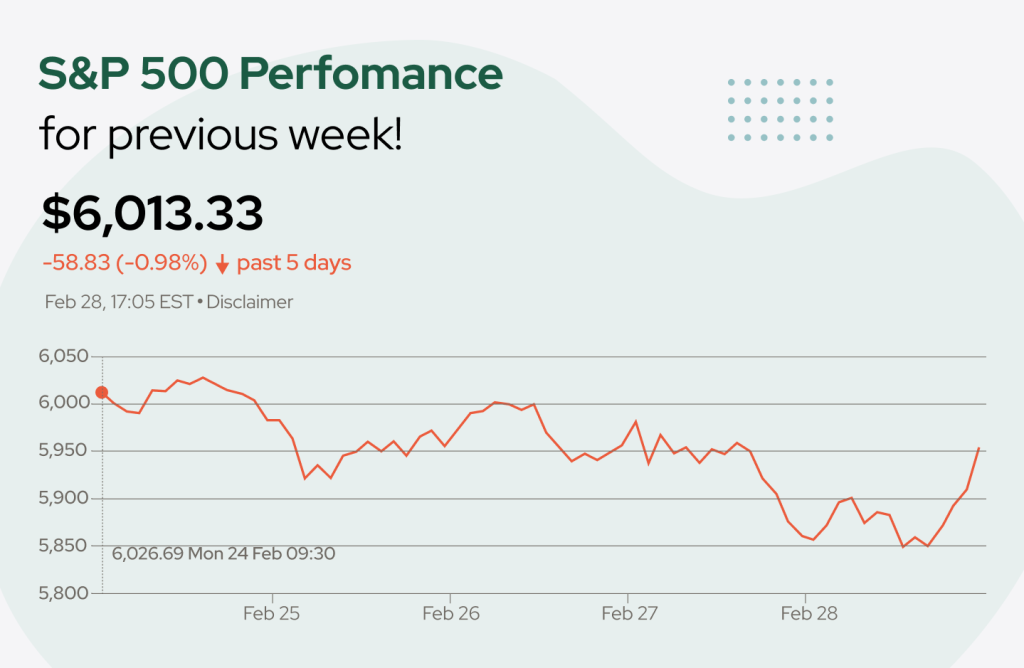

Here’s a quick recap of last week's events (February 24 - March 1) in the US stock market. From major index movements to key economic events, stay informed about the trends that matter to halal investors like you.

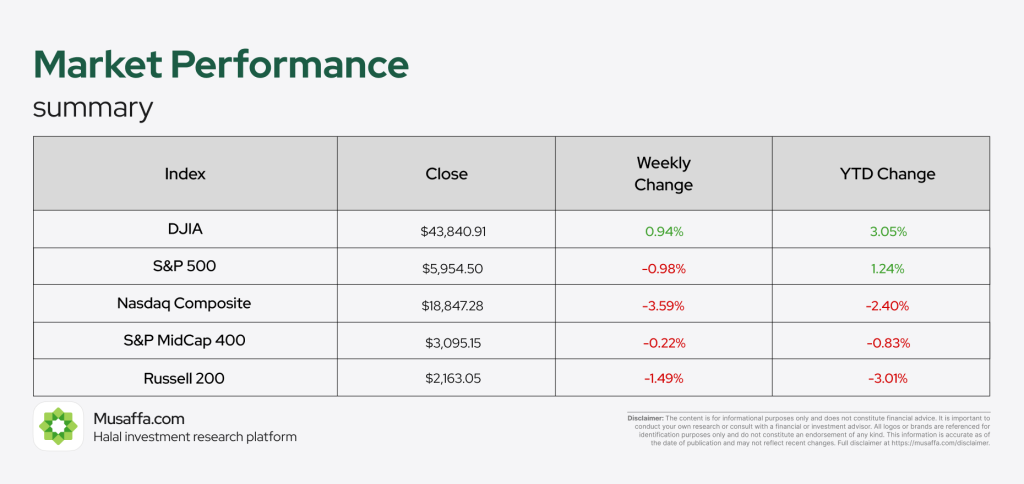

Market Overview

- Most major U.S. indexes declined for the second consecutive week, except for the Dow Jones Industrial Average (+0.95%), which outperformed.

- Growth stocks, particularly tech, saw a sharp drop, with the Nasdaq Composite recording its worst week since September.

- NVIDIA fell 8.48% on Thursday despite strong earnings, fueling concerns that the AI rally may be losing momentum.

- Tariff fears persisted, as President Trump reaffirmed plans to introduce new tariffs by March 4.

Consumer Confidence Drops the Most Since August 2021

- The Conference Board’s Consumer Confidence Index fell 7 points to 98.3 in February.

- Expectations index dropped below 80, a level historically associated with recession risks.

- 12-month inflation expectations jumped from 5.2% to 6%, adding to worries about price pressures.

Inflation Pressures Weigh on Spending

- Core PCE inflation (Fed’s preferred gauge) rose 0.3% in January; annual rate declined to 2.6% (from 2.9%), still above the Fed’s 2% target.

- Personal incomes rose 0.9%, but consumer spending contracted, suggesting that inflation and economic uncertainty are restraining spending.

GDP Growth Remains Steady; Jobless Claims Rise

- Q4 GDP growth held at 2.3%, with strong consumer spending (+4.2%).

- Full-year 2024 GDP growth came in at 2.8%.

- Jobless claims increased to 242,000, the highest since October, signaling softening labor market conditions.

Key Takeaways & Market Outlook

- Consumer confidence is falling sharply, adding to recession fears.

- Inflation remains sticky, keeping Fed rate cuts uncertain in the near term.

- Jobless claims rising suggests the labor market may be softening.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.