Here’s a quick recap of last week’s events (April 27 – May 3) in the US stock market. From major index movements to key economic events, stay informed about the trends that matter to halal investors like you.

Market Overview

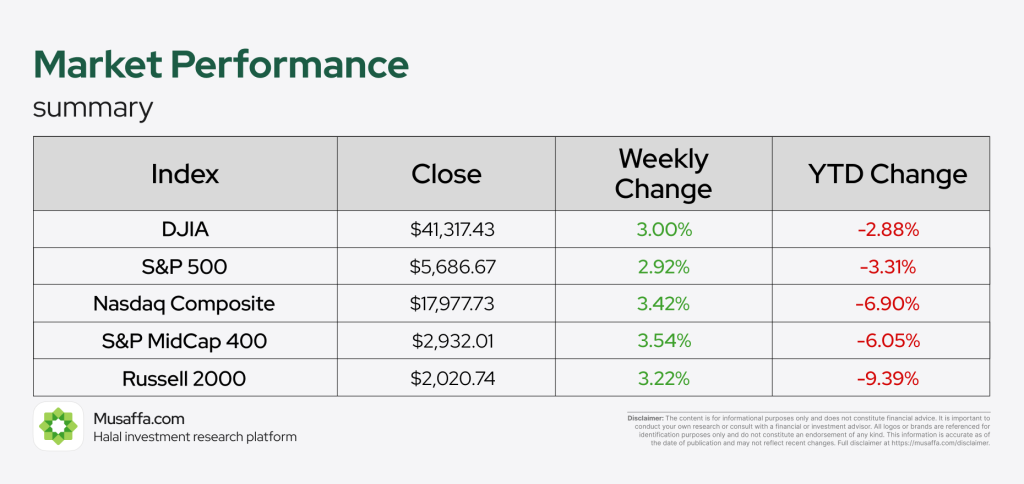

U.S. Stocks Extend Gains as Trade Tensions Cool and Earnings Impress

- S&P 500 marked its second straight weekly gain and nine consecutive positive sessions, its best streak in months.

- Nasdaq surged 3.42%, fueled by solid earnings from large-cap tech, including several of the Magnificent Seven stocks.

- Small-cap and mid-cap indexes posted their fourth consecutive weekly gain, showing broader market strength.

- Trade optimism returned early in the week as Trump rolled back tariffs on auto parts, and Commerce Secretary Lutnick signalled a major trade deal was near.

Earnings Drive Market Higher

- Nearly 40% of S&P 500 market cap reported Q1 earnings this week.

- While companies cited uncertainty in forward guidance, sentiment remained generally positive, with many firms beating expectations.

Jobs Data: Mixed Signals, but April Surprise Lifts Spirits

- Job openings dropped to 7.2 million, the lowest since September, reflecting some hiring softness.

- ADP private payrolls grew just 62,000, well below trend.

- But the official BLS report surprised, with 177,000 jobs added in April vs. 135,000 expected.

- Unemployment stayed at 4.2%, and wages rose modestly (+0.2%), easing inflation fears.

GDP Contracts for First Time in 3 Years

- Q1 GDP shrank 0.3%, the first contraction since 2022, as imports surged (ahead of tariffs), consumer spending slowed, and government spending declined.

- Many businesses front-loaded purchases, anticipating costlier imports after early-April tariff hikes.

Consumer Spending Stays Resilient as Inflation Stabilizes

- March PCE Price Index (Fed’s inflation gauge) was flat, while consumer spending rose 0.7%, showing continued demand strength.

- These figures preceded most of the recent tariff actions, so April and May data may show a different story.

Key Takeaways & Market Outlook

- Markets continue rebounding, driven by de-escalating trade concerns and strong corporate earnings.

- Mixed jobs data was capped by a strong BLS report, easing recession fears.

- GDP contraction signals caution, but consumer spending remains resilient for now.

- Inflation indicators are stable, but risks remain with tariffs just starting to bite.

- Bond markets showed cautious optimism, rotating on changing sentiment across the week.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Nusrat Ahmed

Nusrat Ahmed