Written by Shihab Ahmed

So, you have finally decided to settle down and get yourself a home. In other words, you have committed yourself to descend into the pandemonium that is the US housing market. And now you’re considering your options to finance your big purchase – you’ve come to the right place, dear reader!

But before that, it’s important to consider whether it’s a good time to be a property buyer, in the first place.

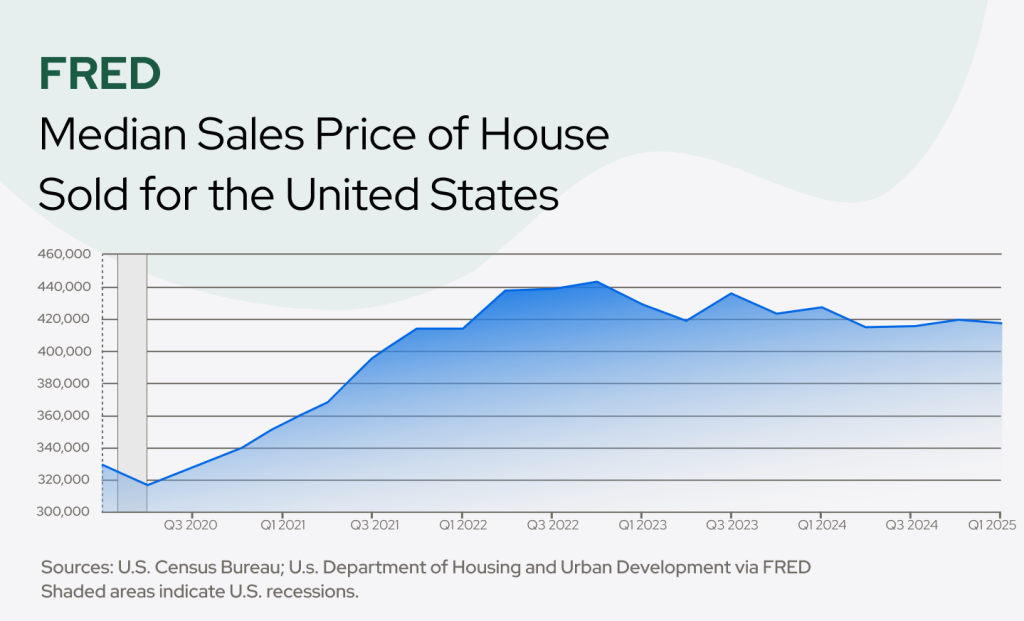

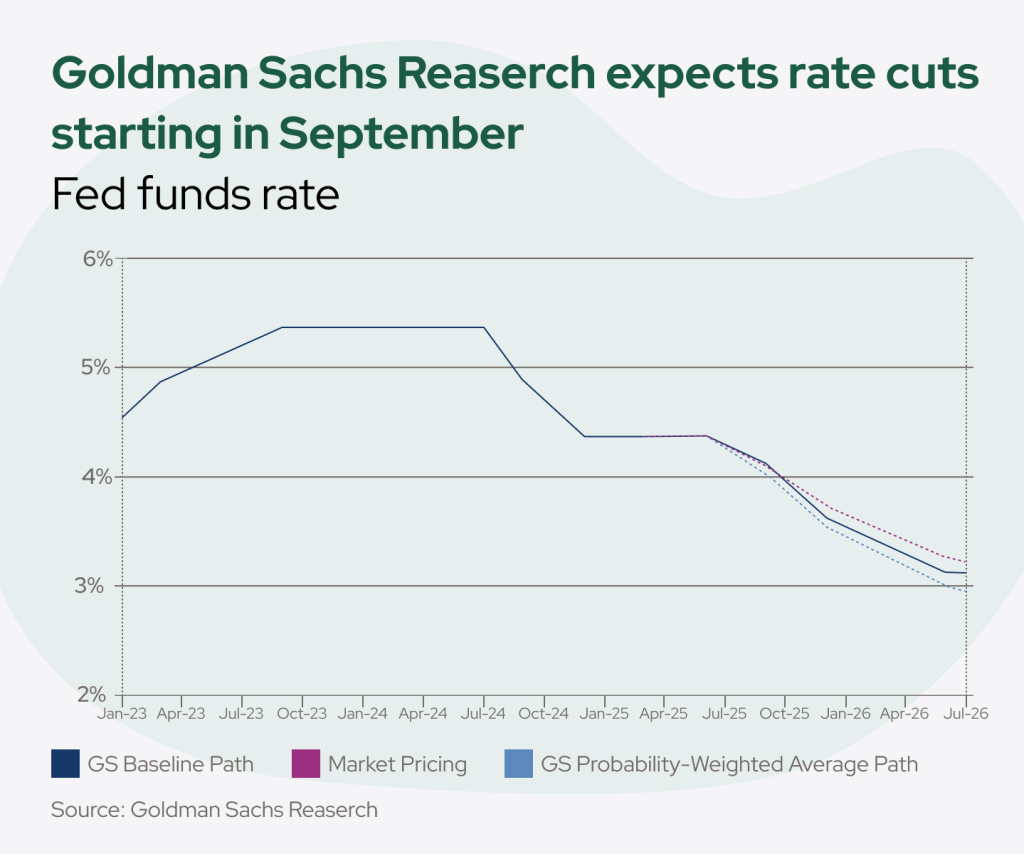

Although property prices have not returned back to pre-covid levels (and it’s unlikely they will do so any time soon), they have been mostly flat for around the past 2 years. More importantly, however, interest rates are expected to fall soon and when they do, property prices will most likely shoot up.

So, we think that now might be a good time to buy while markets are taking a break and interest rates are fairly stable, and before POTUS announces a sudden, large interest rate cut.

Financing the purchase – mortgages

A traditional mortgage loan fundamentally involves lending and borrowing money with interest. Homebuyers secure funds to purchase a home and commit to repayment over time, plus interest. This practice is considered unacceptable under Islamic principles.

As Muslims, we cannot just use any mortgage. This is because, in Islam, lending is a form of charity – it is about helping out a brother or sister in hardship. We cannot earn money off of a loan. Not only that, Islam only permits asset-backed financing. Sales contracts require tangible assets as backing. A traditional mortgage, however, involves paying interest to a lender for the use of their money (which has no intrinsic value), rather than for the home itself.

For these reasons, we look for Islamic mortgages. Instead of being based on a lender-borrower relationship, halal mortgages are a more equitable alternative, where the providers profit in ways other than Riba (interest) – something that Allah (SWT) has sternly forbidden.

What makes a mortgage halal

A mortgage is halal when the contract between the institution and the buyer satisfies both the word and spirit of the Shariah. This means that legal gymnastics to somehow comply with the word of the Shariah but go against it spirit (eg. forming layers of contracts that are individually halal, but together form a kind of lender-borrower relationship) will not be considered permissible in the eyes of Islam.

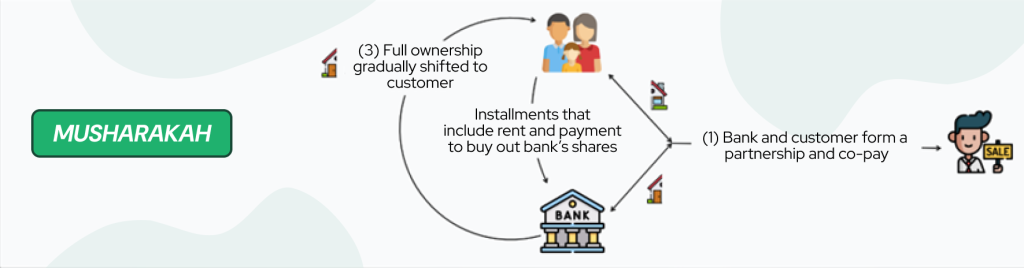

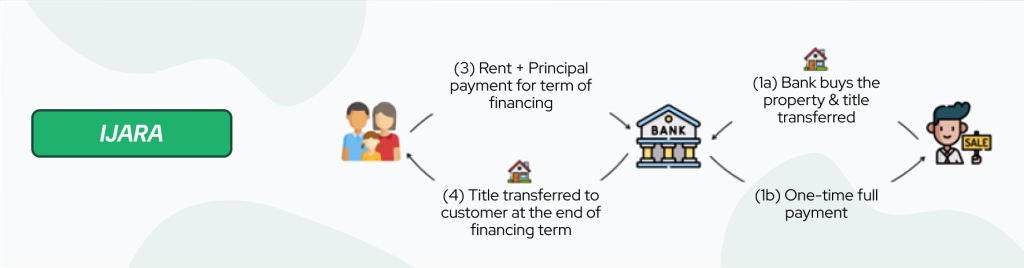

The most common models of contracts that are used in Islamic mortgages are Ijarah (lease-to-own), Murabahah (cost-plus-sale), and Musharakah (partnership).

It is important to note, however, that contract specifics vary among providers and the legal engineering providers engage in to comply with both Shariah as well as US laws are tightly-guarded proprietary secrets.

As such, some legal maxims that might help you navigate your options and the contracts that your presented with are:

- “Hardship must be alleviated.” – This is the most important maxim while evaluating halal mortgage options.

“Need”, in Shariah, is something that removes hardship or constraint. If someone doesn’t have access to something considered a "need," it can cause undue hardship beyond what’s normally expected in life.

According to a Fatwa Committee from AMJA, owning a home is seen as a valid and widespread need for Muslims in America—not just a luxury or preference. This justifies the pursuit of Sharia-compliant housing solutions (like halal mortgages), especially if renting causes harm, stress, or long-term insecurity.

- “Objectives and meanings are given precedence over wording in transactions” – What matters in transactions is the reality and essence, not the wording and formality.

- “Leeway is afforded to matters peripheral to a transaction more than they are given to the main issue of the transaction.” – Things out of your control at the time of the contract will not be held against you, as long as the main issue of the contract is permissible.

What options do you have

According to the Assembly of Muslim Jurists in America (AMJA), there are 3 major categories of companies that deal in Islamic home financing in the US:

1. The “Categorically permissible” category.

Contracts offered by these institutions are meticulously crafted to align with Shariah principles. A key differentiator is their independence from federal, interest-based entities like Freddie Mac and Fannie Mae, allowing them the autonomy to design their own contracts. However, this independence from federal institutions also presents a limitation, restricting their scope and capabilities, and potentially hindering their ability to fully address the diverse needs of all Muslim consumers.

2. The “Conditionally permissible” category

While many financial institutions endeavor to offer Shariah-compliant contracts, their need to sell these contracts to federal institutions for scalability often introduces complexities. This necessity can lead to the inclusion of impermissible components, such as invalid clauses, inequity, undue risk, or unknown quantities, which ultimately compromises the full adherence to Islamic principles. Consequently, the degree of Islamic violations varies among companies, making it preferable to explore alternative solutions. However, applying the maxim of “hardship must be alleviated”, these options may be considered permissible in situations of dire need.

3. The “Categorically impermissible" category

They either deal with Riba directly or engage in ‘legal gymnastics’ to get around the direct prohibition of interest, but break the spirit of Shariah nonetheless.

Mortgage options in the U.S. in 2025

Ameen Housing

The Fiqh Committee of AMJA previously identified two main concerns with Ameen Housing's contracts, leading to a declaration on Islamic Home Financing Companies in the US. These issues were a late payment fee and an improper distribution of maintenance costs, where Ameen returned a fixed percentage of rent to the buyer/renter regardless of actual expenses.

Ameen Housing has since addressed these concerns by discontinuing their late payment fee policy and clarifying that maintenance expense distribution is now handled equitably.

Consequently, AMJA has ruled that Ameen Housing's current contracts align with Sharia law. They no longer have any Sharia objections to Ameen Housing's practices, making it fully permissible for Muslims to purchase homes through them.

Guidance Residential

Guidance Residential, a prominent US provider, employs a Declining Balance Co-ownership Program, rooted in the Islamic Musharaka (partnership) structure. The company offers both home purchase and refinancing solutions, serving a wide spectrum of clients, from first-time buyers to those seeking to refinance, making Shariah-compliant financing broadly accessible due to its extensive presence.

Despite its sophisticated contract structure, the AMJA advises using Guidance Residential only in situations of “dire need”. Concerns have been raised regarding the allocation of maintenance costs, taxes, and insurance within their contracts. However, the company does mitigate ownership risks and refrains from imposing prepayment penalties.

Devon Islamic

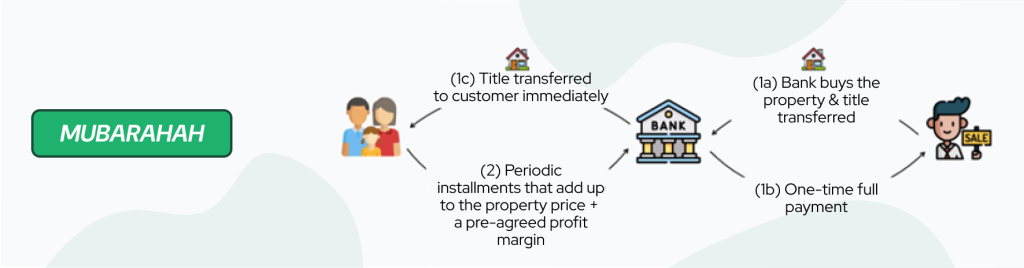

Devon Islamic, a subsidiary of Devon Bank, offers two primary Sharia-compliant mortgage options: Murabaha (cost-plus financing) and rent-to-own contracts. Both have raised concerns among scholars due to specific conditions.

The Murabaha contract, where Devon Islamic buys a property and resells it to the buyer at a profit, faces scrutiny over the bank's true ownership before resale. It also contains potentially unfair clauses, such as the bank retaining exclusive benefits from insurance payouts while the purchaser bears the cost, and the bank's right to freeze accounts based on suspicion of non-payment. Despite these concerns, AMJA has ruled that using this contract is permissible in "dire need," while advising the bank to rectify these issues and affirm property ownership.

The rent-to-own contract is problematic due to the simultaneous existence of two contradictory contracts (sale and lease) for the same item. Fiqh councils have largely deemed this model impermissible. Potential corrections include separating the lease and sale contracts chronologically or replacing the sale with a promise of ownership transfer at the lease's end. This contract also contains void stipulations, such as the bank holding the lessee responsible for rent after eviction and retaining all insurance payments while the lessee pays for the insurance and basic maintenance. Similar to Murabaha, the committee permits its use in "dire need".

Comparing the options

| Criteria | Ameen Housing | Guidance Residential | Devon Islamic |

| Financing Structure | Musharaka (partnership – assets co-owned via cooperative) | Declining Balance Co-ownership (Diminishing Musharaka) | Murabaha (cost-plus) and Rent-to-Own |

| Shariah Compliance | Fully Shariah-compliant; certified by AMJA | Certified halal; but AMJA recommends only in dire need due to maintenance/tax allocation issues | Permissible only in "dire need" per AMJA due to contract issues |

| Minimum Down Payment | 20% | 3% for first-time buyers; otherwise 5% | 5% |

| Available States | Only California | 30+ states | 31 states |

| Home Insurance | Cooperative handles insurance responsibilities; coi‑shares benefits | Buyer pays insurance; partner shares the risk; capped late fees | Buyer pays insurance but bank receives payout—an AMJA concern |

| Pre-approval Process | Membership-required; onboarding → financing eligibility | Online pre-approval, guides walk-through 10-step process | Have Islamic financing specialists; pre-qualification available |

| Customer Education | High – community-driven, guides, member webinars | Strong – numerous guides, webinars, agent support | Reliable service / personalized support |

| Relationship with federal institutions | No | Yes | Yes |

| Reputation / Trust Factor | Member-owned cooperative; Sharia‑approved; strong community reputation | Largest U.S. halal provider; well recognized; FDIC partner | Long-standing legacy since 2003; praised for customer service. |

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.

Danesh Ramuthi

Danesh Ramuthi

Nusrat Ahmed

Nusrat Ahmed