Saudi Arabia’s economy experienced significant growth in December, with FDI surging 37% quarter-on-quarter, increased tourism spending, and a lower unemployment rate of 3.7%. Consumer spending also rose sharply, contributing to economic momentum. The stock market performed well, with the Tadawul All-Share Index gaining 3.39%. Saudi Aramco adjusted its LPG prices for January, while the National Debt Management Center raised $3.09 billion through sukuk issuance. Additionally, Aramco secured strong credit ratings for its $10 billion US Commercial Paper Program. Key corporate developments included WSM’s acquisition update and Al-Jouf Cement’s approval of Green Cement for NEOM projects, aligning with Vision 2030’s sustainability goals.

Saudi Arabia economy update

- Saudi Arabia’s net foreign direct investment (FDI) surged by 37% quarter-on-quarter in Q3 2024, reaching SR16 billion ($4.27 billion), according to the General Authority of Statistics. This increase was driven largely by a 74.36% reduction in FDI outflows, which dropped to SR2 billion.

- Tourism spending in Saudi Arabia rose by 27.25% year-on-year in Q3 2024, reaching SR25.05 billion ($6.68 billion), according to the Saudi Central Bank (SAMA). Meanwhile, spending by Saudi residents traveling abroad grew by 21.79% to SR26.33 billion. The travel balance of payments recorded a deficit of SR1.28 billion during the quarter, a 33.83% improvement from the previous year.

- Saudi Arabia's unemployment rate declined to 3.7% in Q3 2024, marking a 0.5 percentage point decrease from the same period last year, according to the General Authority for Statistics (GASTAT). Labor force participation among Saudis and non-Saudis rose to 66.6%, reflecting a year-on-year increase of 0.2 percentage points and a quarterly rise of 0.4 percentage points.

- Saudi Arabia's consumer spending surged in the final week of 2024, with point-of-sale (PoS) transactions rising by 17.2% week-on-week to reach SR13.8 billion ($3.6 billion), according to data from the Saudi Central Bank (SAMA). Between December 22 and 28, a total of 211.97 million transactions were recorded across all sectors.

Saudi Arabia stock market update

December was a positive month for Saudi markets. The Tadawul All-Share Index rose by 3.39%, closing at 12,036.5. The Parallel Market Capped Index also showed strong performance, gaining 3.56% to reach 31,475.72. Overall, a month of growth for Saudi market indices

- Saudi Aramco announced a reduction in its official selling prices for liquefied petroleum gas (LPG) for January 2025. The price of propane was decreased by $10 per tonne, while butane prices were cut by $15 per tonne compared to December 2024.

- Saudi Arabia’s National Debt Management Center successfully raised SR11.59 billion ($3.09 billion) in its December sukuk issuance, marking a 239.88% increase compared to November's SR3.41 billion. This significant rise follows sukuk issuances of SR7.83 billion in October and SR2.6 billion in September, reflecting growing investor interest in Shariah-compliant Islamic bonds.

- Saudi Aramco has secured strong ratings for its newly established $10 billion US Commercial Paper Program, with Moody's assigning a Prime-1 short-term issuer rating and Fitch Ratings awarding an F1+ short-term rating. These ratings reaffirm Aramco's robust financial standing, with Moody’s also reaffirming its Aa3 long-term issuer rating with a stable outlook.

- WSM for Information Technology Co. issued an appendix announcement regarding the update on the signing of a non-binding Memorandum of Understanding with the partners of Wasl Technology Information Systems Limited Company to acquire 100% of the company. The announcement, published on Tadawul on December 30, 2024.

- Al-Jouf Cement Company has announced the approval of its innovative product, Green Cement, for use in NEOM projects. Developed in collaboration with Asas Al-Muhailb Company, this environmentally friendly cement aligns with Saudi Arabia's Vision 2030 and showcases advanced sustainability features. Green Cement reduces carbon dioxide emissions by 30%, eliminates reliance on imported supplementary components like GGBS and Fly Ash, and enhances concrete quality.

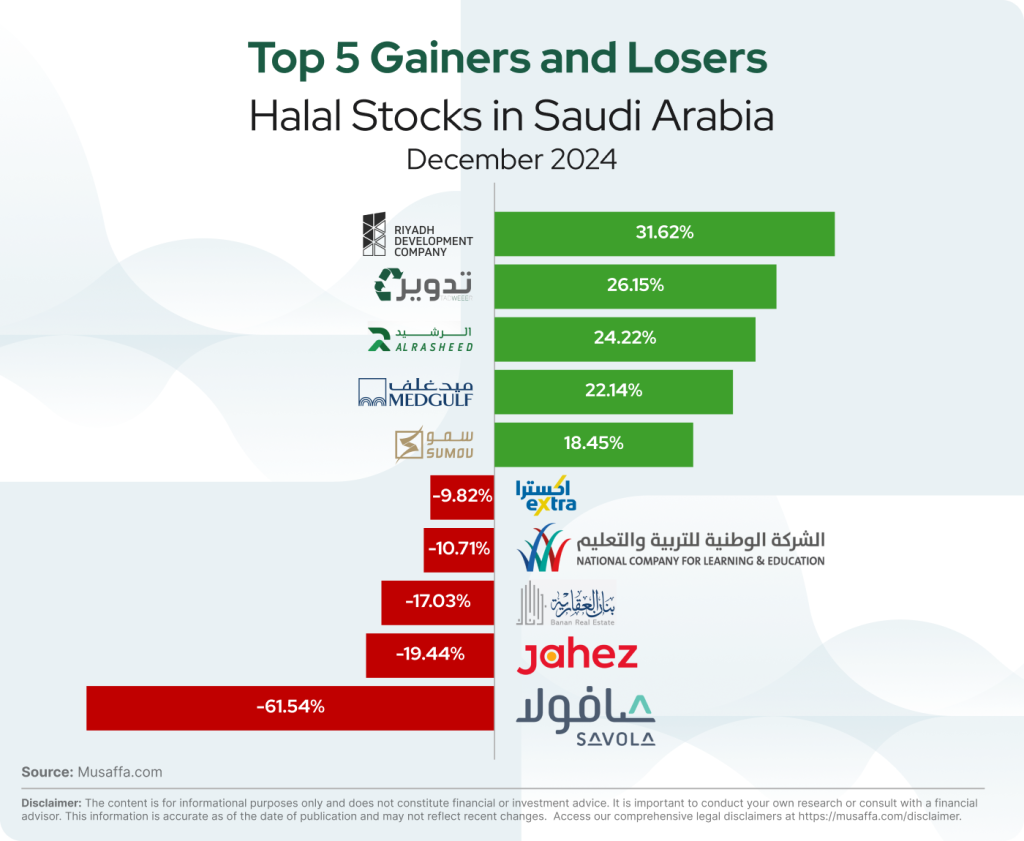

Saudi Arabian top gainer and top loser stocks for December

Summary

Saudi Arabia’s economy remained robust in December, driven by strong FDI growth, higher tourism spending, and declining unemployment. Stock markets saw positive momentum, while Aramco adjusted LPG prices and secured high credit ratings. The successful sukuk issuance and advancements in sustainable construction highlighted the kingdom’s commitment to economic diversification and Vision 2030.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.