic and market developments in the US from July. Let’s get started.

Stock market updates

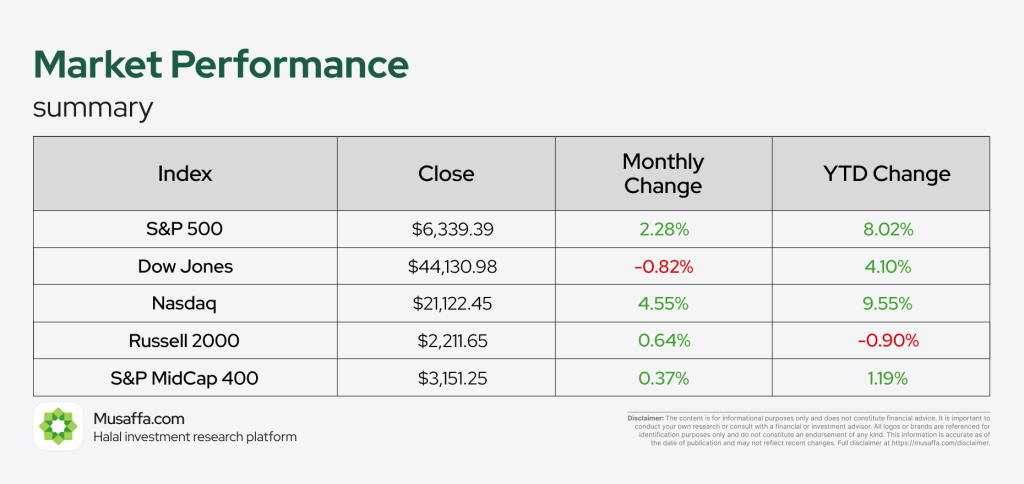

July saw a more tempered performance in U.S. equity markets, with gains in tech driving the Nasdaq up 4.55% to close at $21,122.45. The S&P 500 maintained its upward trend, rising 2.28% to end the month at $6,339.39. However, the Dow Jones slipped 0.82% to $44,130.98, reflecting broader market caution. The Russell 2000 edged up 0.64% to $2,211.65, while the S&P MidCap 400 posted a modest 0.37% gain, closing at $3,151.25. Overall, growth remained steady, albeit with signs of sectoral divergence.

Sarepta Therapeutics' stock plunged over 30% after reports that the FDA may halt shipments of its gene therapy Elevidys following patient deaths, raising concerns over its future. The drug, crucial to Sarepta's revenue, failed a Phase 3 trial and has faced scrutiny since approval, especially as recent deaths tied to Elevidys and another experimental therapy heightened safety fears. Investors worry a market withdrawal could be catastrophic, while families emphasize the treatment’s benefits and the lack of alternatives for Duchenne muscular dystrophy patients.

Starting October, Starbucks will mandate corporate employees to return to the office four days a week, offering a one-time cash exit package to those unwilling to comply. CEO Brian Niccol framed the decision as essential to rebuilding the company’s performance through stronger in-person collaboration, amid efforts to simplify menus and cut service times. The move follows earlier job cuts and reflects a broader corporate trend, with firms like Walmart and Google also tightening remote work policies.

Levi Strauss raised its full-year earnings and revenue forecasts after beating Q2 expectations, with EPS at $0.22 and revenue at $1.45B, driven by strong consumer demand and direct-to-consumer sales. Despite potential tariff impacts from Trump’s evolving trade policy—particularly targeting Levi’s key sourcing regions like Bangladesh and Indonesia—the company plans to absorb up to $30M in related costs this year. CEO Michelle Gass is refocusing the business through product innovation, e-commerce growth, and women's apparel expansion, while recent partnerships with Beyoncé and Nike keep Levi’s brand culturally relevant.

Hims & Hers Health will begin offering generic semaglutide in Canada as Novo Nordisk’s patent on Ozempic and Wegovy lapses in January, opening a $1.18B market projected to grow over $4B by 2035. While the company hasn’t confirmed Health Canada approval yet, it’s working with an approved partner to ensure compliance and marks this as its Canadian debut following its European expansion via Zava. This move comes after Novo Nordisk let its Canadian patent lapse due to unpaid fees, allowing new players like Hims to enter the weight loss drug space amid intensifying competition from Eli Lilly’s Zepbound.

Home Depot will acquire building materials distributor GMS for $4.3 billion via its SRS Distribution subsidiary, aiming to strengthen sales to contractors and professional builders. The move marks a strategic push into the pro market amid slower DIY demand, as higher mortgage rates suppress large home improvement projects. The acquisition is expected to close by early 2026, following a bidding battle with Brad Jacobs’ QXO, and builds on Home Depot’s $18.25B purchase of SRS last year.

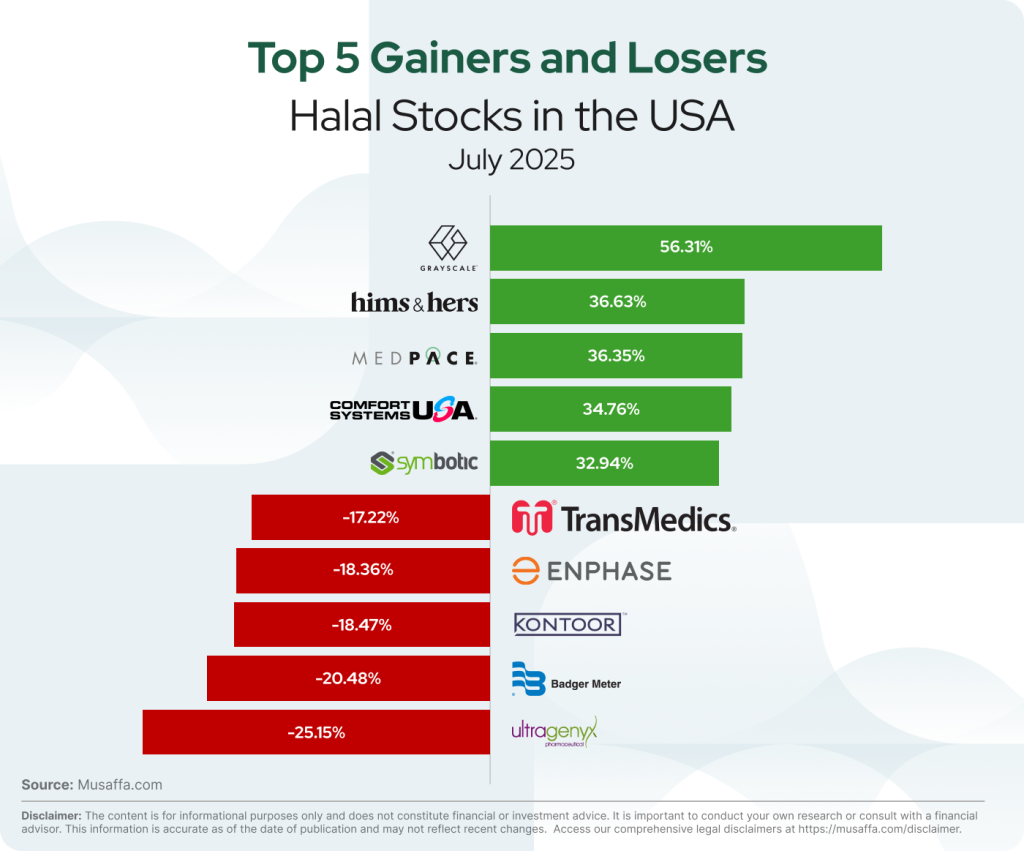

Top gainer and top loser Halal stocks in the USA

Economic updates

President Donald Trump announced a 50% tariff on copper imports, sending copper prices up 13.12% to a record high and boosting shares of U.S. miner Freeport-McMoRan by 5%. Trump also signaled plans to impose 200% tariffs on pharmaceutical imports, allowing up to 18 months for companies to shift production to the U.S. Commerce Secretary Howard Lutnick confirmed the copper tariff, set to be finalized by end of July, aligns with similar steel and aluminum duties and aims to boost domestic production.

The U.S. 10-year Treasury yield climbed 5 basis points to 4.387% on Monday amid growing trade tensions, as President Trump extended his broad tariff deadline to August 1 and announced new duties on imports from at least seven nations, including South Korea and Japan. The 30-year yield rose to 4.921%, while the 2-year hit 3.899%. Trump also threatened 10% tariffs on countries aligned with BRICS, which denounced his trade policies, while more tariff-related announcements are expected in the coming days.

President Donald Trump announced a proposed 10% tariff on countries aligning with what he called the “Anti-American policies of BRICS,” amid the group’s summit in Brazil. The BRICS bloc criticized unilateral tariff measures in a joint statement, implicitly referencing Trump’s trade stance. Trump’s move, widely seen as a reaction to BRICS efforts to challenge U.S.-led global economic dominance, drew a rebuke from China and renewed trade concerns ahead of the Aug. 1 tariff implementation deadline.

US consumer inflation rose to 2.7% in June, driven by higher energy and housing costs, with prices accelerating as President Trump’s tariffs began impacting goods like coffee, citrus, toys, and appliances. While some categories, such as cars and airfare, saw price declines, analysts noted early signs of tariff-induced inflation that may intensify. Despite Trump’s claims that tariffs protect domestic industry without raising prices, economists warn that costs are being passed on to consumers, while the Fed remains cautious about cutting rates amid the uncertainty.

The US government will become the largest shareholder in MP Materials, the operator of the country’s only active rare earths mine in California, as part of a strategic push to reduce dependence on Chinese supply. Under a new deal with the Department of Defense, MP Materials will receive guaranteed prices for key rare earths like neodymium and praseodymium, while building a new US facility to process more of its output domestically. The move comes as rare earths—crucial for tech and defense—remain a flashpoint in the US-China trade war, with Beijing still controlling around 90% of global refining capacity and imposing tight export restrictions.

Donald Trump’s newly passed “Big Beautiful Budget Bill” is projected to add $3 trillion to the US’s $37 trillion debt, raising alarms about the sustainability of America's borrowing. Critics, including Elon Musk and hedge fund giant Ray Dalio, warn that ballooning debt could lead to higher taxes, spending cuts, inflation, or even default—especially as global investors grow wary, pushing down the dollar and steepening yield curves. Despite these risks, the dollar remains dominant due to a lack of viable alternatives, though global financial leaders acknowledge the mounting pressure on US fiscal credibility.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Foziljon Kamolitdinov

Foziljon Kamolitdinov

Suhail Patel

Suhail Patel