Written by Haider Saleem

Financial and Political Analyst | LinkedIn / X

Introduction

From Tokyo to Frankfurt to Washington, bond markets are sending loud and clear signals: investors are nervous. Yields are rising, demand is faltering, and central banks are navigating unfamiliar territory.

For Muslim investors, this shifting landscape raises important questions.

While government bonds aren't Shariah-compliant, they still shape the broader financial environment, such as influencing currencies, inflation expectations, and global investor behavior.

This article answers two simple questions:

1. What’s unfolding in global bond markets; and

2. Why it matters.

What’s Going on in Global Bond Markets?

Government bonds are often seen as the world’s financial bedrock - a place where investors seek safety, especially during uncertainty. But lately, even this corner of finance has turned volatile.

Three major themes are emerging:

- 1) US Treasuries, long considered the ultimate “safe asset,” are losing their shine due to ballooning debt and political risks. Moody’s recently downgraded the U.S.’s last AAA credit rating from a major agency[1][3].

- 2) Japan’s bond market - historically among the most stable - is experiencing sharp sell-offs, driven by weak auction demand and reduced central bank support[5][6].

- 3) In the Eurozone, some economists and policymakers are calling for a bold move: joint debt issuance (Eurobonds), to strengthen the euro’s global role[1].

Meanwhile, expectations around European Central Bank policy are adding to the uncertainty. Some analysts predict the ECB could cut rates if U.S. tariffs drag on the European economy. Markets have already priced in a strong chance of a rate cut by the end of the year[2].

Spotlight: Japan’s Case Study

Japan is the world’s third-largest bond market, but it’s facing a crisis of confidence.

- In May 2025, auctions for both 20- and 40-year Japanese government bonds (JGBs) saw the weakest demand in over a decade[5][6].

- The Bank of Japan (BOJ), which owns more than half of Japan’s sovereign bonds[6], has started scaling back its purchases - a shift that’s left private investors unsure who will absorb the excess supply.

- Japan’s Ministry of Finance has floated the idea of reducing long-term bond issuance to calm the market[3]. This “quick fix” paused the sell-off but didn’t erase deeper worries about Japan’s debt levels, now more than twice the size of its economy[5].

The government is also under domestic pressure. In May, Japan approved a $6.3 billion stimulus package to support households and businesses affected by U.S. auto tariffs. The package includes subsidies for energy costs and aid to small and medium enterprises — a sign that Tokyo is trying to prevent economic strain from compounding market instability[4].

Why does this matter?

Volatility in Japan’s bond market matters far beyond its borders. As some global investors shift away from U.S. Treasuries, they’ve turned to JGBs. But if confidence erodes further, that flow could reverse, with ripple effects across global markets.

Start Your Halal Stock Screening Journey

New to halal investing? Musaffa makes it easy to screen stocks, check Shariah compliance, and purify your portfolio — all in one place. Make informed, ethical decisions every step of the way.

Eurozone and the ‘Haven’ Opportunity

While Japan’s bond market faces turbulence, the Eurozone sees opportunity. The idea of Eurobonds, once politically taboo, is back in conversation.

Economists argue that with the U.S. dollar under pressure, the euro has a rare opening to position itself as a stable global reserve currency. That means more euro-denominated bonds, and potentially joint EU debt issuance backed by member states[1].

This move could:

- Lower borrowing costs across the bloc

- Increase liquidity and investor confidence

- Act as a buffer in future crises by providing a unified safe asset

Still, political resistance remains, especially from countries like Germany and the Netherlands that fear encouraging fiscal irresponsibility among peers[1].

What Does This Mean for Muslim Investors?

For halal-focused investors, the global bond upheaval presents both challenges and reflections.

While most government bonds are excluded from Shariah portfolios due to interest-based structures, their movement influences:

- Currency values

- Inflation expectations

- Global liquidity conditions

As bond yields rise, the cost of capital increases, often dragging down stocks, real estate, and other assets. Muslim investors looking to preserve capital in turbulent times may find it valuable to consider Shariah-compliant alternatives (see below).

| Halal Investment Snapshot Sukuk and gold may offer diversification without interest-based risk: Sukuk These Islamic bonds do not pay interest but instead represent ownership in an underlying asset or project. They can serve as a halal fixed-income instrument for diversification. Gold Often used as a store of value, gold may offer protection in inflationary or uncertain environments. |

Conclusion: Time to Watch, Not Panic

Bond markets are raising caution flags. For Muslim investors, understanding these movements helps build shariah-compliant portfolios, especially as markets undergo stress tests from tariffs, central bank policies, and fiscal uncertainty.

Halal investing doesn't happen in isolation. The health of global bond markets shapes the broader ecosystem - from currencies to risk appetite to inflation. Whether or not you hold bonds directly, their story matters.

To stay informed, explore tools like Musaffa’s halal screening services and investment research to help align your portfolio with your values.

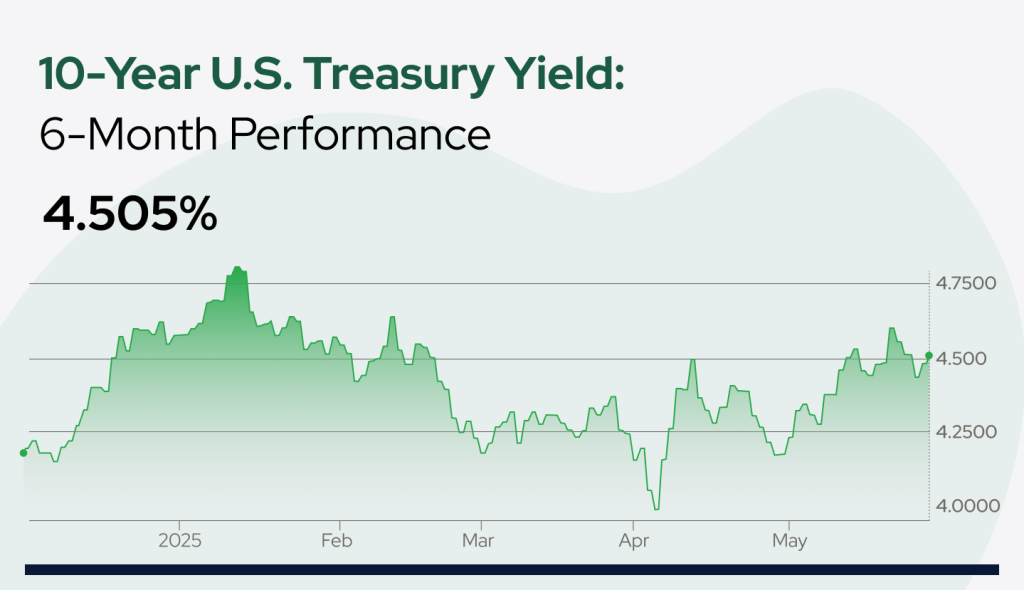

Bond Yield Trends

References

1. Marieke Blom, Now is the Time to Reopen the Eurozone Bond Debate, FT, 27 May 2025.

2. Reuters, Euro Zone Bond Yields Edge Up, 28 May 2025.

3. Reuters, Japan’s Quick-Fix for Bond Markets Sets a Global Test Case, 28 May 2025.

4. NYT, Japan Budgets $6.3 Billion To Weather Trump's Tariffs, 28 May 2025.

5. Leo Lewis, Japan’s 40-Year Bond Sale Draws Weakest Demand Since July, FT, 28 May 2025.

6. Mia Glass, Why Investors Are Worried About Japan’s Bond Market, Bloomberg, 28 May 2025.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Nafisahon

Nafisahon