In November, the U.S. economy demonstrated resilience with steady job gains and stable inflation, though consumer spending showed signs of softening. Market sentiment was influenced by economic policy uncertainty as President-elect Donald Trump's proposed tariffs and tax cuts sparked debate. Meanwhile, investor confidence surged, driven by substantial stock market gains and Bitcoin’s record highs. The tech sector, mainly NVIDIA and Tesla, continued to fuel optimism, while retail strategies adapted to shifting consumer behaviors.

USA economy updates

- The U.S. added approximately 175,000 jobs in November, reflecting ongoing resilience in the labor market. The unemployment rate held steady at 4.1%, supported by gains in the service and healthcare sectors.

- The USA inflation showed signs of stabilization, with the annualized rate holding at 2.2% in October and November. However, consumer spending appeared to weaken due to lingering effects of previous price increases. Black Friday and holiday promotions extended over weeks as retailers tried to entice cost-conscious shoppers.

- President-elect Donald Trump's proposed policies, including significant tax cuts and increased tariffs, are drawing mixed reactions. Economists are concerned about potential long-term effects on deficits and inflation.

- Donald Trump says he will hit China, Mexico and Canada with new tariffs on day one of his presidency, in an effort to force them to crack down on illegal immigration and drug smuggling into the US.

- Analysts adjusted Q4 GDP growth forecasts slightly downward, projecting an annualized rate of 2.6%. Business investments have been cautious amid uncertainty around new tariffs and tax policy announcements from the incoming administration.

USA stock market updates

November was a strong month for U.S. markets! The S&P 500 rose 5.67%, reaching 6,032.38. The Dow Jones also increased by 5.67%, closing at 44,910.65. The Nasdaq saw an impressive gain of 6.21%, reaching 19,218.17. Meanwhile, the Russell 2000 outperformed with a 10.84% surge, closing at 2,434.77. Overall, it was a month of significant gains across all major indices!

- Bitcoin reached record highs, surpassing $97,000, and showed strong investor confidence. This rally was fueled by several factors, including the Republican electoral victory in the U.S., a pro-crypto policy outlook, and the Federal Reserve's rate cuts that revived risk appetites. BlackRock’s iShares Bitcoin Trust (IBIT) also boosted market sentiment, with its strong institutional adoption suggesting a potential price target of $176,000 by 2026.

- Tesla Inc stock also saw a boost in November following CEO Elon Musk's announcement that the company plans to ramp up its AI capabilities, particularly for autonomous driving, while expanding its energy solutions business. This shift toward diversified revenue streams had investors optimistic about Tesla's future growth.

- Home Depot Inc saw its stock rise in November, driven by optimism in the housing market. As mortgage rates declined earlier in the year, home improvement activities picked up, benefiting the retailer. However, this optimism was tempered by rising interest rates, which could challenge the housing market's momentum moving forward.

- NVIDIA Corp continued its strong performance, with shares gaining over 10% in November. The company’s dominance in the AI chip market and ongoing demand for GPUs fueled the rally, maintaining its momentum as a leader in the tech space.

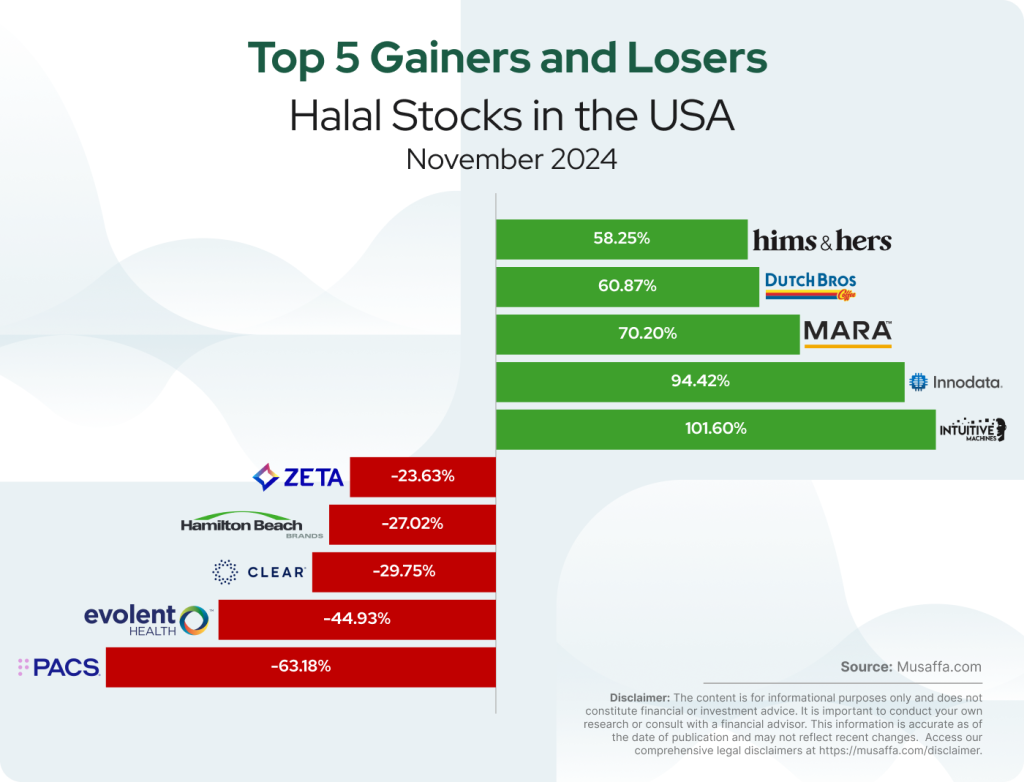

USA top gainer and top loser stocks for November

Summary

November closed with broad gains across U.S. stock indices, marking a strong month for equities. Bitcoin’s surge and AI-driven market optimism contributed to bullish sentiment, while uncertainty surrounding fiscal policies added a layer of caution. Economic growth projections slightly moderated, reflecting business hesitancy amid evolving policy landscapes. Despite these challenges, investor enthusiasm remained strong, highlighting the adaptability of markets and businesses.

Disclaimer: The content is for informational purposes only and does not constitute legal, investment or financial advice.

It is important to conduct your own research or consult with a financial or investment advisor. Past performance is not indicative of future results. All logos or brands are referenced for identification purposes only and do not constitute an endorsement of any kind. This information is accurate as of the date of publication and may not reflect recent changes. Access our comprehensive legal disclaimers at https://musaffa.com/disclaimer.